Published :

Updated :

The Bangladesh Bank (BB) has issued its first-ever bank merger policy, outlining both voluntary or agreed mergers and forced mergers.

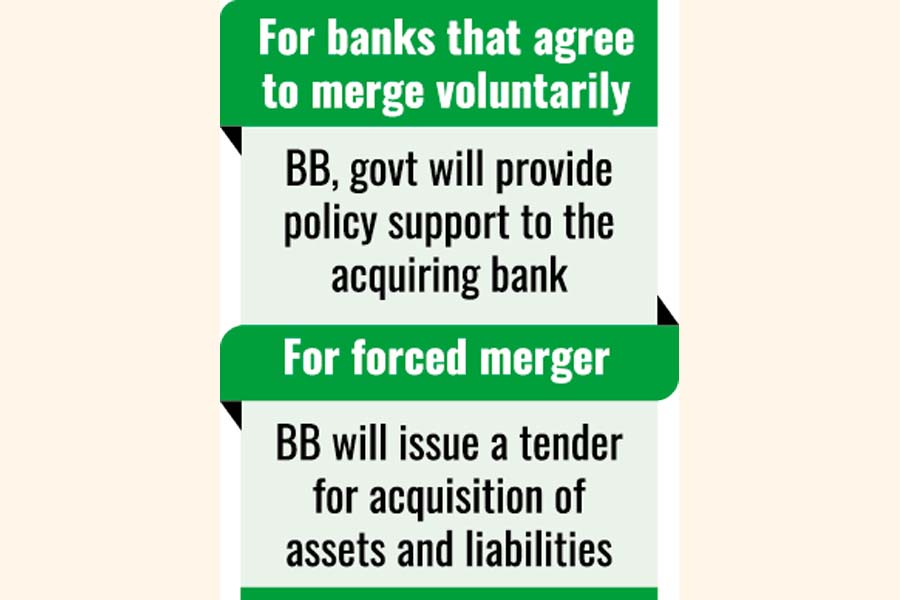

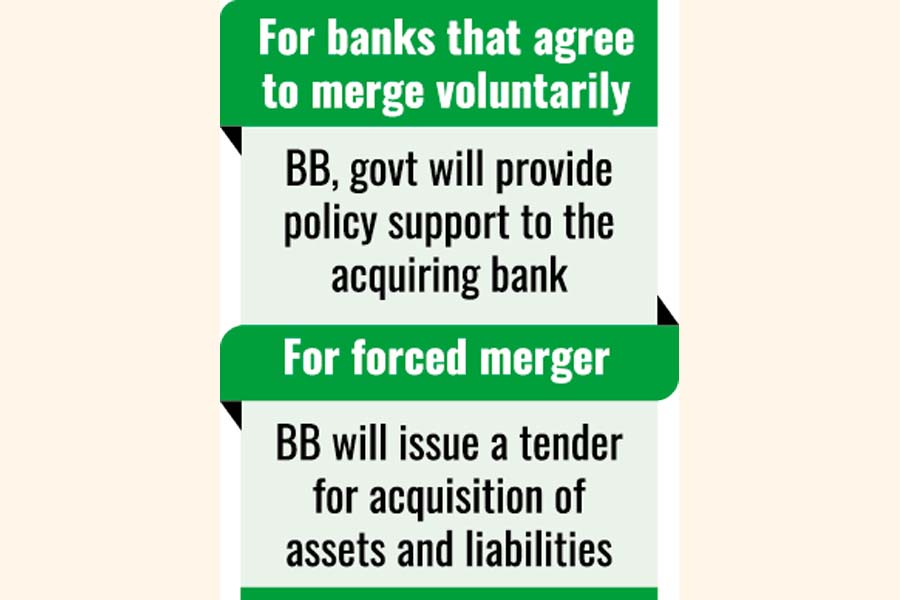

For banks that agree to merge voluntarily, the central bank and the government will provide policy support to the acquiring bank, according to a central bank circular.

In the event of a forced merger, the Bangladesh Bank will issue a tender for the acquisition of assets and liabilities.

On 5 December 2023, the central bank introduced a prompt corrective action (PCA) framework aimed at merging weak banks.

According to the framework, if banks fail to implement the PCA and overcome weaknesses, the central bank can also take steps such as a merger.

Mergers can occur between banks, between banks and finance companies or between finance companies themselves.

However, mergers involving foreign bank branches will be decided by their parent banks.

A merger with a weak bank may negatively impact the acquiring bank's financial indicators, such as capital, liquidity and non-performing loans (NPLs).

To ensure smooth bank operations and maintain the stability of the banking sector, the central bank will offer some policy support, as necessary. That support, according to the policy, includes exemptions, loss absorption and financial assistance.

According to the policy, temporary exemptions will be granted to maintain minimum capital adequacy ratios, cash reserve ratio (CRR), statutory liquidity ratio (SLR), liquidity coverage ratio (LCR) and net stable funding ratio (NSFR).

A grace period will be provided to allow the acquiring bank to absorb the losses of the weak bank through its income or convert them into goodwill.

The central bank will provide cash support by purchasing the bank's long-term bonds. Besides, the policy allows for capital increases through share issues, perpetual bonds and subordinated bonds, the guideline said.

The directors of acquiring banks will not automatically become directors of the newly merged entity. After five years, they may be eligible for board positions based on their shareholding and other qualifications.

The managing director and deputy managing director of weak banks will lose their positions when merged with stronger institutions. However, the new management can retain them on a contractual basis if deemed competent.

The banks will guarantee employment for staff for three years. The merged bank will then make decisions about their future roles and positions.

The Bangladesh Bank will appoint one or more audit firms from its panel to conduct financial, legal and operational due diligence. These firms will submit detailed reports on the status of depositors and shareholders after completing their audits.

jasimharoon@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.