Published :

Updated :

Amid inflation hovering around a double-digit level for around a year, the Federation of Bangladesh Chambers of Commerce & Industry (FBCCI) has proposed exempting all agro-based essential commodities from source tax.

The country's apex chamber called for the withdrawal of the tax, arguing the 2.0 per cent rate on the supply of rice, wheat, potato, onion, garlic, gram, chickpeas, lentils, turmeric, chilli, maize, flour, salt, edible oil, sugar and all types of fruits has led to an increase in essential commodity prices.

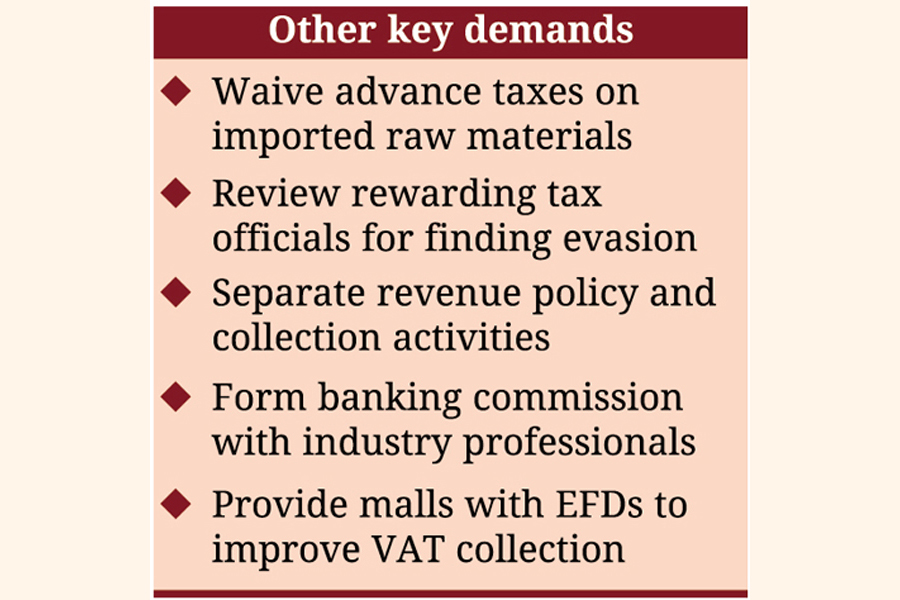

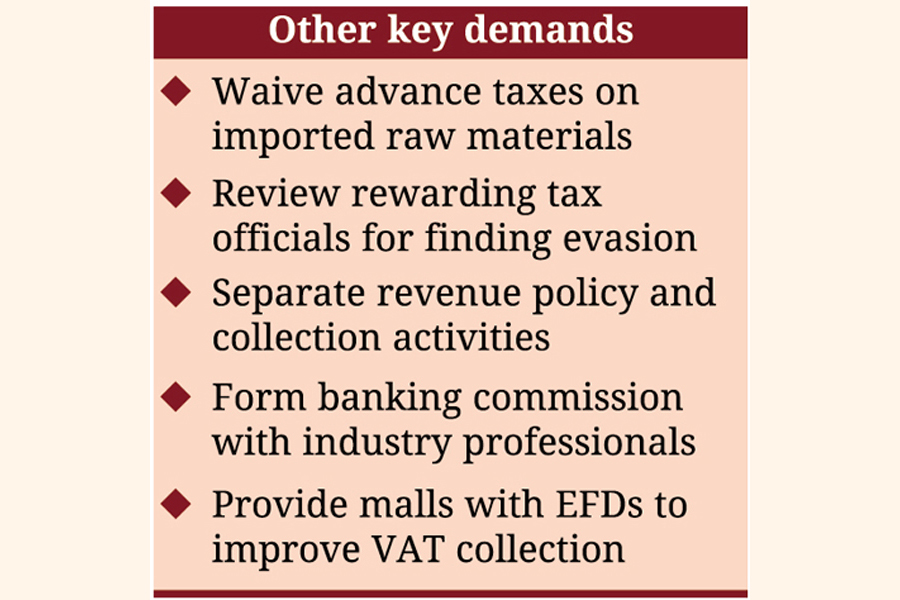

In its recent proposal to the finance ministry for the upcoming national budget for FY 2024-25, the trade body also sought a cut in source tax on export proceeds and their cash incentives, a review of the minimum tax provision and the imposition of a regulatory duty to control imports of certain items.

To resolve the persistent foreign exchange crisis, FBCCI suggested that the Bangladesh Bank take prudent steps through discussions with market players or stakeholders.

The FBCCI will place the proposals for discussion with stakeholders on April 4 at the consultative committee meeting of the National Board of Revenue (NBR) and FBCCI.

The trade body proposed a reduction of source tax for export proceeds to 0.5 per cent from the existing 1.0 per cent for the next five years.

The chamber also recommended macro-economic reforms, including forming a banking commission that prioritises professionals in the banks' governing body and taking immediate steps to reform the tenure of bank directors.

To resolve complexities in releasing import goods from ports, the chambers demanded accepting the lowest value of the last three months as defined by the World Trade Organization (WTO) and withdrawing tariff value and minimum value at the time of customs assessment of goods.

The FBCCI also proposed widening the tax base and reducing the tax rate, implementing the Bangladesh single window project, separating revenue policy and collection activity and ensuring coordination between income tax, value-added tax (VAT) and customs.

It called for waiving the advance income tax and advance tax on imported raw materials and intermediate industrial items.

The chamber alleged abuse of law due to provisions that award tax, customs and VAT officials for detecting tax evasion. "Supplementary duty should be imposed only on luxury items, products involving national security and non-essential items," it said.

The FBCCI also requested allowing duty-free import of a maximum of five sample products to expedite apparel export growth and remain competitive in the international market.

It proposed tax breaks on imports of solar PV systems, exempting VAT on procuring raw materials and supplying recycled fibre to local spinning mills and allowing duty-free facilities for clips used in recycled fibre manufacturing mills and garment cuttings.

"The new income tax law lacks a study to determine source tax. In many cases, source tax deductions exceed a company's actual profit. The current structure increases the cost of doing business," the FBCCI said.

The new law introduced by the tax authority places 39 sectors under minimum tax, which contradicts the main principle of income tax law.

The chamber body proposed reinstating the previous audit law in income tax, finding the existing audit law to be harassment for taxpayers.

The FBCCI argued the advance tax fuels manufacturing costs for industries. It opposed expanding VAT deducted at source and instead proposed supplying electronic fiscal devices to all shopping malls in Dhaka and Chittagong, as well as other city corporations, and introducing online tracking.

doulotakter11@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.