Published :

Updated :

Mohammad Rasel, who owns a handicraft production unit in the Mirzapur upazila of Tangail district, secured a bank loan amounting to Tk 0.4 million from the local branch of a commercial bank in January this year with the hope of changing his fortune further by expanding his business.

But his dream started shattering because of the growing cost of funds coupled with the persisting economic slowdown that affected the purchasing power of consumers.

As a matter of fact, the 40-year-old handicraft maker started losing his market because of imported goods.

He told The Financial Express that he had earlier taken bank loans amounting to Tk 200,000 in December 2022 when the lending rate was 7.0 per cent.

After its repayment, he took the Tk 400,000 loan this year at the interest rate of 12.50 per cent.

He said it has become a burden for him in the form of hiking the prices of what he produces. There are imported products available in the market, which are comparatively cheaper.

"So, people prefer buying imported products and my sales dropped significantly. Continuing production has become a challenge," he said frustratingly.

Like Rasel, there are many small and medium entrepreneurs who are struggling to sustain their businesses due to factors like interest rate buildup.

In fact, the burden of interest rate against formal credit continues to mount on small and medium enterprises (SMEs), leaving the most vibrant actors in the economy in tatters amid persisting economic sluggishness.

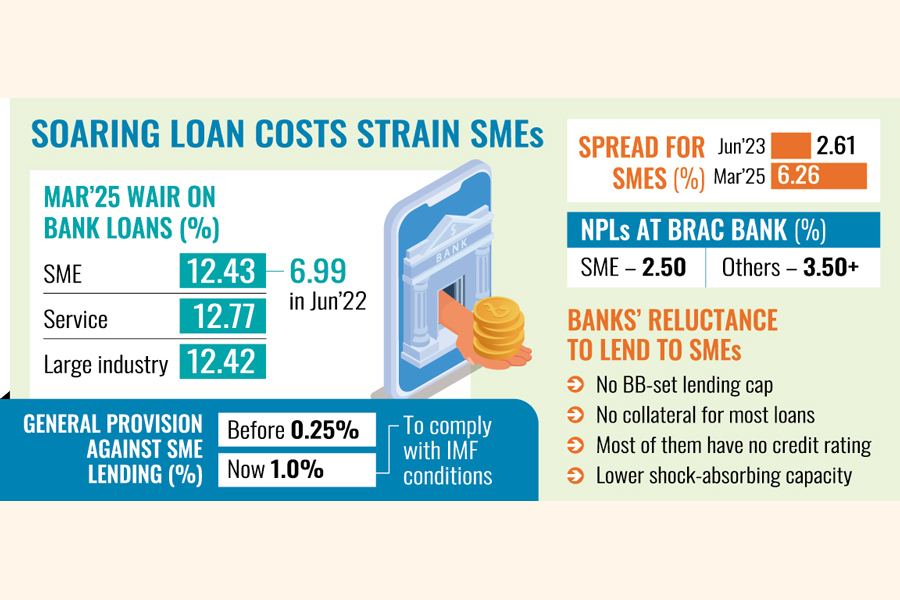

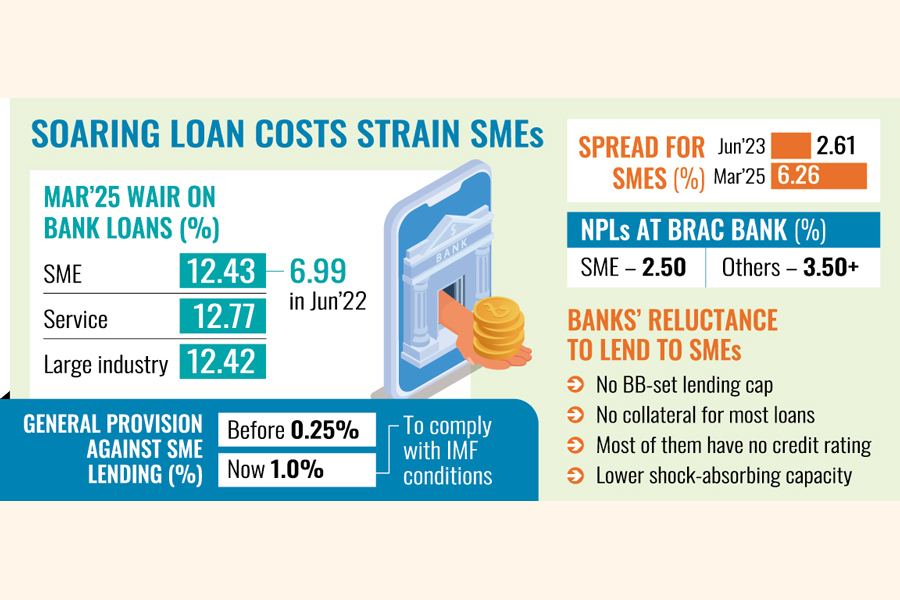

According to the latest major economic indicators released by the Bangladesh Bank (BB), the weighted average interest rate (WAIR) on bank advances for SMEs was 12.43 per cent in March this year, which was the second highest after the service sector (12.77 per cent).

Even the WAIR for large industries was 12.42 per cent at the time.

In June 2022, the WAIR for SMEs was only 6.99 per cent. Since then, it grew to reach 11.80 per cent by the end of FY24.

The upturn continued as the rate reached 11.99 per cent, 12.17 per cent, and 12.28 per cent in September 2024, December 2024, and February 2025, respectively, according to the data.

Seeking anonymity, a Bangladesh Bank official said the lending rate for SMEs keeps rising over the years as commercial banks term such investments supervisory credit.

It mounts pressure on the enterprises under the current macroeconomic situation when business opportunities continue shrinking due to post-uprising political uncertainties, he said.

The central banker said the banking regulator continues to push commercial lenders to give credit to SMEs as much as possible considering their contribution to the economy and also because the ratio of non-performing loans (NPL) is much lower there than other areas.

"Banks were seen increasing their attention to SMEs as it is the area where lenders can have more profitability because of the higher spread driven by the higher interest rate," he explained.

In banking, spread generally refers to the difference between the interest rate a bank charges on loans and that it pays on deposits.

According to the official statistics, the spread for SMEs surged to 6.26 per cent in March 2025 from 2.61 per cent in June 2023.

It is also the second highest spread-contributing area after the service sector's 6.60 per cent.

Expressing fear over limiting bank credit to the most vibrant economic segment, the central bank official said banks normally keep 0.25 per cent general provision against lending to SMEs, and 1.0 per cent to other areas.

Complying with a condition of the International Monetary Fund (IMF) as part of its $4.70 billion lending package to stabilise the country's macroeconomic situation, he said, the provision changed as lenders were instructed to keep 1.0 per cent general provision against SME lending as well.

"The unexpected change might discourage banks to lend to SMEs, which will be unfortunate," he said.

Managing Director and Chief Executive Officer of Shahjalal Islami Bank Mosleh Uddin Ahmed said the regulator fixed the maximum lending cap for agriculture at 12 per cent, but there is no such ceiling for SMEs.

He said banks term SME funding supervisory credit because most of it does not have collateral.

On the other hand, most SMEs have no credit rating and their shock-absorbing capacity is lower, he also said.

"These are some of the factors behind why banks charge SMEs higher. But the lending rate is relatively lower for the SMEs involved in international trade," the experienced banker explained.

If one corporate loan turns bad, it will have a devastating impact on banks. But if ten SME loans turn sour, it will not be as severe as the corporate one, Ahmed said.

He said this is the reason his bank allocates 40 per cent of the loan portfolio for retail and SMEs against 30 per cent prescribed by the regulator.

Among banks, BRAC Bank has higher exposure to SMEs in the country.

Additional Managing Director and Head of SME Banking at BRAC Bank Syed Abdul Momen said the lending rate is rising slowly but is still relatively lower than that of microfinance institutions (MFIs), where the rate is as high as 24 per cent.

Terming SMEs the engine of the economy, the seasoned banker called upon all commercial lenders to pay more attention to this area so that SMEs do not need to get the costly credit of MFIs.

Handling these entrepreneurs is not an easy task, he said, adding that banks need to adopt cutting-edge technology to formalise the enterprises by making them financially literate.

It will also help lessen the operational costs, which is a concern for many banks, he said. "If you properly manage SMEs, it gives you comfort by yielding higher returns and lower NPLs," said Momen.

The percentage of NPLs in SMEs is 2.50 per cent, while it is over 3.50 per cent in other areas, according to BRAC Bank.

Managing Director of SME Foundation Anwar Hossain Chowdhury said the foundation has long been advocating for a policy that will be SME-friendly.

The rising cost of formal credit continues to put pressure on such enterprises. If the trend continues, it will be very difficult for the entrepreneurs to absorb the pressure under the current macroeconomic situation, he said.

"We should not forget that SMEs account for around 98 per cent of the industries. If they sustain, the economy will sustain," he added.

jubairfe1980@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.