Secondary trading of treasury bills, bonds jumps 56 pc in FY24

Published :

Updated :

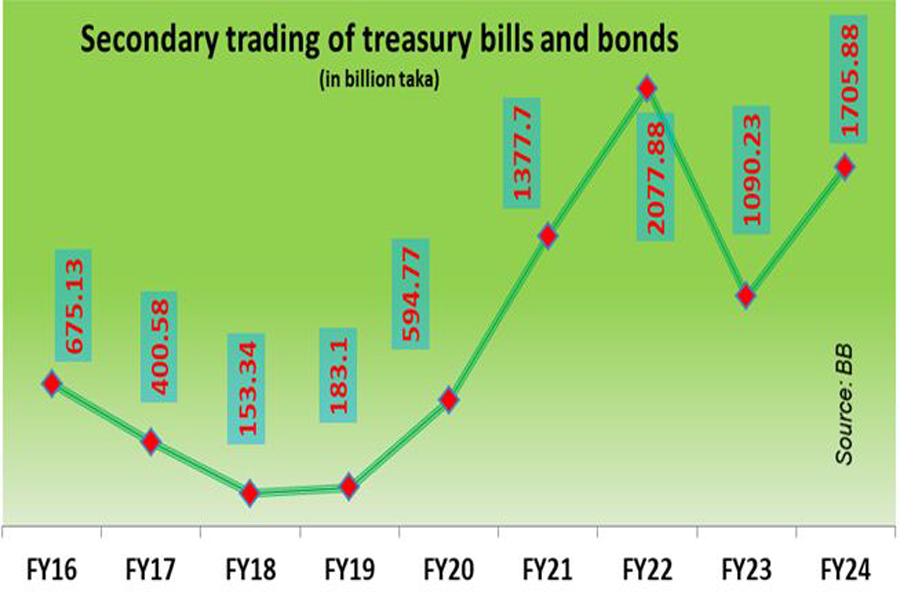

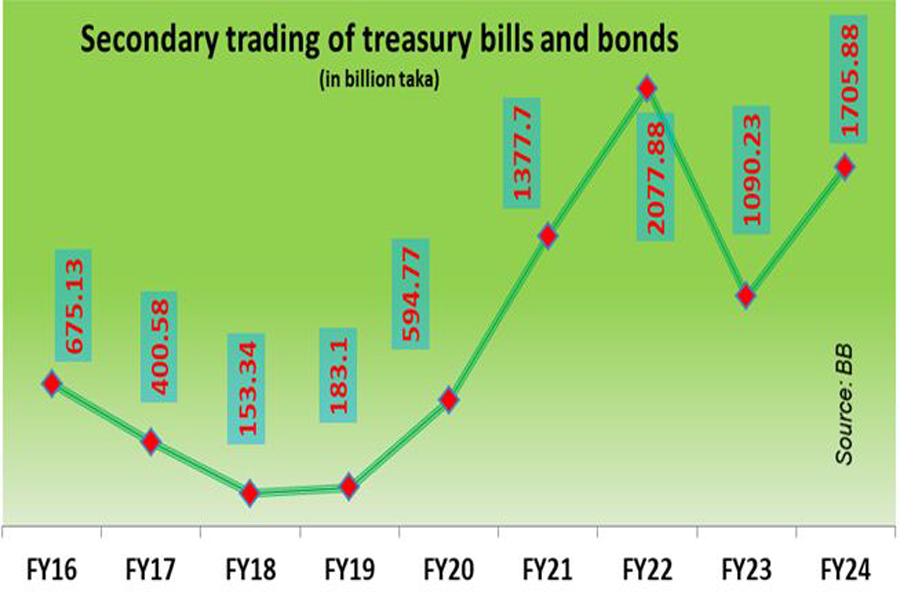

After a sharp decline in the annual transactions of the government’s fixed-income tradable securities in the secondary market in FY23, the transaction bounded back in the past fiscal year (FY24).

Statistics available with Bangladesh Bank showed that the combined value of annual secondary transactions of short and long term government securities stood at Tk 1705.88 billion (or Tk 1.70 trillion) in FY24 which was Tk 1090.23 billion (or Tk 1.09 trillion in FY23.

Thus, annual secondary trading of treasury bills and bonds in the last fiscal year increased by 56.50 per cent over the previous fiscal year.

Bangladesh Bank statistics also showed that annual secondary trading of the fixed income government securities was recorded at Tk 2077.88 billion (or Tk 2.07 trillion) in FY22 which was 50.82 per cent more than Tk 1377.70 billion (or Tk 1.37 trillion) in FY21.

Treasury bills are short-term debt instruments of the government while treasury bonds are long-term in nature.

Bangladesh Bank, on be-half of the government, issues the treasury bills to manage day to day liquidity. It also issues the treasury bonds for mobilising long-term debt for the government to finance the budget deficit.

Selected banks are now authorised primary dealer to purchase the bills and directly through the auction conducted by Bangladesh Bank.

Other banks and financial institutions are allowed to purchase and sale the bills and bonds among themselves in the secondary market as a secure investment. Individuals can also invest in these fixed-income securities.

Meanwhile, Bangladesh Systemic Risk Dashboard: 2023, released by the central bank last week showed that the banks’ treasury bonds with a remaining maturity of over 5 years and up to 10 years accounted for the largest volume of the sector’s overall holding of government securities at end-December 2023.

It also showed that the smallest was maintained by the ones with a remaining maturity of more than 15 years. Moreover, maturity up to 2 years, and over 5 and up to 10 years increased and the rest decreased during the review period compared to that of the preceding period.

The dashboard also unveiled that treasury bills with remaining maturities up to 91 days remained the largest and over 91 and up to 182 days remained the smallest in terms of volume. The outstanding of the remaining maturities up to 91 days increased and the remaining decreased at end-December 2023 compared to the position of end-June 2023.

Savings certificates with various maturities are other fixed income government securities. These are, however, not tradable in the secondary market.

Bangladesh government issues and sales all these securities to borrow from the market to finance the budget deficit.

asjadulk@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.