Published :

Updated :

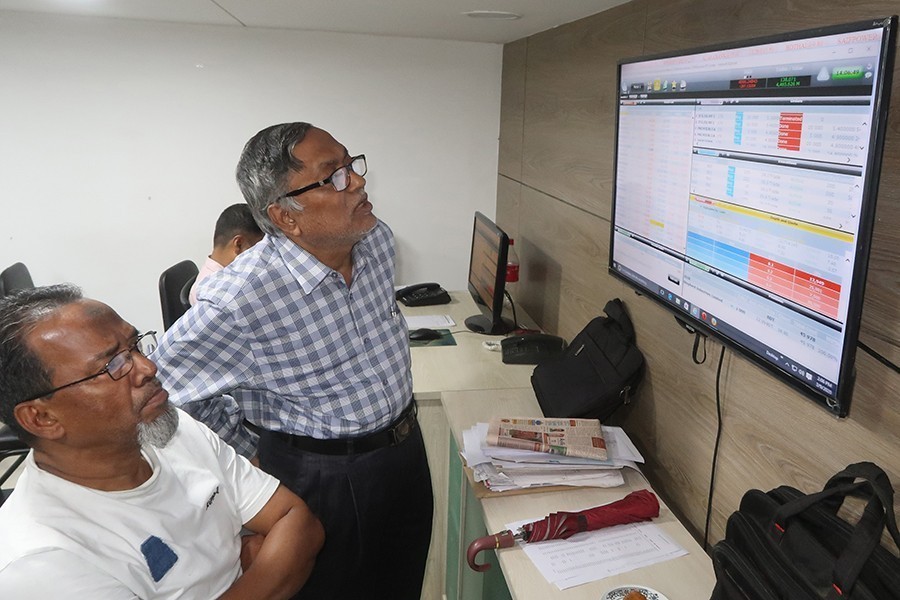

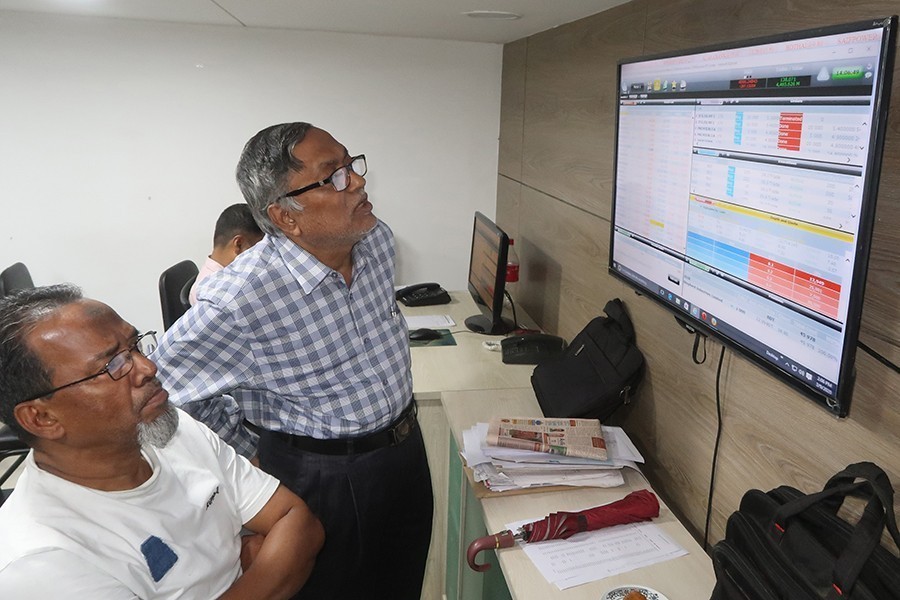

Stocks opened marginally lower on Wednesday as the shaky investors continued their sell-off in the major sector issues amid dismal earnings disclosure from most of the companies.

Following the previous day’s fall, DSEX, the prime index of the Dhaka Stock Exchange (DSE), went down by 4.06 points or 0.06 per cent to 6,380, after the first hour of trading at 10:30 am.

Two other DSE indices also saw a negative trend till then. The DS30 index, comprising blue chips, dropped 2.90 points to 2,240 and the DSE Shariah Index (DSES) fell 3.42 points to 1,393.

Turnover, another important indicator of the market, stood at Tk 2.70 billion after the first hour of trading at 10:30 am.

Market experts said investors are yet to regain confidence as they remained sceptical about the market outlook amid the current macroeconomic adversities in the country.

Most of the traded issues remained unchanged due to the ‘floor price’ restriction. Of the issues traded, 67 advanced, 62 declined and 157 issues remained unchanged on the DSE floor.

Genex Infosys was the most traded stock till the filing of this report with shares worth Tk 382 million changing hands following the company's recently signed business deal with the National Board of Revenue.

It was followed by Basundhara Paper Mills, Orion Pharma, Navana Pharma and Eastern Housing.

The Chittagong Stock Exchange also opened lower with its All Shares Price Index (CASPI)—losing 2.0 points to stand at 18,898 while the Selective Categories Index – CSCX – shed 1.0 points to reach 11,326, also at 10:30 am.

Of the issues traded till then, 22 gained, 37 declined and 27 remained unchanged with Tk 35 million.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.