Bangladesh's coveted RCEP membership

Accession requires opening services sector

Published :

Updated :

Bangladesh's coveted membership in the Regional Comprehensive Economic Partnership (RCEP), world's largest trade bloc, presupposes challenging sweeping liberalisation of trade in services as a predominant condition.

A study, backed by a UN agency, shows how to circumvent the challenge in a measured manner. It suggests making a to-do list for phased execution of the requisite WTO-plus liberalisation in services trade to get in and derive dividend from the promising China-pivoted economic grouping encompassing Asia and the Pacific.

So far, the country's focus has been primarily on trade in goods although RCEP negotiations cover trade in services, investment, economic and technical cooperation, intellectual property, competition, dispute settlement, e-commerce, and small and medium enterprises (SMEs).

For the last couple of years, Bangladesh has worked to join in the bloc in pursuant to its strategy to absorb the possible shocks stemming from its graduation from the least-developed country (LDC) status by the end of next year. In 2024, the country formally placed its request to get in the largest free-trade bloc that now accounts for 28 per cent of global GDP, 29 per cent of population on the planet, and 25 per cent of global trade in goods and services.

To make it, Bangladesh has to make a long list of commitments to gradually open up various areas or sub-sectors of services for the 15 members of the grouping.

Signed in on November 15, 2020, the RCEP entered into force on January 1, 2022. It is constituted of the 10 ASEAN nations--Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam--plus Australia, China, Japan, South Korea, and New?Zealand.

The study, published as a working paper by Asia-Pacific Research and Training Network on Trade (ARTNet), analyses various aspects of and challenges for Bangladesh to liberalise trade in services to partner RCEP.

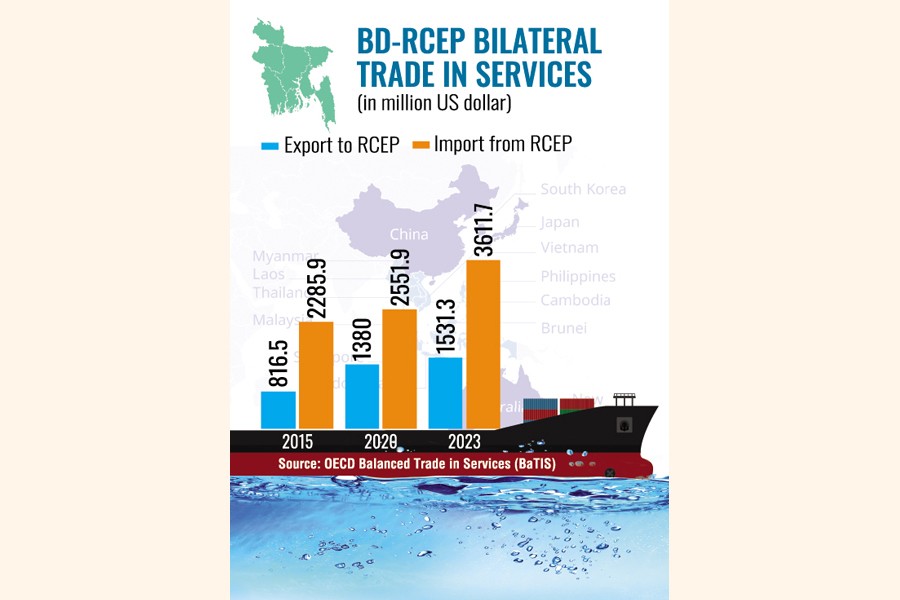

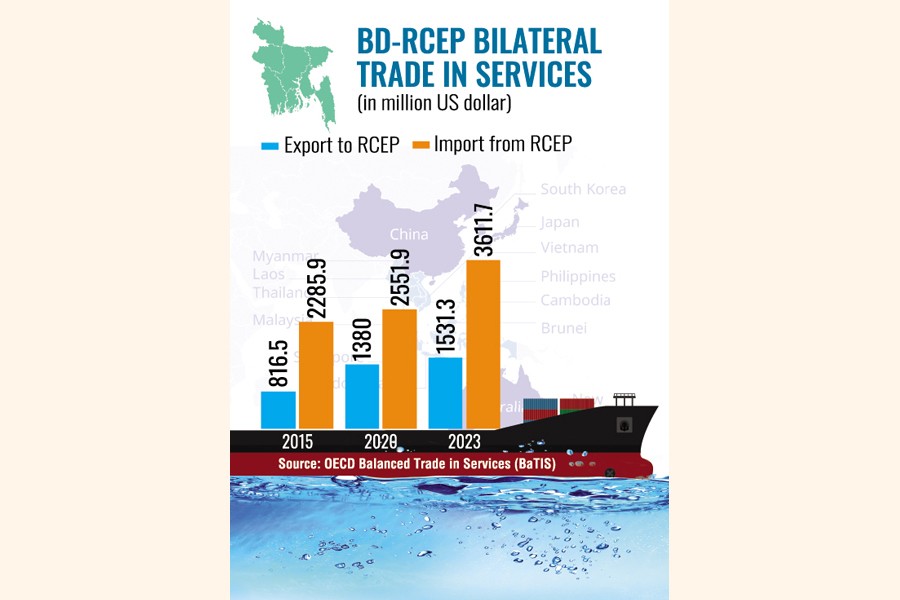

The paper shows that Bangladesh's services exports to RCEP have grown modestly, 8.2 per cent in- between 2015 and 2023. The country exported US$ 1.5?billion worth of services to RCEP members in 2023--around one-fourth of its total services exports.

At the same time, RCEP economies are the major suppliers of Bangladesh's services imports. In 2023, services imports from the bloc cost $3.61?billion or around 33 per cent of total imports of services. China and Singapore stand out as the largest RCEP suppliers for Bangladesh as these two countries accounted for more than two-thirds of total supply from the trade bloc.

By benchmarking Bangladesh's readiness against the other RCEP members who have made lowest commitment to opening services sectors under the trading bloc, the report identifies sectors where "Bangladesh already complies with liberalisation norms and sectors where significant gaps remain".

"Most sectors need reform, but some are already compliant: travel, banking, and ICT are relatively RCEP-ready; meanwhile, IP, insurance, education, and media require extensive reform," says the report on findings.

"Government procurement and mutual-recognition mechanisms also require significant policy upgrades," it adds, pointing out that regulatory-and market-access barriers remain significant.

The report also points out that many sectors like professional services, insurance, intellectual property and media, remain highly regulated or closed to foreign firms.

It further mentions that in some areas, like telecoms and banking, partial liberalisation has occurred but still falls short with RCEP members' commitments.

Contacted for local expert views, Professor Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue (CPD), said in RCEP, Bangladesh has to make WTO-plus commitment to liberalise trade in services.

"In the World Trade Organization (WTO), Bangladesh has already committed to opening telecommunications and five-star hotel business to trading partners," he said.

"Moreover, banking sector in the country is also largely liberalised. So, Bangladesh can easily offer these sectors to RCEP partners. Nevertheless, to get entry into other markets of the RCEP-member countries, Bangladesh needs to open more sectors--and that will lead to WTO-plus commitment."

The international-trade expert also stresses reviewing the liberalisation commitments on trade in services made by the member-countries of RCEP and design the stance of Bangladesh accordingly.

Manzur Ahmed, Trade and Tariff Policy Adviser of the FBCCI, says RCEP provides an opportunity for Bangladesh to increase trade in services and making a WTO-plus commitment will not be a big problem for the country.

"Currently, we are negotiating Economic Partnership Agreement with Japan where we have to go for some RCEP-plus commitment in goods, services and intellectual property rights, which is not desirable," he says. "Instead we should stick to RCEP framework and there is little need to go for EPA with Japan as it is also a member of RCEP."

The working paper suggests that Bangladesh join in the bloc with a limited-commitment schedule for services as like Cambodia as it would allow gradual liberalisation along with boosting investor confidence and regional integration.

Overall, the report observes, RCEP accession, coupled with deep domestic reforms, is a strategic necessity for Bangladesh to remain competitive in the post-LDC era.

The working paper, titled 'Analysis Report: Bangladesh's Service Trade and RCEP Accession', is prepared by Tao Qi and Rupa Chanda. Dr Chanda is Director, Trade, Investment and Innovation Division, the UN Economic and Social Commission for Asia and the Pacific (ESCAP).

The suggestions also have that Bangladesh needs to adopt a phased, learning-by-doing, approach to liberalisation of trade in services and it may initially liberalise selectively.

"For example, Cambodia and Lao PDR as RCEP members were given more time in terms of trade liberalisation among RCEP members," it added. "This phased approach would allow Bangladesh to open sectors gradually, focusing first on areas of comparative strengths or easier wins, and deferring more sensitive liberalisation until domestic industries are better prepared."

asjadulk@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.