CLIENTELE SPINOFFS FROM SHARIAH BANKS' MERGERS

Conventional banks race to fill Islamic banking void

Published :

Updated :

Conventional banks go jockeying to seize switching clientele through unconventional Islamic-banking operations as a vast market emerges as spinoffs from merger of five financially weakened shariah-based lenders, sources say.

The readied merger of the five unconventional banks under reform recipes pursued by the Bangladesh Bank (BB) prompt the clients of Islamic banking to look for alternative but compliant lenders for their deposits.

In the changing paradigm, the mainline banks are now in competition to allure the switching depositors with either expanding their Islamic windows and branches or moving to convert to full-fledged Islamic lending entities.

There are 10 complete shariah-based banks in the country. Five of them are financially too weak that forced the banking regulator to decide on their mergers while the financial condition in three others is not sound enough. And it creates an opportunity for the conventional banks amid prevailing lower-investment regime.

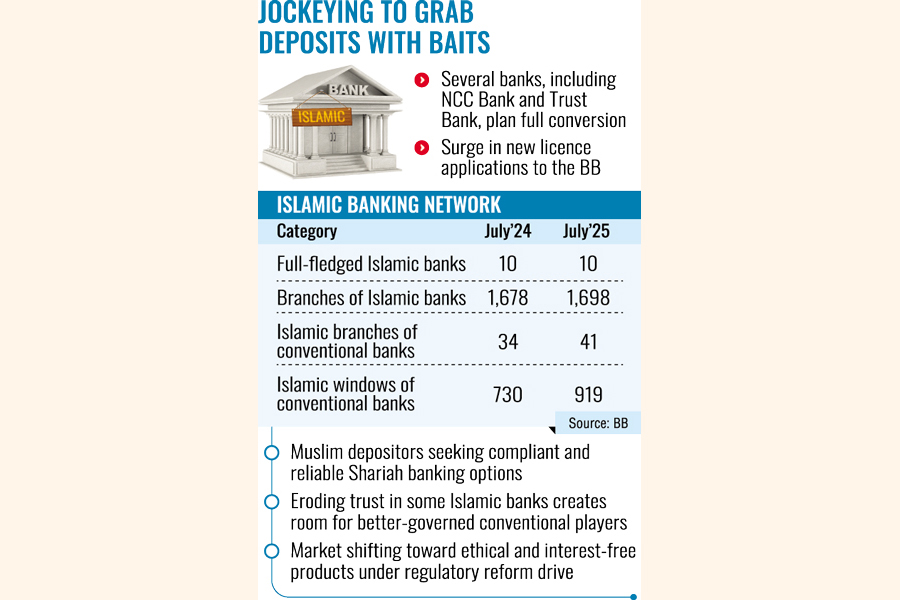

Apart from 1678 branches of the sariah banks, the number of Islamic branches and windows of the conventional banks were 34 and 730 respectively until July 2024, according to data available with the BB, the country's central bank.

But the number of Islamic branches and windows of the general banks increased to 41 and 919 respectively by the end of July 2025, the official data showed.

On the other hand of the switch, the number of branches of the fully fledged lenders rose to 1,698 over the last one year up to last July.

Seeking anonymity, a BB official has said they have received increased number of applications in recent times from the conventional banks seeking regulatory approval for expanding their Islamic-banking network across the country.

"This is very interesting. It seems that conventional banks tilt towards the Islamic-banking operations," the BB official told The Financial Express, adding that a few traditional banks have already expressed their interest to change their identity into a complete Islamic lender.

Explaining reasons, the central banker says there are huge Muslim clients who want to get engaged in shariah-focused banking activities but they don't have enough trust on many of the existing Islamic banks here because of the non-compliance in those lending entities.

As a matter of fact, the clients keep switching sides to the compliant conventional banks having unconventional-banking operations.

"This could be a major reason behind the banks' growing attention on Islamic banking."

Talking to the FE, managing director of NCC Bank M. Shamsul Arefin said the board of directors of the bank decided to convert the bank to a complete Islamic bank by considering demand of the market. He said they had already shared the decision with the banking regulator and the central bank wanted a detailed roadmap of the conversion.

"We are doing a study with respected and quailed experts in that area. We are taking some time to make it a reliable and comprehensive financial service provider for this segment of customers."

Theirs will turn into an Islamic bank in line with guidance from the central bank after getting the approval.

Managing director and chief executive officer of Trust Bank Ahsan Zaman Chowdhury says they have also planned to be a full-fledged shariah-based lender and are taking necessary preparation for the metamorphosis.

Simultaneously, says the bank's top executive, the bank has a total of 122 branches and 30 Islamic-banking windows currently operating in various corners of the country.

"We have already submitted proposal to the central bank for approval to open 10 Islamic-banking branches and 70 more Islamic windows to serve more shariah-centric banking clients," the experienced banker explains the transition pursuit.

Later last week, the advisory council of the interim government approved the central bank's proposal for merger of the five financially troubled Islamic banks: First Security Islami Bank, Social Islami Bank, Global Islami Bank, Union Bank, and Export Import Bank of Bangladesh PLC (EXIM Bank).

The overriding cause is to stabilise the financial sector-shaken by past fiascos. Under the ongoing financial-sector-reform recipes, the ill-fated banks will be merged into a state-owned Islamic bank with full protection to the depositors of the struggling lenders.

The combined non-performing loans (NPLs) of the five banks are around Tk 1.47 trillion, which is 77 per cent of their total loan disbursements.

Union Bank has the highest percentage of NPLs at 98 per cent, followed by First Security Islami Bank (96 per cent), Global Islami Bank (95 per cent), Social Islami Bank (62 per cent) and EXIM Bank (48 per cent).

jubairfe1980@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.