RESERVES $32.71B, BD POISED TO MAKE $1.6B ACU PAYMENT NEXT WEEK

Forex buffer wanes amid earnings, spending mismatch

Published :

Updated :

Bangladesh sees its foreign-currency buffers wane amid a rather abrupt earnings dip and external payments, stoking fears of pressure on the country's current-account balance too soon.

The fall in foreign-currency surplus happened principally because of the steadily growing overseas liabilities of the country in the form of import settlement in recent times while export earnings show rather abrupt downturn.

Although the country gains some acceleration in remittance inflow, it is not getting the benefits due to dips in export earnings in recent months, officials and experts have said.

In fact, the country has enjoyed steady surplus in foreign-currency inflow in-between over $1.0 billion and $2.0 billion since May 2025 because of downturn in import settlements. Since September last, the import payments have shown an upturn, weighing the surplus down to $1.0-billion mark.

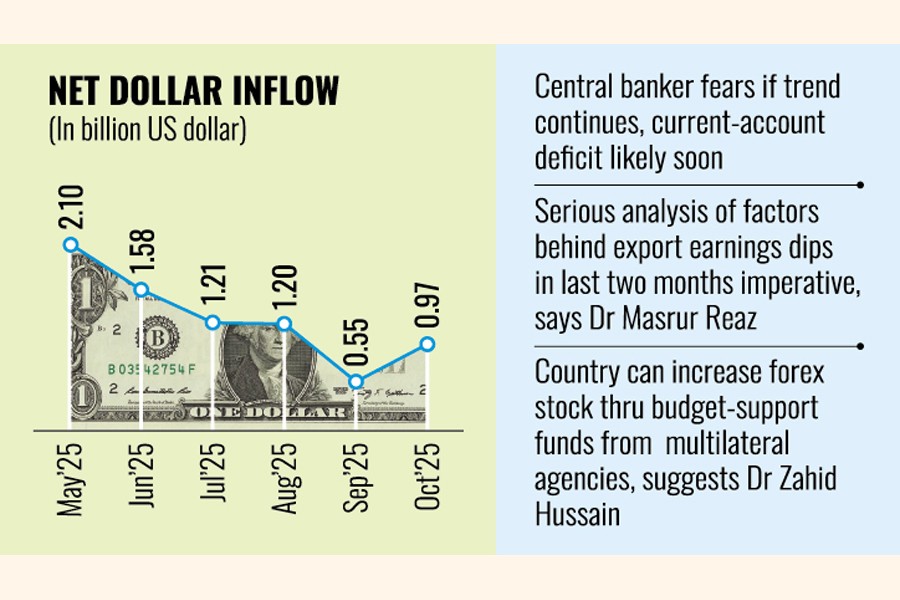

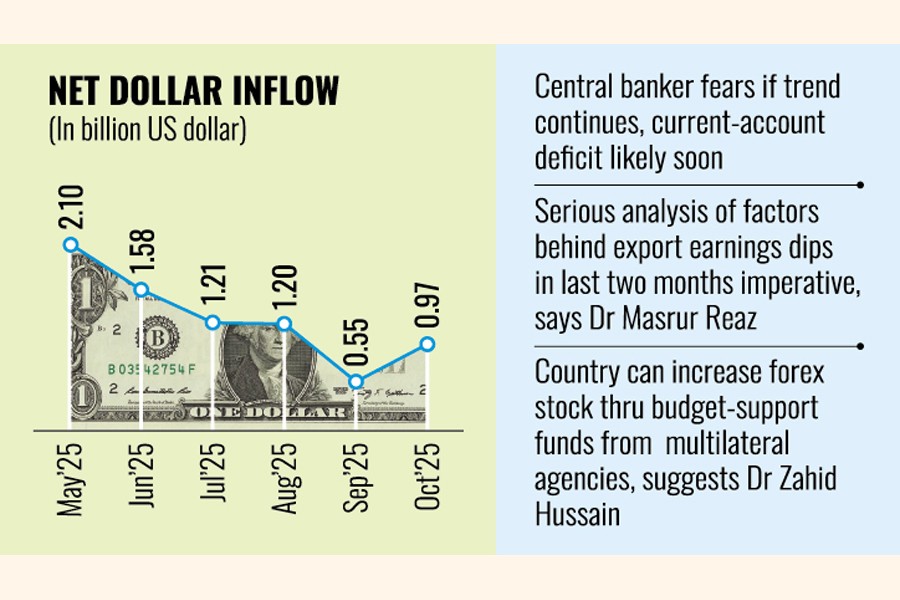

According to Bangladesh Bank (BB) statistics, earnings of foreign currencies amounted to $6.30 billion in the form of remittance and exports in the just-past October. But settlement of import orders ate up $5.41 billion. The volume of excess inflow now reached a mere $0.97 billion in the last month.

In May 2025, there was a net inflow of $2.10 billion when it earned $7.70 billion through remittance and export receipts against clearing import liabilities of $5.60 billion.

The surplus inflow was recorded $1.58 billion, $1.21 billion, $1.20 billion and $0.55 billion in June, July, August and September of this year respectively, as shown in the data.

Seeking anonymity, a BB official says the growth in remittance slowed down a bit while exports kept falling. On the other hand, imports start gathering momentum.

"So, the benefit from export-plus remittance over import is getting squeezed, which is a concern for the economy that saw significant improvement in the country's balance of payments (BoP) recently," the BB official told The Financial Express.

The central banker fears if the trend continues, the country may see deficit in current account soon.

Former lead economist in World Bank's Dhaka office Dr Zahid Hussain says if the domestic demand, which is not foreign-financed, increases over the supply, it will put some pressure on the market.

"The country needs to raise supply of the forex. This is the ultimate solution," the eminent economist suggests.

He mentions that the central bank builds up foreign-exchange reserves through buying the American greenback from the market to keep stable the taka-dollar exchange rates.

If any form of volatility arises in the coming days because of the supply-demand mismatch, he says, the regulator will be able to cool down the market through selling the US dollars.

Simultaneously, he suggests, the country can increase its forex stock through ensuring budget-supporting funds from the multilateral agencies like the World Bank and the International Monetary Fund (IMF).

Explaining the apparent economic paradox, Dr M Masrur Reaz, Chairman of Policy Exchange Bangladesh, says the central bank, as part of its economic rebounding move, allows all kinds of imports for the last several months after lifting the import compression by riding a record inflow of forex.

As a matter of fact, he notes, the economic activities have slowly been rebounding. To make it sustainable, the country needs to continue the relaxation in imports in the coming days, too.

"But the worry part is the falling trend in exports. We need to analyse factors seriously why the earnings from exports took a dip in the last two months and act accordingly," the international-trade expert told The Financial Express.

However, central bankers set their sights high on a rebound in the country's stock of the greenback on a few counts, notwithstanding external payment obligations.

Bangladesh's gross foreign-exchange reserves, meanwhile, stood at US$32.71 billion Thursday, driven mainly by higher inflows of inward remittances, officials said.

The reserves are expected to remain above the $31-billion mark next week even after settling import-payment obligations worth $1.60 billion with the Asian Clearing Union (ACU) member-countries.

The central bank estimates that the reserves of the global trading currency may reach $34- billion mark before the next national elections, scheduled for February 2026.

"We expect the country's gross forex reserves to reach around $34 billion within the first week of February 2026 if the current trend continues," a senior central bank official told The Financial Express (FE), citing the BB projection.

He also says nearly US$800 million had been added to the forex reserves during the past two months, following the immediate-past ACU settlement.

Earlier on September 7, the country's gross forex reserves stood at $30.30 billion after settling import-payment obligations worth $1.50 billion with the ACU member-countries for the July-August period of 2025.

"We have built up the latest reserves without receiving any overseas funds from development partners," the central banker explains the internal strengths.

Meanwhile, the central bank is set to settle import-payment obligations worth $1.60 billion with the ACU member-countries for September-October of this calendar year.

"The ACU payment-settlement process has already begun and is expected to be reflected in the reserves figure on Sunday or Monday next week," another senior official of the central bank told the FE.

siddique.islam@gmail.com

jubairfe1980@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.