Published :

Updated :

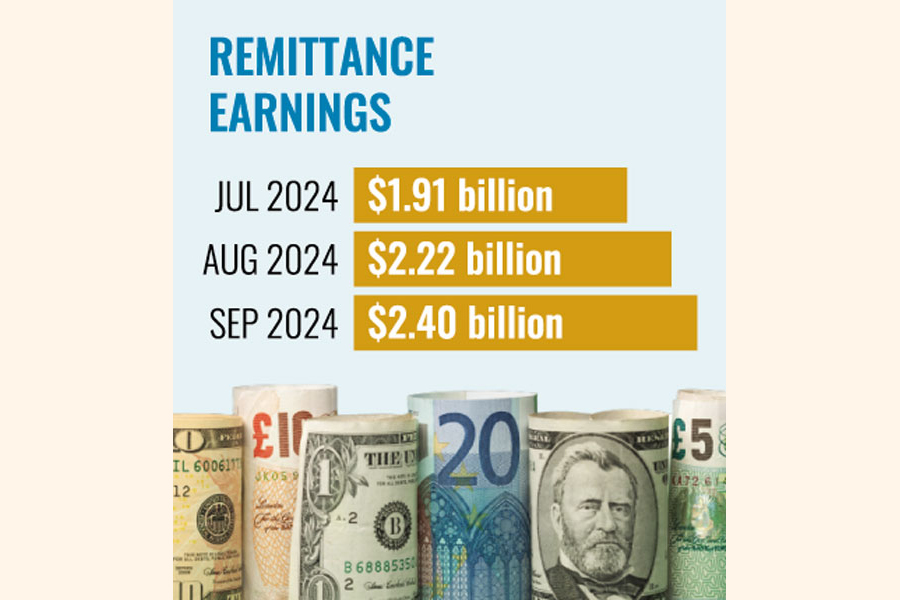

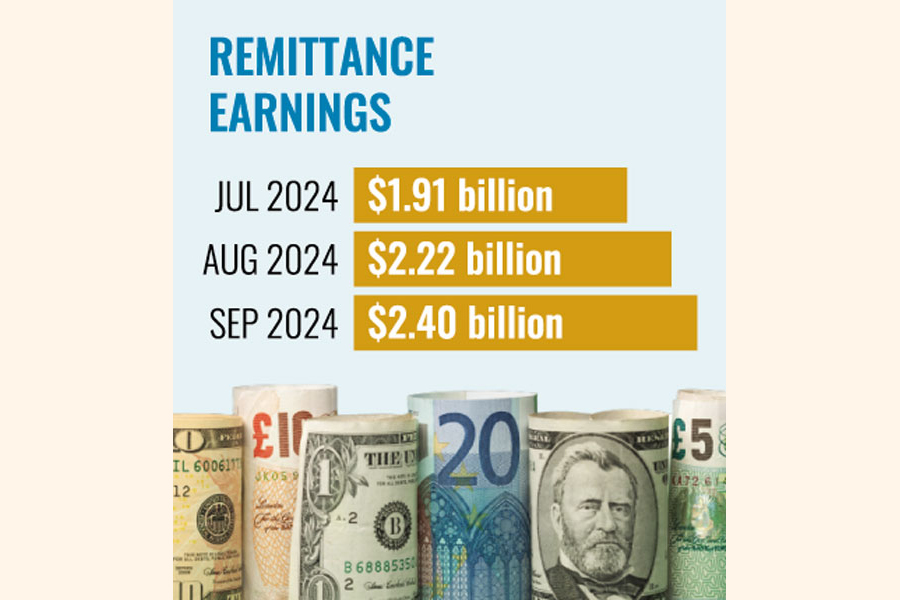

A rebound in remittance brought Bangladesh US$2.40 billion in September, accounting for a hope-raising second-highest monthly inflow in 39 months.

The upturn in remittance earnings provides much-needed respite for the economy facing multiple macroeconomic strains in recent times amid a persistent foreign-exchange (forex) shortage, officials and analysts said.

According to data with Bangladesh Bank (BB), the country's central bank, Bangladeshi expatriates working abroad sent $2.40 billion in the just-concluded month, which is the second monthly highest remittance inflow in the last 39 months after this year's June figure of $2.54 billion.

This September receipt got enhanced by over 80 per cent year on year from $1.33 billion recorded in September 2023.

Compared with the remittance earnings in August 2024 worth $2.22 billion, the September figure is around $200-million higher.

Seeking anonymity, a BB official said the central bank took some proactive measures to boost inflow of foreign currencies, like further depreciation of the local currency against the US dollar alongside expanding the crawling peg mid-band, which encourages remitters to send more money home.

"And we see the impact. This is a positive sign for the economy, which is currently under stress due to the foreign-exchange shortage," says the central banker.

Senior bankers also appreciate the outcome of remittance-boosting baits and the outcome.

Managing director and chief executive officer of Mutual Trust Bank (MTB) Syed Mahbubur Rahman terms the growth in remittance very timely and much- required relief in the current context of the forex market.

"The net payment is higher than whatever the inflow is. So, increased remittance flow is very encouraging and we need to pay more focus to keep the trend continuing in the coming days," the experienced banker told the FE writer.

Newly appointed managing director of Dhaka Bank Sheikh Mohammad Maroof explains the situational change that makes the difference and encourages the remitters.

Banks were not allowed to offer actual and real exchange rate by the central bank in the last couple of years. And that strategy diverted remitters to informal channel riding on higher gains. "That's' why we did not get expected level of remittance in the last two years," he said.

Now, according to the bank's top executive, there is no such restriction in controlling the exchange rate--and that started alluring the overseas Bangladeshi working community to send their hard-earned money back home through the formal channel.

"If we keep on offering market-centric exchange rate in the coming days, the inflow of remittance will be increasing," Mr Marrof added.

Seeking anonymity, top executive of a private commercial bank notes the demand of forex flight comes down following the regime change from the Sheikh Hasina government after a mass uprising. As the demand on grey market declines, the inflow of remittance rising in the formal channel.

"Prevailing restriction over foreign trips is another reason behind the rise in remittance," the executive says.

jubairfe1980@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.