Money changes course back into banks

Drained deposits worth Tk 190b return in a single month

Published :

Updated :

Currency buildups outside banks are waning fast with the money flowing back into vaults in a latest pivot that gives some respite to the commercial lenders from a crisis-bred liquidity crunch.

Out-flowed deposits amounting to Tk 190 billion returned into the banking sector in a month, last April, amid a lax investment regime as well as gradual restoration of confidence in banking operations after a past rout, official data show and analysts believe.

Central bankers and money-market analysts say depositors took away a large volume of their deposits from the banking system during Ramadan and Eid-ul-Fitr, which enhanced the volume of currency outside the banks -- euphemistically called mattress money-- to a record high in March 2025.

But, after the largest religious festival in the Muslim-majority economy was all over, the deposits began changing course back into the banking system in absence of other investment opportunities under the prevailing economic sluggishness, according to them.

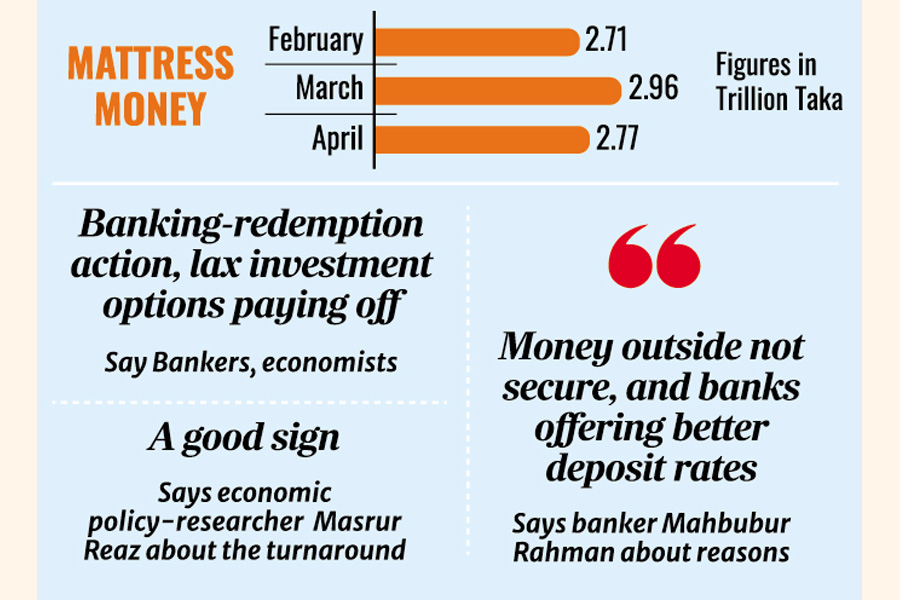

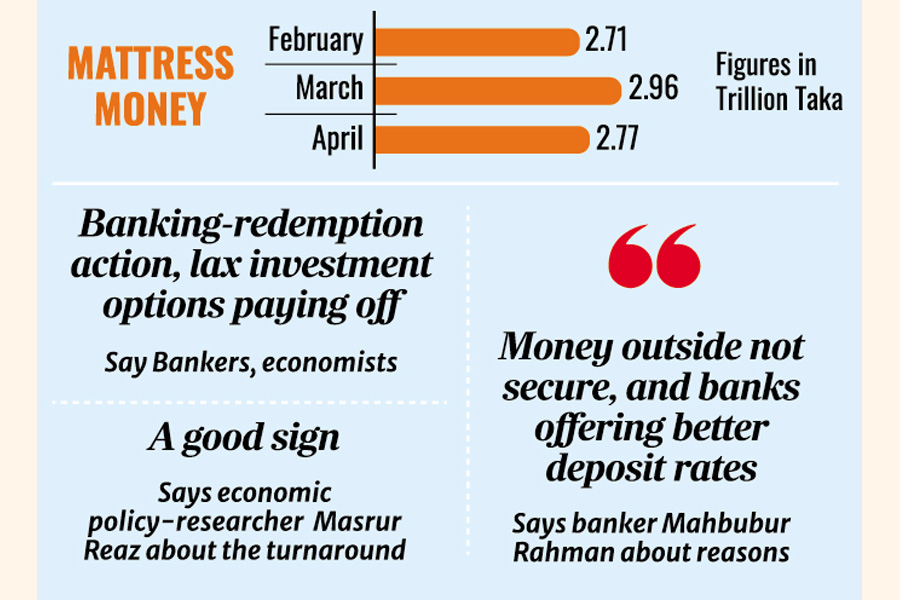

According to the latest data available with the central bank, the cache of currency outside banks dropped to Tk 2.77 trillion at the end of April, from the March count of Tk 2.96 trillion.

The deposit outflows from banks had been on stream since October 2024 following reports of gross irregularities in some commercial banks. The amount rose to a record-high Tk 2.96 trillion in March 2025, before a climbdown began with the money changing its course over again.

Seeking anonymity, a BB official says people normally takes away deposits in large volumes ahead of any major festivals, like Eid. Because of the fact, the volume of money outside the banks increased by Tk 250 billion in just a month in March when the country observed Ramadan and Eid-ul-fitr.

"That's why the volume of mattress money rose to Tk 2.96 trillion in March from February's count of Tk 2.71 trillion. After the festival, it dropped to Tk 2.77 trillion in the following month," the official told the FE writer in explaining the latest switch on the money market.

The central banker predicted the figure would increase again in May once the post-Eid data were conflated.

Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank (MTB), says people probably do not feel comfort in keeping money outside the banks for a long time by taking the current law-and-order situation into consideration.

On the other hand, the experienced banker mentions, banks have been offering relatively better rates for the depositors while the yields on treasury bills and bonds are still lucrative for the investors.

"These factors might attract the deposits that out-flew in recent times to return to the banking system, which is a good sign," the banker adds.

Contacted, Policy Exchange of Bangladesh chairman Dr M Masrur Reaz said there were very limited investment instruments for common people here and this makes them pivot back to banks.

Excepting banks, potential investment areas were savings certificate and capital market. But the share market is unhealthy and putting money in stocks is becoming extremely risky while the rates on savings certificates are not as lucrative as the savers desire.

"That is why people are now returning back to banks, which is a good sign," says Mr Reaz about the turnaround.

The development especially bears significance for happening at a time when the interim government is trying to restore shaken client confidence in banks and putting the banking system back in order through major reforms that include mergers of those weakened through alleged mismanagement and plunder in the past.

The cleanup recipe also includes drives for repatriating funds siphoned off the banks and enterprises as well as freezing suspect bank accounts of runaway or detained tycoons.

jubairfe1980gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.