Published :

Updated :

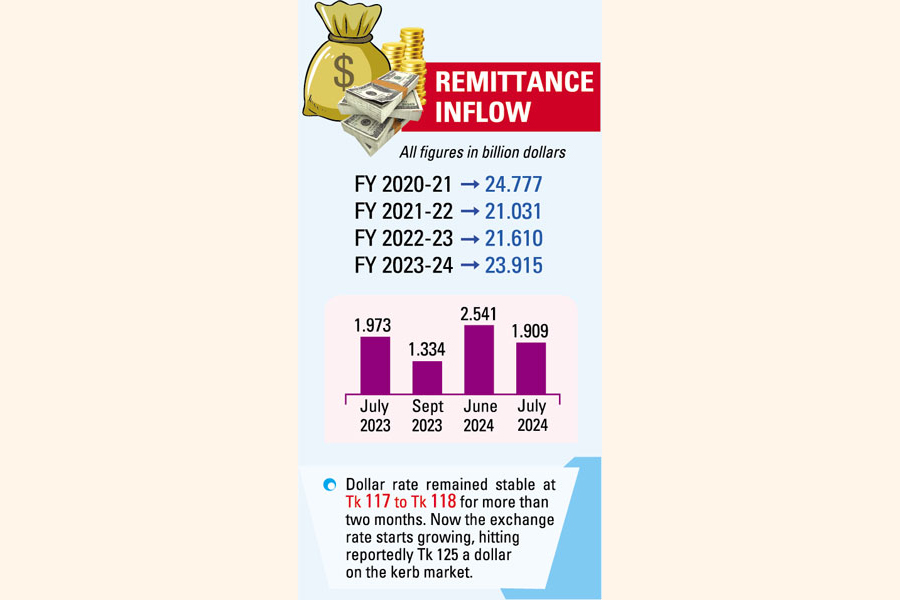

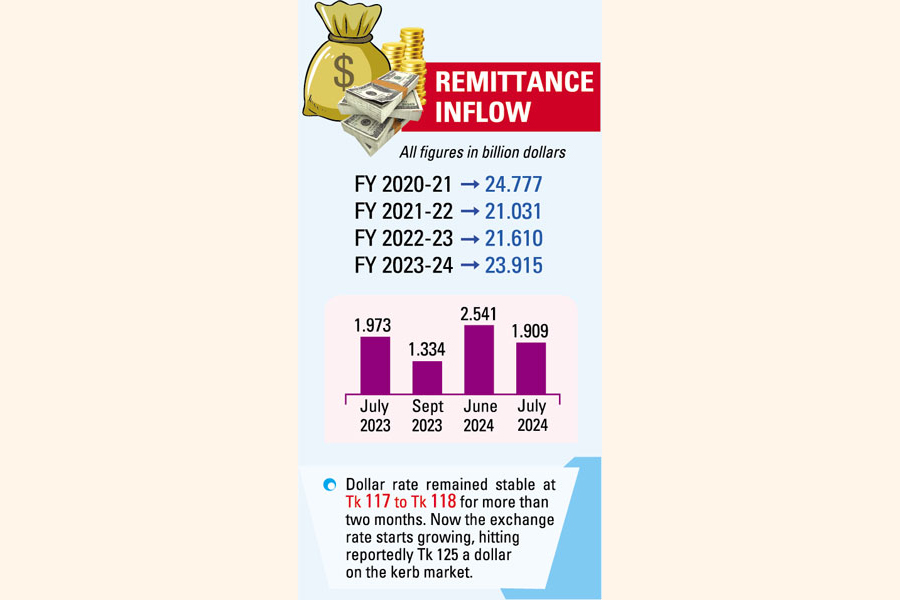

Inward remittance navigates rough weathers to reach a receipt of US$1.909 billion in July as rate hikes pay off, yet misses the expected mark for the month.

Latest Bangladesh Bank statics on the foreign exchange sent home by wage earners last month marked a year-on-year fall of $64 million.

The expatriates living in different parts of the world sent a higher amount of their hard-earned income worth $2.541 billion in the previous month of June.

This monthly receipt happens to be the lowest in last 10 months since September 2023 when the remittance was recorded at $1.334 billion and the country's foreign-exchange reserves had gone on a slide.

The inflows in June 2024, however, were the highest for a single month in the last three years thanks to some perks put in the process of reserves boosting.

Many believe this downturn in remittance inflows was mainly due to countrywide internet blackout over the massive quota-reform movement by students and social- media campaigns by a section of Bangladeshi expatriates against government action against the protesters.

Bangladesh Bank spokesperson and executive director Md Mezbaul Haque shared the remittance information with journalists through WhatsApp. This used to be posted on the central bank's official website at month-end.

The spokesperson said, "In July, some $1.909 billion came in the country. In July in 2023, the amount was $1.973 billion."

After the introduction of crawling-peg system early May to stabilize the foreign- exchange market, the dollar rate increased by Tk 7 to Tk 117. As a result, the dollar rate remained stable at Tk 117 to Tk 118 for more than two months. Now the exchange rate starts growing, hitting reportedly Tk 125 a dollar on the kerb market.

Many expatriates are campaigning for not sending remittances through banking channels in protest over the casualties in violence amid the student movement at home.

Under such circumstances, the central bank has given verbal instructions to banks for luring in remittances with higher dollar prices to reduce the pressure on reserves.

An influential deputy governor of the regulator recently directed the managing directors and CEOs of as many as 12 commercial banks to generate more remittances.

According to Bangladesh Bank, in the fiscal year 2023-24, remittance inflow was $23.915 billion. It was $21.610 billion in 2022-23.

jasimharoon@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.