SAMMILITO ISLAMI BANK LAUNCH GOES GREAT GUNS

Newborn bank's BB account opens before licensing

Published :

Updated :

Government authorities are going great guns to operationalise the newborn Sammilito Islami Bank in state sector as its account is opened with the central bank well before licensing, sources say.

The new shariah-based bank is born out of the merger of five liquidity-crisis-ridden Islamic banks, in the wake of banking-sector overhaul by the post-uprising government.

As part of the hectic move, Bangladesh Bank (BB), at behest of the Ministry of Finance (MoF), has already opened the current account with the central bank for the proposed largest unconventional bank before it is licensed by the regulator, which is deemed a breach of the regulation.

According to the regulation, the commercial bank needs to complete all the formalities to get licence from the banking regulator within six months of securing LoI (letter of intent) from the regulatory body.

The central bank issued LoI in favour of the proposed shariah-based bank on November 09. Within 18 days, the current account was created on November 27, reflecting how fast things are being processed.

Seeking anonymity, a BB official says there is a precondition for securing licence that a commercial bank will have to deposit its paid-up capital first with any scheduled bank for getting the licence.

But the authorities of the proposed bank didn't do it. Instead, it opened a current account, which is a post-licence affair, with the BB's account and budgeting department on Thursday. No fund is yet deposited.

"This is the first time in the history of the central bank a current account was created before the licensing," the BB official told The Financial Express.

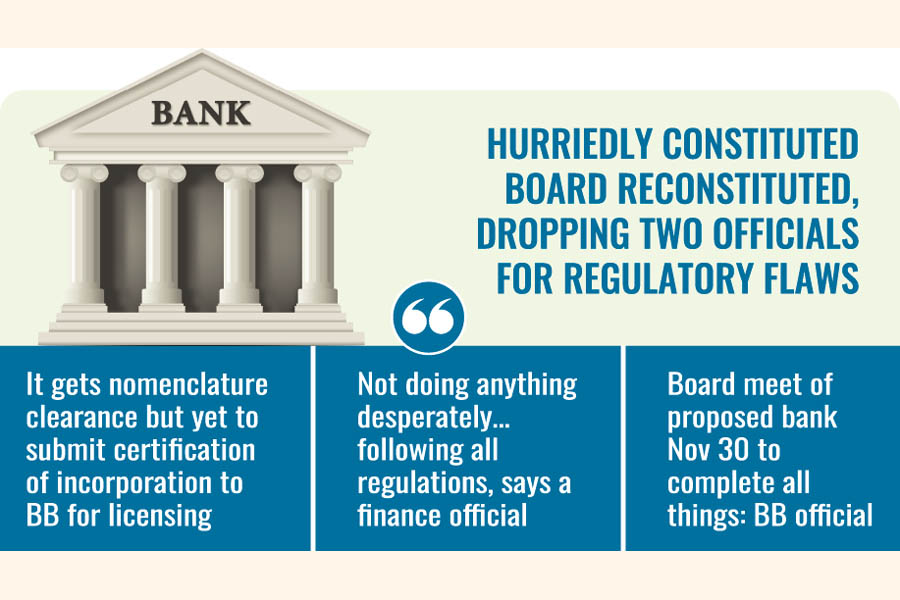

The central banker says the proposed Sammilito Islami Bank got its nomenclature clearance but it did not submit the certification of incorporation to the BB, although it is also mandatory for licensing.

On condition of not being quoted by name, an official at Treasury and Debt Management wing of the ministry of finance says they have been processing all the formalities simultaneously considering importance of the matter.

"But we're not doing anything desperately. We're following all the regulations required. We don't want to make anything delay," he says.

Another BB official, who also prefers to be anonymous, says the ministry seems to be in a hurry to complete the licence proceedings. A board meeting of the proposed bank is scheduled to take place tomorrow (November 30) where all things, including the licence, might be completed.

"That's probably the reason behind the hurry of the ministry," the official guesses.

The central banker also informs that the ministry concerned earlier had formed a seven-member board of the proposed bank in hectic way without properly assessing the existing regulations.

As a matter of fact, the ministry has reconstituted the board again by inducting two directors in place of finance division secretary Md Khairuzzaman Mozumder and Secretary of the Financial Institutions Division (FID) Nazma Mobarek, who was the chairman of the board.

The two new picks as director are former government secretary Dr Muhammad Ayub Miah and incumbent secretary Dr Hafiz Ahmed Chowdhury.

The central banker says both Mr Mozumder and Mrs Nazma Mobarek were part of Bangladesh Bank's board of directors. Under the BB Order 1972, one cannot hold position on two boards.

"That's why they have been replaced by another two. But the equity shares of the bank will remain same," the BB official says.

According to the official documents, a seven-member board of directors will be formed, headed by the finance secretary.

Of the 20-billion shares, six directors will hold one share each, while the finance secretary will hold the remaining shares of the state-owned unconventional bank.

Under Article 64, a director qualifies if they hold at least one unencumbered share worth Tk 10 in their own name. Directors representing interests holding the requisite shares will not be required to hold a qualification share personally.

Citing Article 5, the documents state: "At no time shall the total capital of the bank be less than 10 per cent of risk-weighted assets, or as may be prescribed by Bangladesh Bank (BB) from time to time."

According to BB merger roadmap, the proposed bank will have a paid-up capital of Tk 350 billion: Tk 200 billion provided by the government as equity and the remaining Tk 150 billion coming from the deposit-insurance trust fund and institutional deposits.

The problem banks to be merged are Union Bank, First Security Islami Bank, Global Islami Bank, Social Islami Bank and EXIM Bank.

jubairfe1980@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.