Published :

Updated :

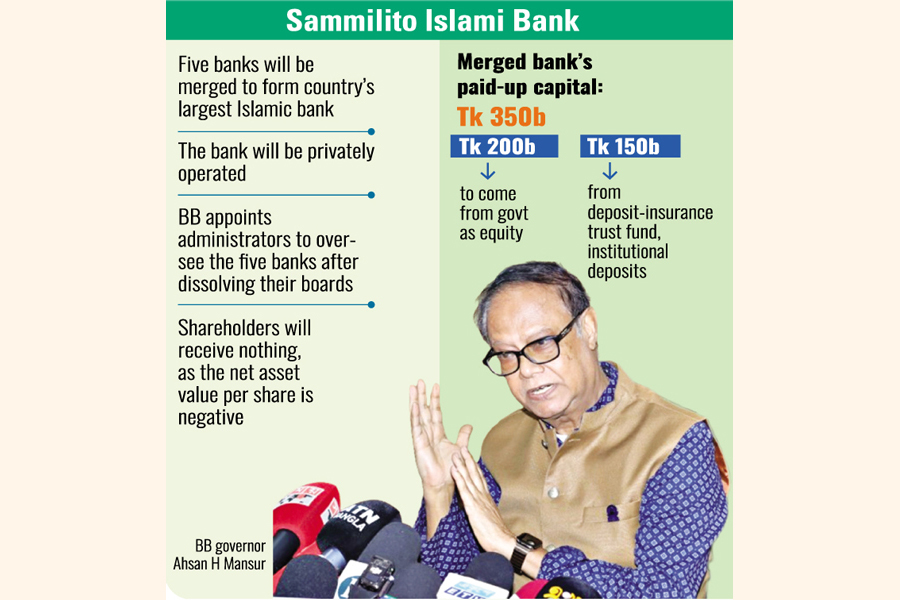

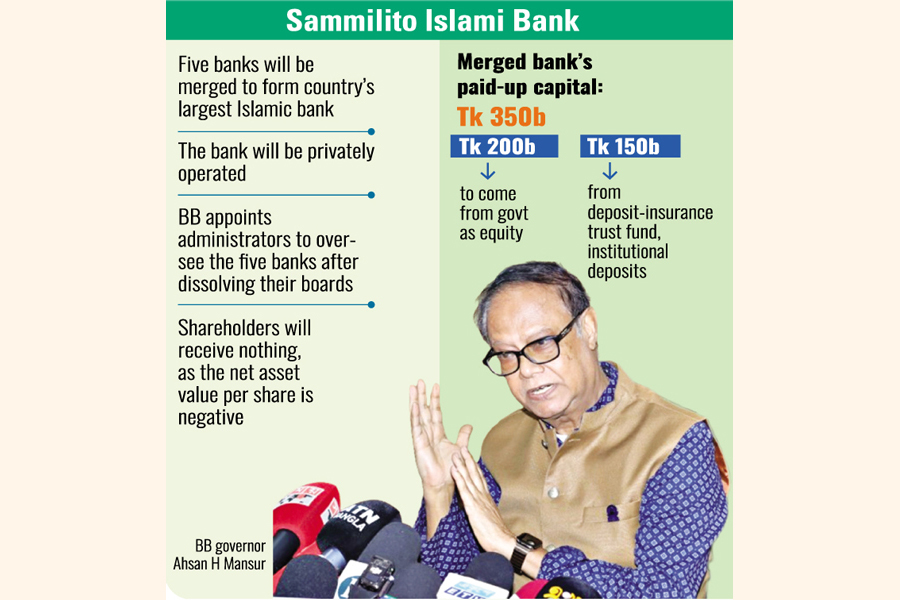

Shareholders return empty-handed with net asset value (NAV) of their shares turning zero as the merger of five liquidity-crisis-ridden commercial banks into a big-dream Islamic bank begins.

The central bank Wednesday officially started the merger process through dissolving boards of the banks and placing administrators as a stop-gap measure.

As part of the intervention stage of the process, the banking regulator appointed administrators to take control of the struggling unconventional banks after dissolving current boards of directors of Exim Bank, First Security Islami Bank, Global Islami Bank, Union Bank, and Social Islami Bank.

Now, the Bangladesh Bank-appointed administrators will look after operations of the shariah-based banks for a temporary period before the banks' merger into the country's largest Islamic bank styled 'Sammilito Islami Bank'.

Regarding the fate of shareholders of the banks, BB governor Dr Ahsan H. Mansur at a press conference said they have been implementing the whole process following international best practices and recently-formulated bank resolution ordinance.

"The net asset value per share (face value at Tk 10) became negative in- between Tk 350 and Tk 420. We should have realised negative value per share for public interest. But we did not do it. Instead, it is being declared zero. So, shareholders will get nothing," the governor said.

He said they sent non-viability letter to each of the banks, stating that the central bank thinks the banks are not viable and declared ineffective.

Following the letters, the regulator invited members of the board of directors of the banks to the BB headquarters and appreciated their roles in the crisis period before the dissolution.

"They tried hard…there is no doubt but they failed making turnaround of the banks. So, we dissolved the boards and appointed administrators to take control of the banks for an interim period," he said.

He mentions that the central bank had given enough time to revive the banks injecting funds between Tk 100 billion and Tk 120 billion over more than a year. Despite such fund injections, the banks were not able to make a turnaround and kept requesting more funds.

"So, we rejected their requests and decided for implementing the bank- resolution ordinance," the BB governor said, explaining the government action.

He said the administrators and their assistants were appointed by the BB mainly to ensure four functions -continuity of the operations, IT (information technology) integration with close monitoring, assessing HR (human resource) situation and rationalisation of branch networks of the banks

"We want to keep financial situations of each bank in close observation to avert further deterioration. If anything happens, we can trace and act accordingly," he said.

The governor said they would not go for layoff of the banks and the employees of the banks will get their salaries as usual. Though it is taken under control of the government, it will be operated privately.

About interests of the depositors, Dr Mansur, who took the central bank leadership after last year's mass uprising, said depositors are likely to get access to their funds within a month.

Depositors with less than Tk 0.2 million will be able to withdraw. But the depositors have been requested to withdraw the money that is urgently required.

Matters of payment to other depositors over Tk 0.2 million and institutional depositors will be clarified later through a gazette notification, according to the governor.

Sharing an ambitious target of the merger move, the governor says they want to make the proposed bank coming out of mergers as a 'very strong' bank.

The paid-up capital of the bank is Tk 350 billion. Currently, the bank having the highest paid-up capital has Tk 150 billion here in Bangladesh.

"Just think how big the bank will be. We also think Islamic banking has future in Bangladesh. We're hopeful that the depositors will keep their faith on us. It will be a government-owned bank. So, there is nothing to be worried," he said.

The BB appointed a five-member team, including the administrator, in each of the banks losing their existence. According to the BB sources, the central bank's executive directors Md Salah Uddin, Muhommad Badiuzzaman Didar and Md. Sawkatul Alam will be the administrators in Social Islami Bank, First Security Islami Bank and EXIM Bank respectively.

On the other hand, BB directors Mohammad Abul Hashem and Md. Muksuduzzaman will administer Union Bank and Global Islami Bank respectively.

The central bank has allotted a 2,336-square-foot office on the 17th floor of Sena Kalyan Bhaban in Motijheel to oversee the merger process. From this office, the five banks will be amalgamated to form the country's first full-fledged government-owned unconventional bank.

According to the mergers and acquisitions roadmap made by the post-uprising government, the proposed bank will have a paid-up capital of Tk 350 billion, with Tk 200 billion provided by the government as equity and the remaining Tk 150 billion coming from the deposit-insurance trust fund and institutional deposits.

jubairfe1980@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.