Published :

Updated :

Concerns over overlapping loans and rising debt burdens are increasingly overshadowing the achievements of microcredit sector, prompting calls for deeper research and policy intervention.

Officials and experts warn that many borrowers are becoming trapped in a "debt spiral", taking on new loans to repay old ones, undermining the sector's long-held reputation as a tool for poverty alleviation.

These concerns were highlighted on Thursday at an inception seminar titled "Debt Spiral in Bangladesh's Microfinance: An Assessment of Its Size and Implication for Indebted Households and Suggestions for Remedial Measures", organised by the Microcredit Regulatory Authority (MRA).

The study, now under way, aims to assess the scale of the problem and propose remedies to make microfinance more sustainable and borrower-friendly.

The research is being conducted by the Economic Research Group (ERG) under the initiative of the MRA. Fieldwork will cover 32 upazilas across 16 districts, with the objective of generating realistic and effective policy recommendations based on ground-level evidence.

Financial Institutions Division Secretary Nazma Mobarek attended the seminar as chief guest, while MRA Executive Vice-Chairman Mohammad Helal Uddin presided over the event.

Ms Mobarek said over-indebtedness and the debt spiral have emerged as major policy concerns. She noted that evidence-based recommendations from the study would help make the microfinance sector more humane, resilient and sustainable.

ERG Executive Director Sajjad Zohir, in a presentation on the study's framework, said the long-celebrated role of microfinance in poverty reduction is increasingly being questioned.

According to him, many believe that rising debt burdens are eroding earlier gains, making it essential to reassess the sector's real-world impact.

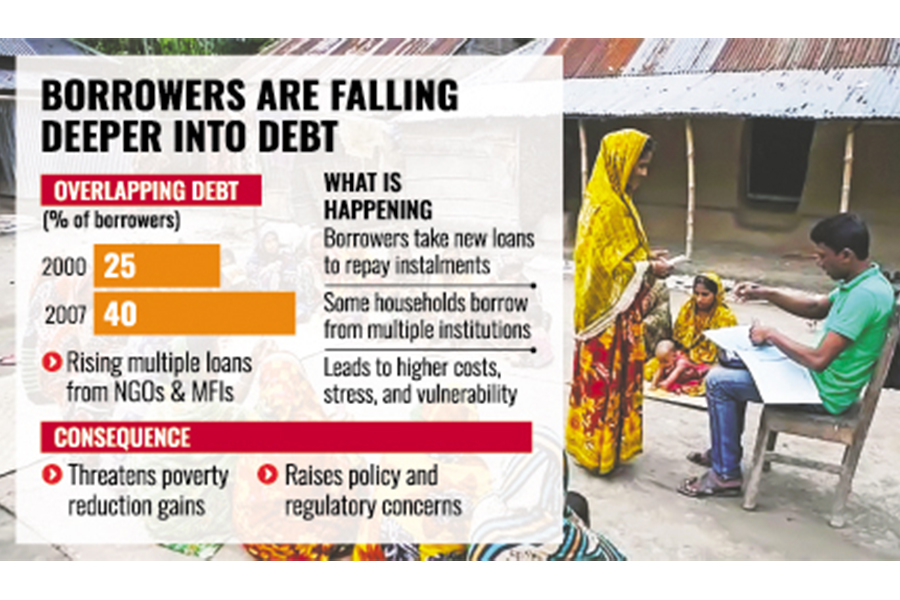

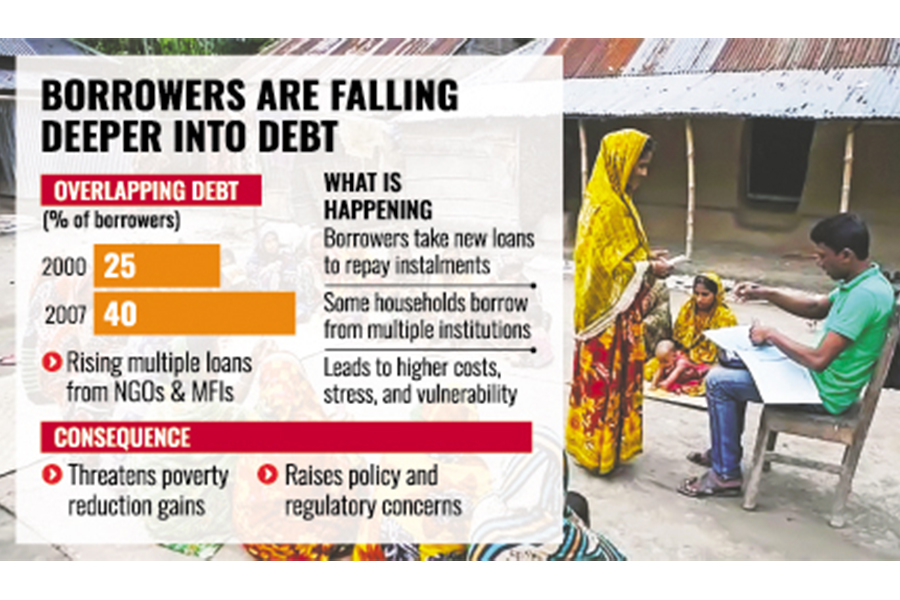

Palli Karma-Sahayak Foundation (PKSF) Managing Director Md Fazlul Kader said the extent of overlapping debt has risen significantly over time, from 25 per cent in 2000 to around 40 per cent in 2007.

In many cases, borrowers are compelled to take loans from other NGOs or associations when they fail to meet instalments, leading to multiple borrowing and deeper indebtedness.

He stressed the need for effective policies to curb this trend, while also noting that multiple borrowing is not always harmful, as shown in some earlier PKSF studies.

Mr Kader also questioned the reliability of some official statistics, saying data from the Bangladesh Bureau of Statistics may not fully capture the complex realities on the ground.

Other speakers at the seminar included Mohammad Yakub Hossain, Executive Director of the MRA; Lila Rashid, former Executive Director of Bangladesh Bank; and academic and microfinance expert Professor M A Baqui Khalily, all of whom emphasised the need for informed policy responses to address rising borrower vulnerability.

nsrafsanju@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.