WEEKLY MARKET REVIEW

Stocks recover from three-week low

Average daily turnover up 6.2pc on DSE

Published :

Updated :

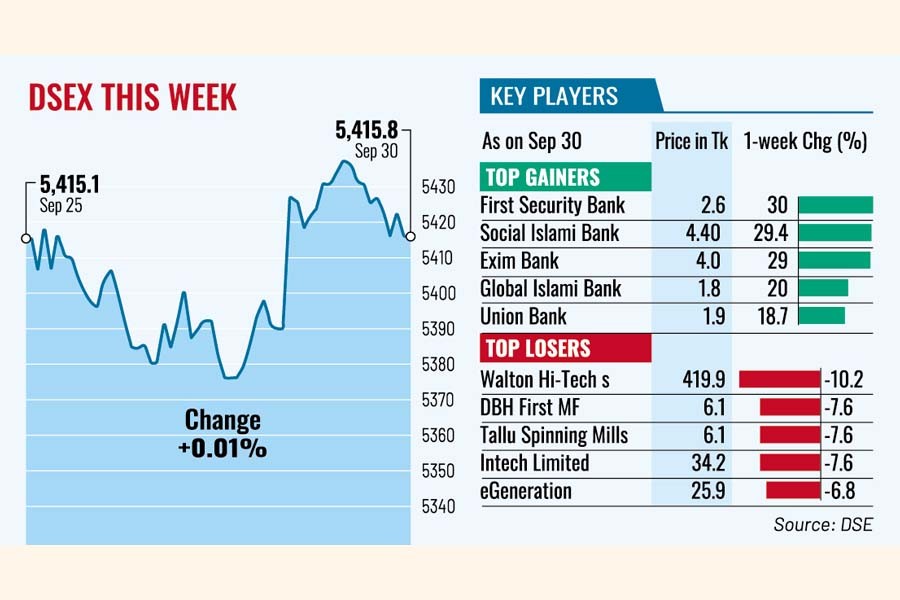

The benchmark equity index ended the holiday-shortened week flat, halting the three straight weeks of decline as bargain hunters came out of the sidelines to snap up beaten-down stocks while most investors stayed cautious ahead of the upcoming earnings season.

Absence of a decisive catalyst for the market's revival has kept investors away while institutional and high-net-worth investors adopted a 'go-slow' approach due to mixed earnings expectations from the June-closing companies, analysts noted.

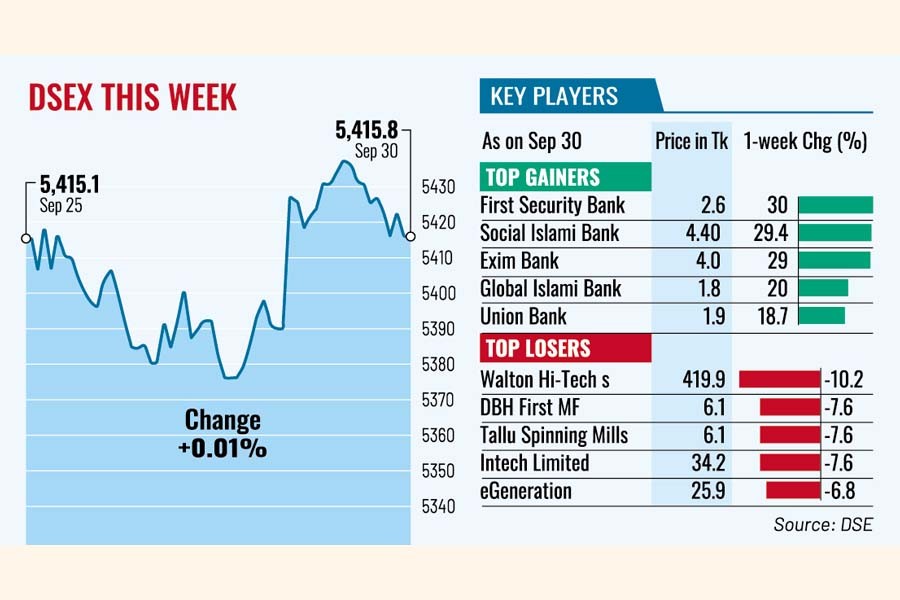

The market's slight recovery was largely driven by gains in banking stocks, but continued cautious selling kept the benchmark index from advancing further, they said.

Of the week's top 10 index drivers, five were banking stocks and three were financials. Mostly those banks which are undergoing a merger process experienced sharp rise during this week.

Of the three trading sessions this week, the market fell sharply on the first day. However, the following two sessions ended higher, paring the losses from the first session despite ongoing volatility.

The DSEX, the benchmark index of Dhaka Stock Exchange (DSE), saw almost no change, settling the week at 5,415.79. The DSEX had lost 199 points in the past three consecutive weeks.

The blue-chip DS30 index, a group of 30 prominent companies, however, lost 21.2 points to close at 2,081 while the DSES index, which represents Shariah-based companies, ended flat at 1,171.98.

Investor participation appeared muted, as many awaited a fresh catalyst to reignite the market's momentum.

There is also cause for concern as shares of several underperforming companies continued to rise sharply, raising suspicions of potential market manipulation.

Six junk stocks -- Global Islami Bank, Union Bank, Peoples Leasing and Financial Services, First Finance Limited, Fareast Finance & Investment, and National Feed Mill Limited -- ranked among the week's top 10 gainers, each posting gains of 16 to 20 percent.

The total turnover came down to Tk 14.60 billion as against Tk 29.18 billion in the week before as this week saw only three trading days instead of regular five days due to Durga Puja holiday.

Despite the shorter week, the average daily turnover rose to Tk 6.2 billion, marking a 6.2 per cent increase from the previous week's daily average of Tk 5.8 billion.

Investors were mostly active in the textile sector, which accounted for 13.9 per cent of the week's total turnover, closely followed by banking sector (13.6 per cent), pharmaceuticals (12.9 per cent), life insurance (8.28) and engineering sector (8.26 per cent).

Losers outnumbered the gainers, as out of 397 issues traded, 215 saw price correction while 150 others gained and 32 issues remained unchanged on the DSE floor.

Most of the major sectors showed negative performance. The pharma sector witnessed the loss of 0.9 per cent, followed by engineering (-0.75 per cent), textile (-0.64 per cent), and power (-0.5 per cent).

BRAC Bank topped the weekly turnover list, closely followed by Orion Infusion, Summit Port Alliance, Sonali Paper, and Khan Brothers PP Woven Bag Industries.

The Chittagong Stock Exchange also ended nearly flat, with its All Shares Price Index (CASPI) shedding only nine points to close at 15,079, while the Selective Categories Index (CSCX) fell 13 points to 9,264.

The port city bourse traded 7.8 million shares and mutual fund units with turnover value of Tk 419 million.

farhan.fardaus@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.