Published :

Updated :

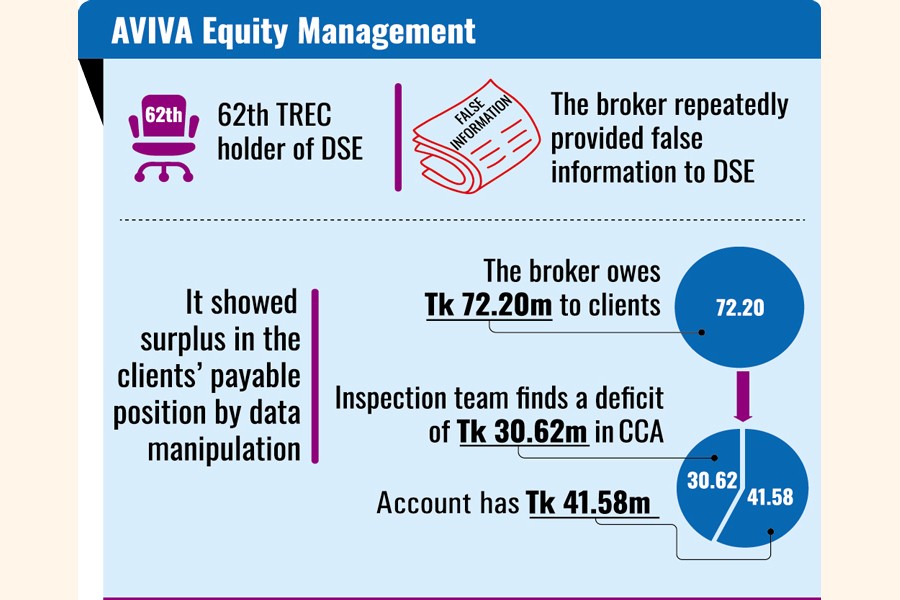

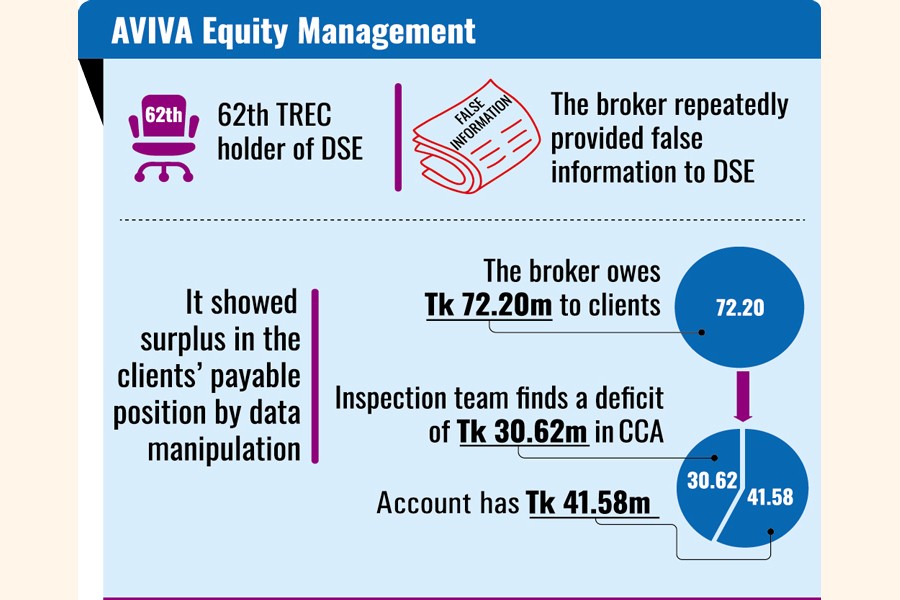

The Dhaka bourse has found a deficit of Tk 30.6 million in the consolidated customers' account (CCA) of AVIVA Equity Management.

An inspection team of the Dhaka Stock Exchange (DSE) examined the customers' account and identified misappropriation of investors' money and other anomalies.

In a letter sent to the brokerage firm on Monday, the premier bourse sought cooperation to fix the problems.

Scrutinising bank documents in July, the DSE inspection team detected the deficit in the clients' payable position.

According to the inspection report, AVIVA Equity Management owes Tk. 72.2 million to its clients, but the DSE team found Tk. 41.6 million in the company's document.

Having found investors' funds worth Tk 30.6 million missing, the DSE sought documents relating to loans taken and transactions made by the company. But the company did not comply with the instruction.

Moreover, Aviva Equity Management has been presenting fabricated data showing surplus in the clients' payable position.

A stock broker has to maintain a CCA opened with any scheduled bank to receive clients' funds for the purpose of trading in the capital market. Any deficit in that account indicates that the stock broker has set aside that amount of investors' fund from the CCA.

"It is very much unfortunate and with grave concern we would inform you that the company has not provided pertinent supporting documents," reads the DSE letter.

The bourse has not yet taken any stringent action against the company even though it did not get any response to its queries about negative equity.

Rather, the DSE said in its letter that the company's cooperation and professional support would be highly appreciated in this regard.

When contacted, Mohammed Shahidul Islam, managing director of Aviva Equity Management, refused to make any comment.

Earlier, four brokerage firms --- Tamha Securities, Banco Securities, Crest Securities and Shah Mohammad Sagir -- embezzled investors' money worth more than Tk 2 billion between 2019 and 2021. Trading in these brokerage firms has remained suspended.

Md Harunur Rashid, owner of Tamha Securities, illegally used two back-office accounting software, one for the regulator and the other for its clients to generate misleading information.

Tamha Securities defrauded clients of around Tk 513 million in 2021, and has been closed since November of the same year.

Banco Securities siphoned off Tk 1.07 billion, Crest Securities Tk 386 million and Shah Mohammad Sagir misused Tk 132 million from CCA, according to the DSE.

farhan.fardaus@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.