Bankrolling megaprojects, major works with borrowed money

Bangladesh gets deep into hard-term debts

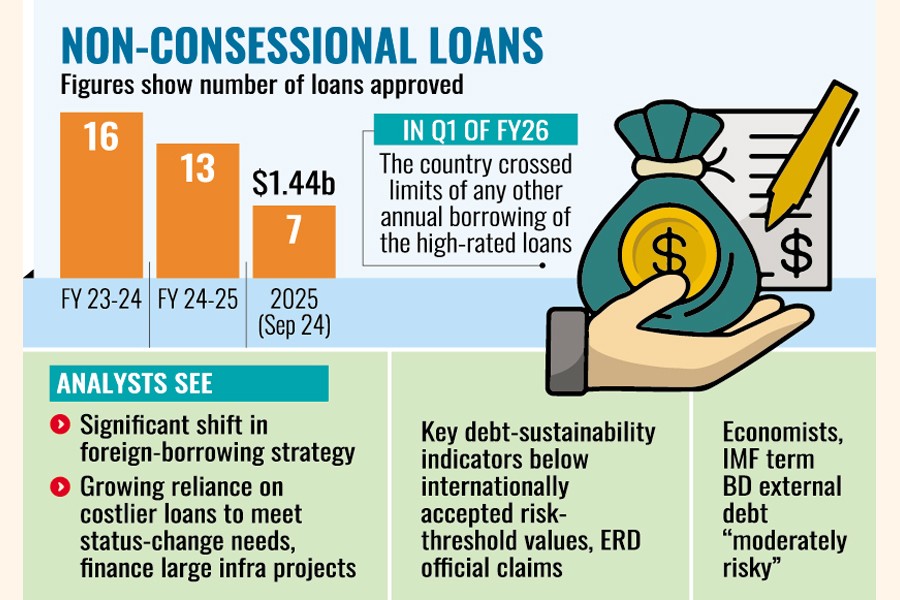

Seven hard loans worth $1.44b approved in a single sitting

Published :

Updated :

Bangladesh is increasingly getting into hard-term-debt burden by taking volumes of non-concessional loans particularly for bankrolling some mega-and major projects, officials say and warn of forex risks.

In the first quarter of the current fiscal year (FY) 2025-26, the country had already crossed limits of any other annual borrowing of the high-rated loans, they add.

In a single sitting on September 24, the interim government approved seven loans worth US$1.44 billion on hard terms, official and analysts said Tuesday.

Chaired by Finance Adviser Dr Salehuddin Ahmed, the standing committee on non-concessional loan (SCNCL) in September gave the all-clear for these loans from the Asian Development Bank, the European Investment Bank (EIB), the Islamic Development Bank and the Asian Infrastructure Investment Bank (AIIB), Economic Relations Division (ERD) officials have said.

Among the foreign credits, the non-concessional loan committee endorsed ADB's three fresh loans worth $649 million at its September meeting.

On the other hand, the rest $791-million loans from three separate lenders are older ones as the Bangladesh government had already taken those for four separate projects.

According to ERD, the ADB is to provide $508 million hard-term loan for the Chittagong-Dohazari railway-line project, $50 million for Khulna WASA, $91 million for expanding distribution network under the NESCO from its non-concessional window -- Ordinary Capital Resources (OCR) -- which hands outs market-based credits.

Among the already-confirmed non-concessional loans, AIIB's $400-million budget support, EIB's Euro 90 million for Sayedabad water-treatment plant and Euro 70 million for the Dhaka Environmentally Sustainable Water Supply (Dhaka WASA) project were approved at the meeting.

The non-concessional loan committee also approved IDB's $231-million loan for the construction of five climate-resilient bridges in Mymensingh division, which is also a market-based loan.

Analysts say Bangladesh is navigating a significant shift in its external-borrowing strategy, increasingly relying on costlier, non-concessional loans in recent years, a move driven by its transition to middle-income status and the need to finance large infrastructure projects.

Meanwhile, a total of 107 proposals for non-concessional loans have been approved by the Standing Committee in last 10 years to June 2025.

The SCNCL in the last fiscal year (2024-25) scrutinised loan terms and approved 13 proposals in line with national development priority.

In FY2024, the Standing Committee approved the proposal for taking 16 non-concessional loans.

According to the ERD, the SCNCL was constituted on 14 July 2013 to examine and approve the flexibility of the loan in a process consistent with the best international practices for negotiating the risk of hard conditions.

Foreign loans with less than 25-percent grants are required to be presented to the SCNCL for examination and approval.

A senior ERD official says the ERD is trying to maintain Bangladesh's strong debt-management record. "Key debt-sustainability indicators remained below internationally accepted risk-threshold values."

Analysts say Bangladesh's shift is escalating the nation's debt-servicing obligations and putting pressure on its foreign-exchange reserves, according to recent reports from financial institutions and economists.

Total debt-service payments during last FY2025 stood at US$4.087 billion, comprising $2.59 billion as principal repayment and $1.49 billion as interest payment, ERD data show.

The ERD official says the country's graduation to a lower-middle-income country in 2015 meant it became less eligible for highly concessional, low-interest loans (like the World Bank's IDA credits) which have long grace-and maturity periods.

As a result, the share of highly concessional IDA loans in the total external- borrowing portfolio dropped sharply from 58.9 per cent in 2013 to 27 per cent in 2022.

In their place, Bangladesh has increasingly turned to more expensive bilateral sources, such as China and Russia, and non-concessional windows of multilateral partners like the Asian Development Bank (ADB) and the Asian Infrastructure Investment Bank (AIIB), the official notes.

Chairman of the Policy Exchange, Bangladesh Dr Masrur Reaz told the FE that foreign loan-based indiscriminate and excessive project taken up by the last government already created pressure on the fiscal discipline.

"Bangladesh's total debt obligation (private and public sectors) has already crossed US$100-billion mark. Out of the loans, some three-fourths are the public-sector debt. So, the government has to think before taking any loan, especially the non-concessional ones," he adds.

Only those external credit-based projects need to be taken which have highest and critical returns, the young economist suggests.

The government should also negotiate strictly on the terms and conditions set by the foreign lenders to reduce the pressure on the foreign-exchange reserves.

A significant portion of the increased debt is tied to large-scale infrastructure projects, including the Rooppur Nuclear Power Plant (financed by Russia) and the Padma Bridge Rail Link (financed by China), another ERD official mentions.

"The grace periods on several of these large loans are ending or have recently ended, leading to a sharp increase in principal and interest payments," the ERD official mentions.

He says the significant depreciation of the Bangladeshi Taka against the US dollar, rising global interest rates, such as the transition from LIBOR to SOFR, have also increased the cost of existing loans with flexible-interest terms.

A former ERD secretary, Kazi Shofiqul Azam, notes that the economic success of achieving middle-income status has paradoxically led to tougher lending terms, with higher interest rates and shorter repayment periods.

Economists and the International Monetary Fund (IMF) have classified Bangladesh's external debt as "moderately risky" and are urging greater caution and improved debt-management strategies.

Experts recommend focusing on rigorous project evaluation, enhancing domestic revenue collection, and ensuring transparency to maintain long-term debt sustainability and avoid a potential crisis.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.