Published :

Updated :

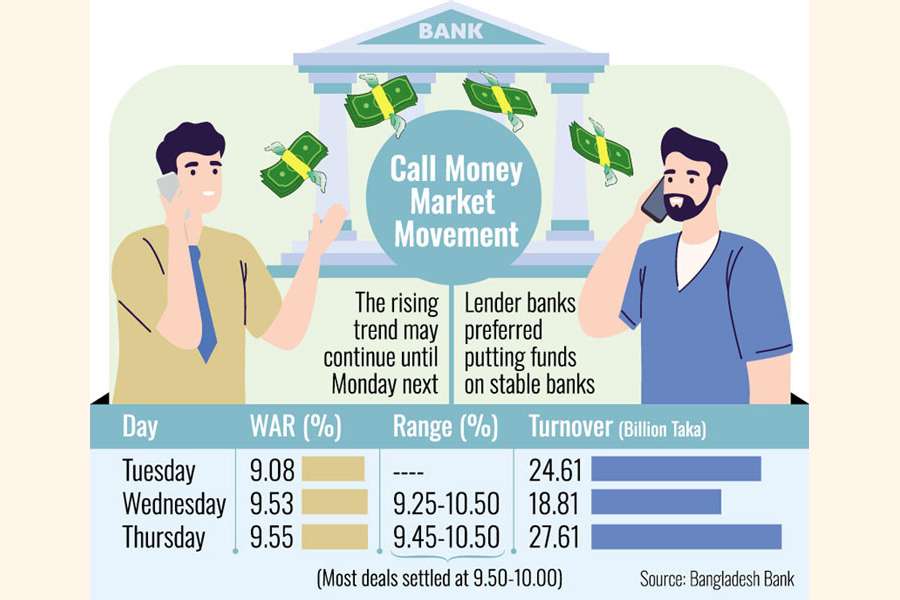

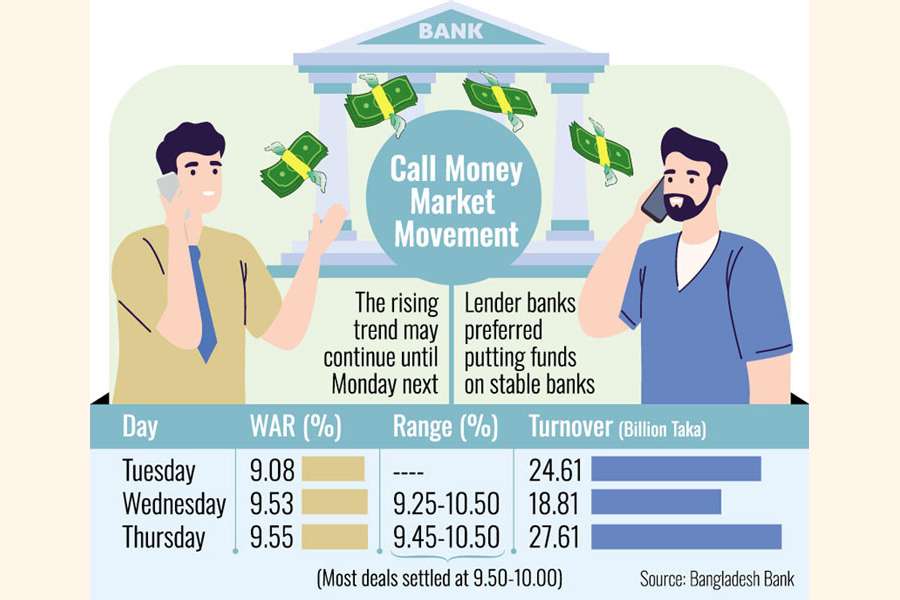

The inter-bank call money rate increased for the last two consecutive days following the policy rate hike by the central bank on Tuesday.

The weighted average rate (WAR) of call money rose to 9.55 per cent on Thursday from 9.53 per cent of the previous day. It was 9.08 per cent on Tuesday.

The call rate ranged between 9.45 per cent and 10.50 per cent on Thursday against the previous range between 9.25 per cent and 10.50 per cent.

However, most of the deals were settled at rates varying between 9.50 per cent and 10.00 per cent, according to the market operators.

They also said the lender banks preferred putting their excess funds through overnight deals on the stable banks and avoided the troubled ones.

Meanwhile, the deficit in the current accounts of the troubled nine private commercial banks maintained with the central bank has exceeded Tk 180 billion.

National Bank has a current account deficit of over Tk 23.42 billion, First Security Islami Bank Tk 72.69 billion, Social Islami Bank Tk 33.94 billon, Union Bank Tk 22.09 billion, Commerce Bank Tk 3.80 billion, Global Islami Bank Tk 0.39 billion, Islami Bank Bangladesh Tk 22.01 billion, Padma Bank Tk 2.34 billion and ICB Islami Bank Tk 0.95 billion.

Of them, five commercial banks - National Bank, First Security Islami Bank, Global Islami Bank, Social Islami Bank and Union Bank - have obtained a central bank guarantee to avail liquidity support from the inter-bank money market.

"Some lender banks have parked their excess funds in the central bank using the reverse repo arrangement to avert financial risk," a senior treasury official at a leading private commercial bank told the FE while replying to a query.

He also said some banks have also lent their excess funds to other banks using 'short notice' arrangements charging a maximum 12.25 per cent on Thursday.

The rising trend of call money rate may continue until Monday next as all the scheduled banks have to maintain 4.0 per cent cash reserve requirement (CRR) on the day with the central bank.

Under the existing rules, the banks are allowed to maintain the reserve at 3.50 per cent instead of the existing 4.0 per cent on a daily basis, but the bi-weekly average has to be 4.0 per cent in the end.

However, total turnover in the inter-bank call money market rose to Tk 27.61 billion on Thursday from Tk 18.81 billion on the previous working day. It was Tk 24.61 billion on Tuesday.

Earlier on Tuesday, the Bangladesh Bank (BB) raised the policy rate, also known as the repo rate, by 50 basis points to 9.50 per cent in an effort to reduce inflationary pressure on the economy.

The policy rate hike means banks under liquidity crunch will now have to pay more interest for loans taken from the central bank.

To manage liquidity more effectively, the BB also raised the upper limit of the policy interest corridor. The Standing Lending Facility (SLF) rate rises to 11 per cent, up from 10.5 per cent, while the Standing Deposit Facility (SDF) floor rate moves up to 8.0 per cent from 7.5 per cent.

siddique.islam@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.