Capital flight thru offshore accounts

Nearly US$3.15b drains from BD annually

WB shows tip of iceberg, economists say and suggest prompt action to save forex reserves

Published :

Updated :

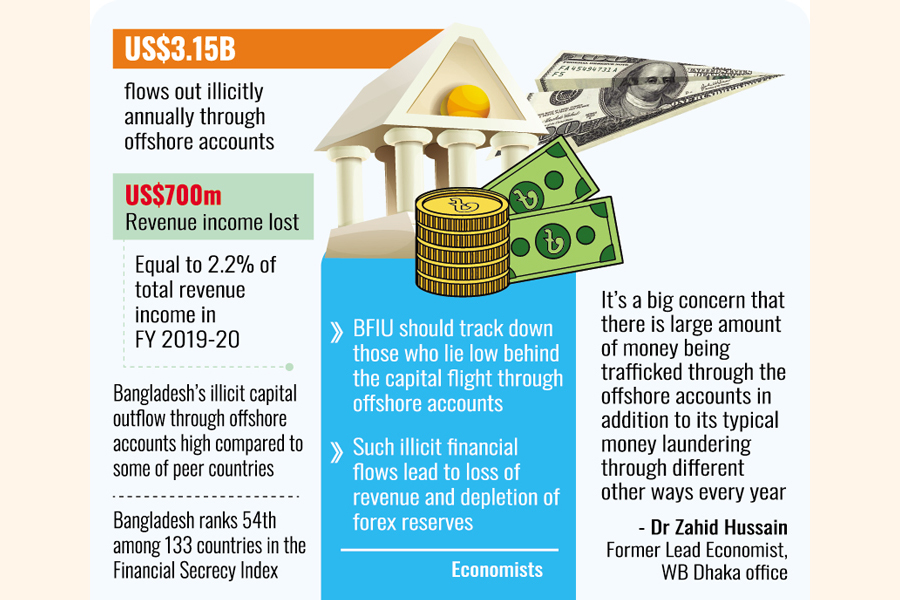

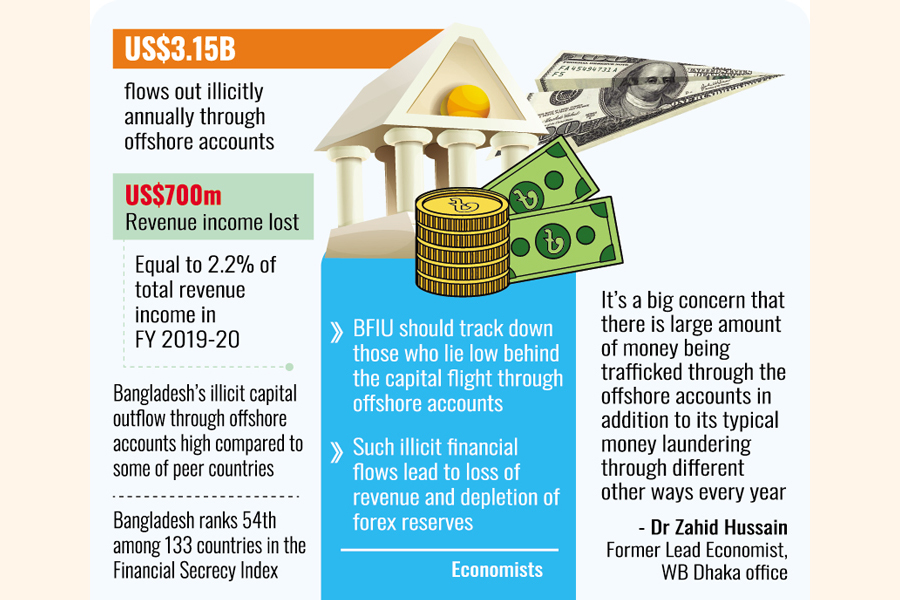

Nearly US$3.15 billion flows out illicitly from Bangladesh annually through offshore accounts while the country smarts from dearth of foreign-exchange reserves for over a year now, the World Bank reveals.

The offshore financial wealth of Bangladeshis is estimated at 0.7 per cent of the nation's GDP, the WB says quoting the State of the Tax Justice Report 2020.

Findings by the Washington-based multilateral financier just show the tip of the iceberg in capital flight from the country through several conduits, economists and analysts say.

The illicit fund flight, mainly taking place through alleged corporate abuse and offshore tax evasion, deprives Bangladesh of over US$700 million worth of revenue income, the Bank states in its latest Bangladesh Development Update report.

The amount is equal to 2.2 per cent of the country's total revenue income in fiscal year (FY) 2019-20, it says as one reason why the financial crunch finds little or no letup and affects main economic spectrum.

Local economists have raised grave concern over the illicit capital flight and suggested that the government take immediate measures for checking further cross-border money flow.

They say the Bangladesh Financial Intelligence Unit (BFIU), a dedicated public-sector organisation for tracing illegal money transfers, should track down those who lie low behind the capital flight through offshore accounts.

The economists are of the view that such illicit financial flows outside the country lead to loss of government revenue and depletion of foreign-currency reserves.

The WB, on a note of concern in the Development Update report, further says the illicit capital flows into offshore accounts from Bangladesh have been on the rise.

It has also estimated that as much as US$3.6 billion worth of funds, on average per year, have been laundered from Bangladesh through trade mis-invoicing.

Referring to the latest Global Financial Integrity Report 2021, the WB has said: "As much as $3.6 billion on average per year has been laundered from Bangladesh through trade mis-invoicing between 2009 and 2018."

Former World Bank Lead Economist Dr Zahid Hussain says it's a big concern for Bangladesh that there is large amount of money being trafficked through the offshore accounts in addition to its typical money laundering through different other ways every year.

This capital flight has the immediate negative impact on foreign-exchange reserves, investment and revenue generation, he told the FE.

"It is reality that the money already siphoned off is difficult to bring back. But the government has to undertake those kinds of policy and institutional measures which will prevent further capital flight," Dr Hussain suggests.

The WB in its Development Update has said Bangladesh's illicit capital outflow through offshore accounts is high compared to some of Bangladesh's peer countries.

Meanwhile, Bangladesh currently ranks 54 among 133 countries in the Financial Secrecy Index, which measures how intensely country's tax and financial systems serve as a tool for individuals to hide their finances from the rule of law, the WB says.

Besides, according to the WB, Bangladesh ranked 44th globally and 3rd in South Asia in terms of illicit outflows through trade mis-invoicing.

Distinguished fellow of the Centre for Policy Dialogue (CPD) Professor Mustafizur Rahman told the FE correspondent that it's really a concern for Bangladesh that people are illegally transferring money to other countries through a new tool, "offshore account".

"The Bangladesh Financial Intelligence Unit (BFIU) is a dedicated public-sector organisation for tracing the illegal money transfer. This Unit has some agreements with different international anti-money laundering bodies. So it should work promptly to track such illicit capital flight from Bangladesh," he said.

The economist suggests that the BFIU and the central bank should have realtime data of money transfer and accordingly they should go for prompt action against any suspicious transactions in and outside the country.

BFIU has agreements with the Financial Action Task Force (FATF), an inter-governmental body established in 1989 by the ministers of different countries, the Asia/Pacific Group on Money Laundering, an inter-governmental organisation for combating money laundering, terrorist financing and proliferation financing of weapons of mass destruction, and Egmont Group, a platform of 170 Financial Intelligence Units (FIUs) for securing exchange of expertise and financial intelligence to combat money-laundering and terrorist financing.

Meanwhile, the government agencies have identified top 10 countries where tainted money is siphoned from Bangladesh.

As per a government report, the money finds safe haven in the USA, the UK, Canada, Australia, Singapore, Hong Kong, the UAE, Malaysia, Cayman Islands and British Virgin Islands.

kabirhumayan10@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.