Published :

Updated :

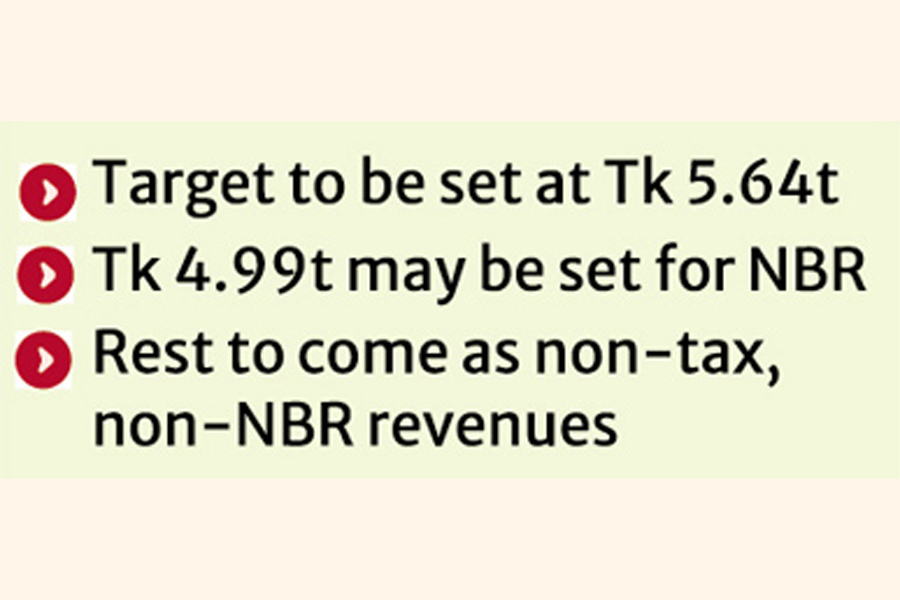

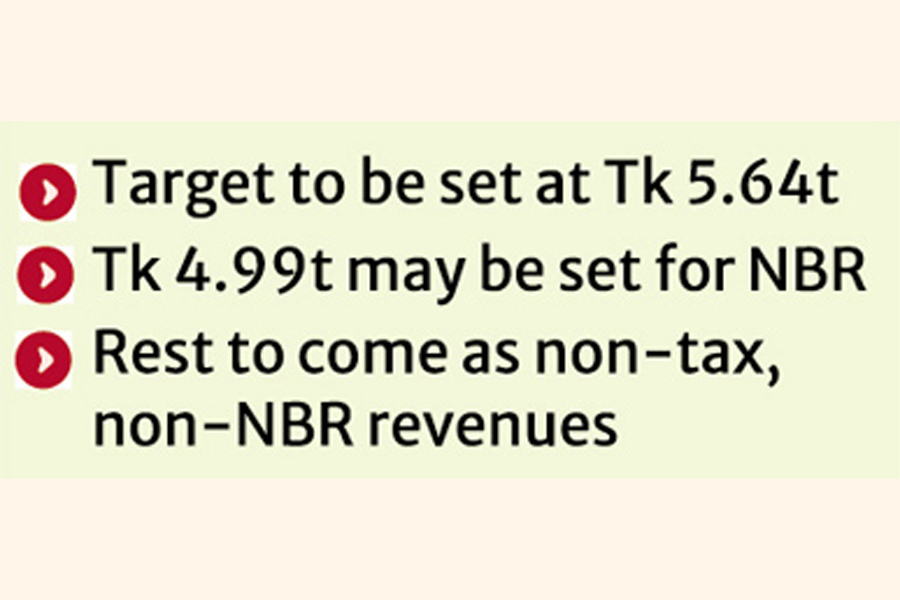

The government is set to fix its total revenue target for the upcoming fiscal year at Tk 5.64 trillion, expecting nearly 4.25 per cent growth from the FY25 figure.

As the government has planned to keep the budget size small, it is going to set a reasonable revenue target for FY26, officials said.

The original revenue collection target was Tk 5.41 trillion for FY25, Tk 5.0 trillion for FY24, and Tk 4.33 trillion for FY23.

Of the FY26 target, Tk 4.99 trillion is likely to be set for the National Board of Revenue (NBR), while the rest will come as non-tax and non-NBR revenues.

The Ministry of Finance (MoF) has finalised the total revenue target after several revisions to accommodate it in the actual budget size, which is likely to be above Tk 7.0 trillion.

The total revenue collection target for the current fiscal year was Tk 4.80 trillion, which has been revised down to Tk 4.63 trillion.

A senior finance ministry official said the budget wing struggles to fix the revenue target by balancing it with other budget figures due to poor revenue collection growth.

Ministry officials said the government needs to increase the country's tax-to-GDP ratio to meet the International Monetary Fund's (IMF) conditions given against its $4.7 billion loan package.

As per the IMF's target, the government will have to collect an additional Tk 570 billion in tax revenues in the upcoming fiscal year.

Until March of this fiscal year, the NBR collected Tk 2.56 trillion in tax revenues, which marked a shortfall of Tk 660 billion against the revised target.

However, the revenue board achieved 10 per cent year-on-year growth in the nine months of FY25.

Former NBR chairman Dr Muhammad Abdul Mazid said perhaps the government wants to adjust the revenue target as per the budget size.

However, the tax-to-GDP ratio must go up as the Bangladesh economy has the potential to generate more revenues, he added.

Dr Masrur Reaz, chairman of Policy Exchange Bangladesh, found the revenue target modest considering the present reality in imports, investments, and compressed Annual Development Programme (ADP). He, however, suggested taxmen focus on ensuring that the target is met and maintaining compliance to this end.

It is the government's right approach not to impose an ambitious target that NBR misses every year, he added.

doulotakter11@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.