Spectrum auction to fetch Tk 2.37 billion per unit

Hurdles cleared as govt sets earnings target from 700MHz sale

Published :

Updated :

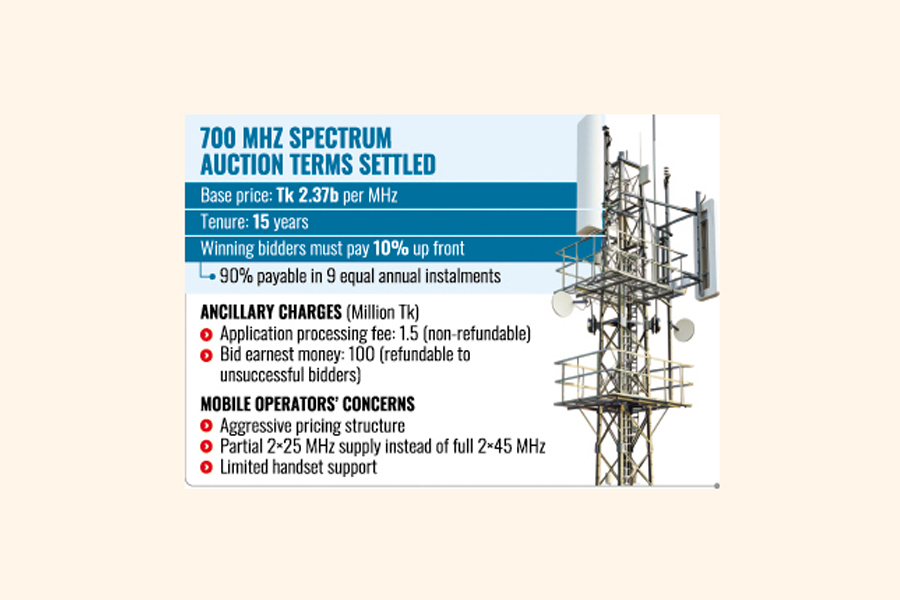

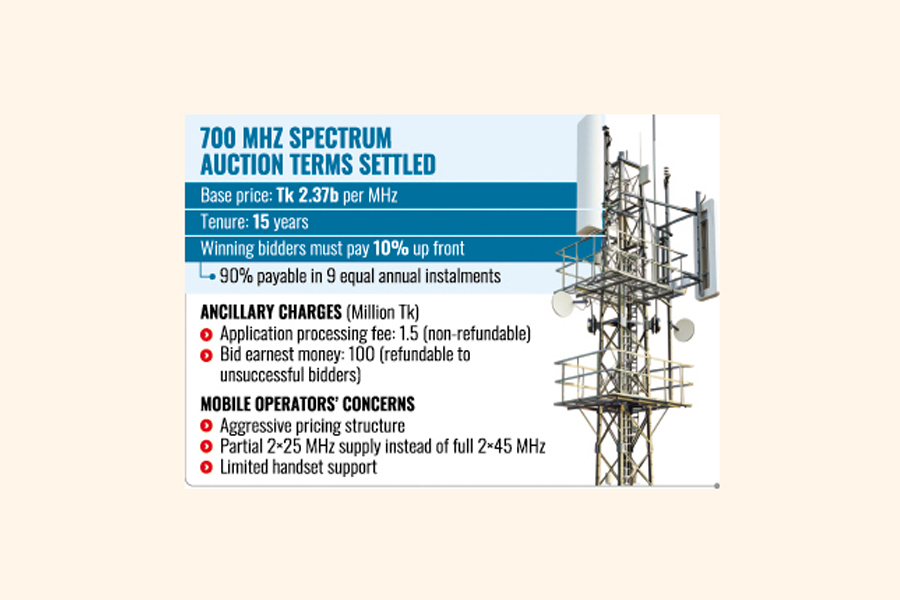

Bangladesh plans to earn Tk 2.37 billion per unit from 700MHz spectrum auction as the government approves the long-awaited financial terms for selling the highly coveted telecommunications backbone.

The Finance Division has endorsed the modus operandi, clearing a major regulatory hurdle and setting the stage for releasing a band long described as the telecoms sector's "golden" goose.

According to an official document issued on November 23, the division endorsed the Ministry of Posts and Telecommunications proposal to set the base price at Tk 2.37 billion per MHz for a 15-year tenure.

Winning bidders must pay 10 per cent upfront, with the remaining 90 per cent payable in nine equal annual installments. The Bangladesh Telecommunication Regulatory Commission (BTRC) may issue the spectrum-assignment letter upon receipt of the first tranche.

Alongside the base price, the Finance Division has approved ancillary charges that include a non-refundable Tk 1.5 million application-processing fees and Tk 100 million as bid earnest money, refundable to unsuccessful bidders.

All auction proceeds will be deposited into government exchequer under the Telecommunications Act.

The circular comes against the backdrop of nearly 18 years of disputes, delays and legal battles that have kept the prized 700MHz band largely out of commercial service.

An 18-year saga of disputes runs as follows.

The 700MHz band - globally valued for its wide coverage and strong indoor penetration - entered controversy in 2007 when BTRC allocated 12 MHz to a lesser-known ISP, Always On Network Bangladesh Ltd (AONB), at a nominal rate. The allocation took place years before the band was internationally harmonised for mobile broadband use.

Once the International Telecommunication Union (ITU) designated it as an IMT band, regulators moved to reclaim the block. BTRC cancelled AONB's licence in 2014, prompting the operator to file a court challenge in 2015. The case has since reached the Appellate Division, where it remains pending. As a result, about 20 MHz of the band remains frozen, delaying expanded 4G coverage and any transition toward broader 5G rollout.

The BTRC estimates that the stalemate has cost Bangladesh significant unrealised revenues over the years.

Operators warn of aggressive pricing, partial release. As the government revived plans for a 2025 auction, mobile operators and their international shareholders raised concerns over the reserve price, the decision to release only 2×25 MHz instead of the full 2×45 MHz, and the limited device ecosystem supporting 700MHz band.

Major foreign shareholders of Grameenphone, Robi and Banglalink recently sent a joint letter warning that the pricing structure was "too aggressive" and could undermine the business case for investing in a low-frequency band meant to improve nationwide coverage.

They argue that restricting supply would artificially heighten competition and inflate the eventual price.

Operators also note that only a portion of existing 4G devices support the 700MHz band, meaning substantial investments may not translate into immediate customer benefit.

Telecoms officials defend the valuation, saying that the taka's depreciation justified recalibration and that dollar-based benchmarks remained aligned with regional markets. The government later signalled a possible 5-10-percent reduction in prices, depending on improvements in service quality and tariffs. Industry reactions air concerns over fairness and affordability. Reacting to the government approval, industry officials sharply criticise the decision to proceed without addressing core structural problems.

Shahed Alam, Chief Corporate and Regulatory Officer of Robi Axiata, says the proposed auction "overlooks two critical issues: market competition and customer affordability".

He adds that without access to the full 45 MHz, "any auction outcome will inevitably create a serious market imbalance".

He further argues that the pricing methodology was flawed, noting that rates were set using historic benchmarks for the 900MHz band "even though 900 MHz is supported by nearly 100 per cent of handsets, while only about 60 per cent support 700 MHz today".

Deploying the band, he says, will require "building an entirely new ecosystem", driving up operators' costs.

He also resents BTRC's refusal to provide VAT receipts, saying that it "piles extra costs onto an already-inflated price" and risks raising consumer charges while undermining fair competition.

Banglalink offers a similar warning. Taimur Rahman, the company's Chief Corporate and Regulatory Affairs Officer, says the price is "disproportionately high compared to our very low average revenue per user in the country." He cites a recent GSMA study calling for more affordable spectrum to drive digital adoption.

"To maximise its impact in Bangladesh, it must be priced lower and must be allocated fairly across all licensed operators," he proposes, stressing that 700 MHz is globally considered primary digital-dividend band for nationwide coverage.

Debate runs over reserving spectrum for Teletalk. The government has also indicated that 10 MHz of the unreleased block may be administratively reserved for state-owned Teletalk once the court case is resolved.

Industry analysts argue that allocating such high-value frequencies outside competitive bidding could distort the market and reduce efficiency.

Officials maintain that the move would strengthen Teletalk's capacity to deliver public-interest connectivity.

Auction outcome hinges on industry appetite. With the financial terms now cleared, BTRC is expected to proceed with auction preparation. Yet operators say their participation - and the intensity of bidding - will depend on whether the government addresses concerns over high pricing, partial spectrum release and device compatibility. If the court impasse continues, only part of the band will be available, a condition operators warn could distort deployment economics.

Still, the release of the 700MHz band marks a pivotal moment for Bangladesh's telecoms sector. Its eventual rollout has the potential to reshape network coverage, improve rural connectivity and lay essential groundwork for future 5G expansion - provided longstanding disputes and pricing concerns can be resolved in the months ahead.

bdsmile@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.