Weekly analysis

Core index sees biggest single-week fall in 2 yrs

Average turnover slumps 12pc on DSE

Published :

Updated :

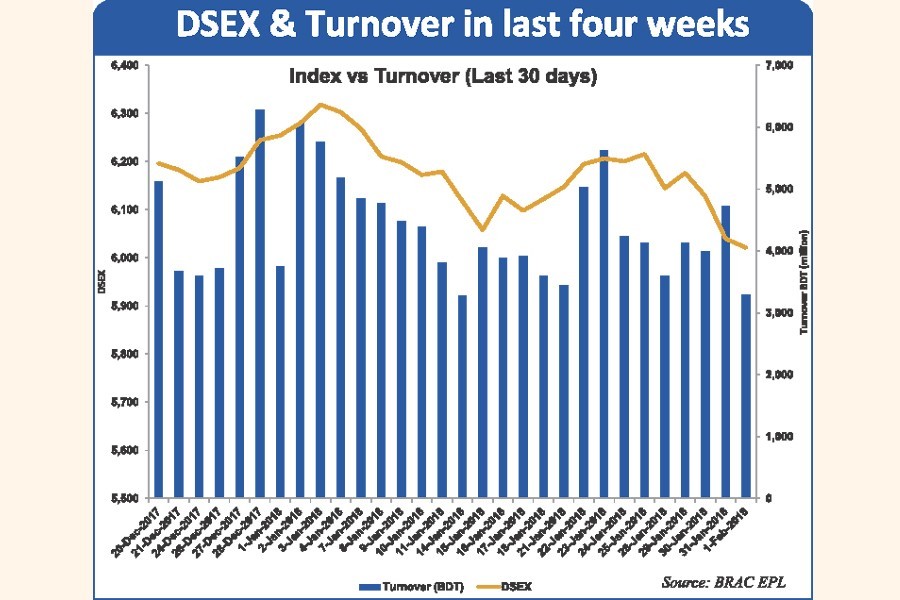

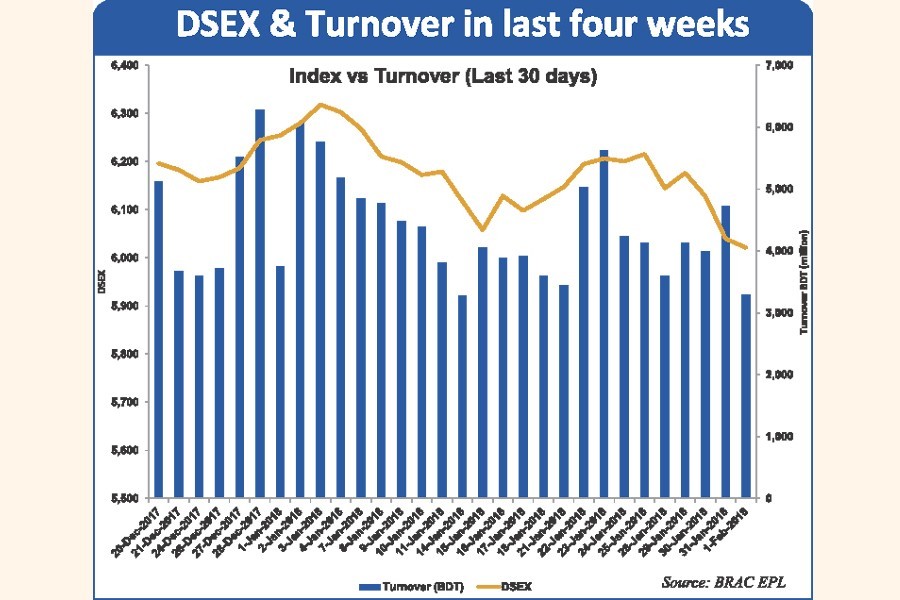

The core index of the Dhaka bourse dipped 3.13 per cent last week as nervous investors sold shares in bulk.

Merchant bankers and stockbrokers alleged that a 'political rumour' spread by a vested quarter created panic among the stock investors, prompting them to go for a sell pressure.

"Growing political tension coupled with fears of liquidity shortage due to the central bank's latest directive to slash the limit of banks' advance-deposit ratio (ADR) kept most of the investors at bay," said an analyst at a leading brokerage firm, wishing not to be named.

The leaders of Bangladesh Merchant Bankers Association (BMBA) and DSE Brokers Association, however, said in a press briefing on Wednesday that the investors' reactions were not rational.

They said there is no logical reason for the investors to be panicky about the market.

On Tuesday, the central bank instructed conventional banks to lower their loan-deposit ratio to within 83.5 per cent and Shariah-compliant banks to within 89 per cent by June 30 with a view to curb aggressive lending.

Four out of five trading sessions of the week witnessed sharp fall.

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), shed more than 194 points or 3.13 per cent to settle at 6,021. It was the biggest single-week fall in two years since February, 2016.

"Index passed one of the most bearish weeks in the last two years," commented LankaBangla Securities, in its weekly market analysis.

The stockbroker noted that the market seems to feel the post-monetary policy announcement.

"Although the rumoured advance-deposit ratio regulation change was actually less strict than anticipated, market reaction has been vastly negative, with very slow participation throughout the week," the stockbroker said.

Two other indices of the premier bourse also saw sharp fall. The DS30 index, comprising blue chips, plunged 76.77 points or 3.33 per cent to finish at 2,228 and DSES (Shariah) slumped 34 points or 2.40 per cent to close at 1,397.

Chittagong Stock Exchange (CSE) also dipped with the CSE All Share Price Index -- (CAPSI) -slumping by 537 points or 2.80 per cent to finish at 18,623.

The Selective Categories Index of the second bourse of the country-- CSCX, also plunged 322 points or 2.78 per cent to settle at 11,249.

According to International Leasing Securities, the recent rising political tension and Bangladesh Bank's instruction for lowering of ceiling for banks' loans-deposit ratio.

The stockbroker noted that the investors mostly liquidated their holding from financial institution, engineering, bank and fuel power sectors.

"The corporate declarations during the week of some listed companies also failed to meet the investors' expectation," the stockbroker said.

Total turnover on the DSE came down to Tk 19.73 billion against Tk 22.46 billion in the week before.

The daily turnover averaged Tk 3.38 billion, which was more than 12 per cent lower than the previous week's average of Tk 4.49 billion.

The banking sector snared 16 per cent of the week's total turnover, closely followed by engineering with 15 per cent and pharmaceuticals 13 per cent.

Grameenphone (GP), RAK Ceramics and Prime Finance First Mutual Fund recommended dividend for the year ended on December 31, 2017 last week.

GP recommended 100 per cent final cash dividend and the total dividend will be 205 per cent as the company already paid 105 per cent interim cash dividend. RAK Ceramics recommended 10 per cent cash and 10 per cent stock dividend while Prime Finance recommended 8.50 per cent cash dividend.

The market capitalisation of the DSE also fell 2.14 per cent as it was Tk 4,268 billion on opening day of the week while it came down to Tk 4,176 billion on Thursday.

The losers took a strong lead over the gainers as out of 338 issues traded, 274 closed lower, 48 higher and 16 issues remained unchanged on the DSE trading floor.

GP topped the week's turnover chart with 1.99 million shares worth Tk 1.0 million changing hands, followed by Square Pharmaceuticals with Tk 859 million, IFAD Autos Tk 530 million, Monno Ceramic Industries Tk 513 million and LankaBangla Finance Tk 450 million.

Monno Ceramic was the week's best performer, posting a gain of 18.11 per cent while National Polymer was the week's worst loser, slumping by 12.09 per cent.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.