DELAYS IN ENLISTMENT, RENEWAL FOR AUDITORS, AUDIT FIRMS

Many practitioners face regulatory limbo

Published :

Updated :

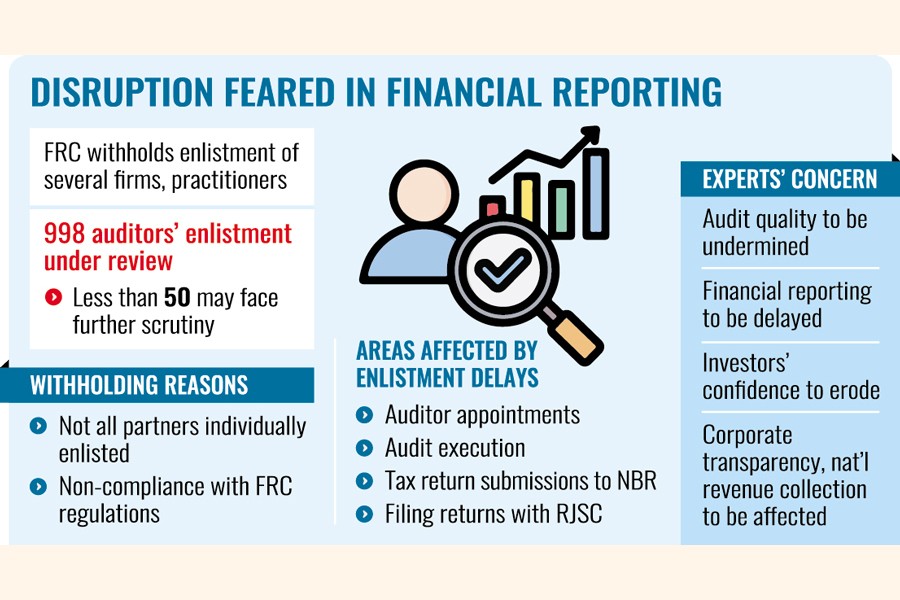

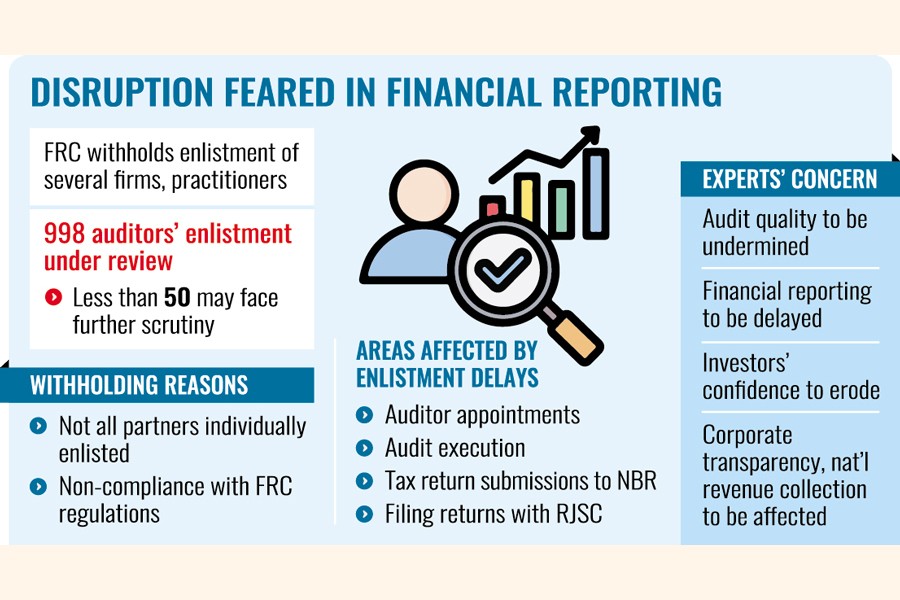

Bangladesh's financial reporting and audit ecosystem is on the verge of serious disruption as the Financial Reporting Council (FRC) has yet to complete the enlistment and renewal process for auditors and audit firms, leaving many practitioners in regulatory limbo.

Despite clear provisions under the Financial Reporting Act (FRA) 2015 and Auditor Enlistment Rules 2022, the FRC has withheld the enlistment of several chartered accountant (CA) firms and individual practitioners on grounds that not all partners are individually enlisted or are allegedly non-compliant with FRC regulations.

Accounting professionals say this interpretation has created widespread confusion, as the law treats auditors and audit firms as separate entities.

They also point out that many of the necessary rules and regulations under the FRA 2015 remain unframed, creating a significant regulatory gap.

Under Rule 6(6) and Rule 17(3) of the FRC Enlistment Rules 2022, the enlistment year runs from July to June, with a mandatory requirement that all enlistment or renewal be completed at least 10 days before the start of the new year - that is, by June 20.

However, more than three months of the current enlistment year have already elapsed, and a large number of auditors and CA firms are still waiting for their enlistment letters, which is why they are unable to perform statutory audit functions.

As a result, many CA firms - even where some partners have fulfilled all regulatory requirements - remain unable to undertake audits, while individual auditors have been waiting for months for approval.

This delay has had a cascading effect on auditor appointments, audit execution, tax return submissions to the National Board of Revenue (NBR), filing returns with the Registrar of Joint Stock Companies and Firms (RJSC), and other regulatory processes, potentially affecting government revenue collection.

The audit process has been further complicated by the involvement of multiple regulators, including the FRC, the Institute of Chartered Accountants of Bangladesh (ICAB), the Bangladesh Securities and Exchange Commission (BSEC), and the Dhaka Stock Exchange (DSE), each having its own enlistment or approval criteria.

The absence of a universal enlistment system is thus hindering corporate and financial statement audits, as auditors must obtain clearance from several bodies separately.

Speaking to The Financial Express, ICAB President NKA Mobin has reiterated the need for a universal enlistment system under a single authority, ideally the FRC, as it serves as the super-regulator for the accounting and auditing profession.

"Enlistment itself is a tiny job, not a big deal," he says.

"The FRC's main function is to ensure audit quality. Audit reports could be examined by FRC experts, who can then issue necessary guidelines to auditors. But to implement this, the FRC must be adequately equipped and resourced."

He adds that the government should pay special attention to strengthening the FRC, as the country needs a larger pool of qualified chartered accountants to meet the growing financial sector demands, particularly after Bangladesh's graduation from the least developed country (LDC) status.

"With the erosion of LDC privileges, Bangladesh will face tougher competition from other developing nations. The role of chartered accountants will be crucial for ensuring compliance, transparency, and competitiveness," he explains.

"We should encourage more CAs to enter practice, not deter them with prolonged enlistment hurdles."

Mobin has also urged the FRC to suspend its unilateral enforcement decisions and work closely with the ICAB to resolve the ongoing issues.

Before issuing the certificates of practice (CoPs), the enlistment of auditors is done by the ICAB as the primary regulator after a rigorous screening.

"All activities must strictly adhere to the FRC Act 2015 and the Auditor Enlistment Rules 2022, without relying on extraneous or unofficial interpretations," he notes.

He further emphasises the urgent need for the FRC to issue formal regulations for its four divisions under sections 23(2), 24(2), 25(2), and 26(2) of the FRA 2015 before making any administrative decisions.

Experts warn that if the stalemate persists, it will undermine audit quality, delay financial reporting, and erode investor confidence, ultimately affecting corporate transparency and national revenue collection.

An issue may crop up with the demand for opening up the services of auditors from other countries under the World Trade Organisation (WTO) regulation, they say.

Responding to the concern, FRC Chairman Dr Md Sajjad Hossain Bhuyian says the enlistment issue would be resolved by October 23, where a few members may face delays in getting enlisted.

"As a regulator, I have to ensure compliance among the auditors, but it is the basic right of an auditor to be enlisted," he says.

As the country faces a scarcity of auditors, hindrances to enlistment will discourage them from entering practice, he says.

A total of around 998 auditors' enlistment is now under review in the FRC. Of them, less than 50 may face further scrutiny, he adds.

Speaking about enlistment from a single platform, Dr Sajjad says the FRC will hold meetings with nine enlistment authorities, including the Bangladesh Bank and the BSEC, on October 22 to find ways for single enlistment for auditors.

Auditing provides reasonable assurance of the transparency and fairness of the accounts of commercial organisations and business entities.

In this regard, preparers have a great role to play in the correctness or fairness of the state of affairs of the business.

The preparers of accounts are in direct contact with the management of an entity.

Annual reports serve as a key tool for stakeholders, such as investors and shareholders, to assess financial health, manage risks, and make strategic investment decisions.

Proper reflection of profitability and risk will encourage and invite prospective investors to buy the shares of a particular company.

The importance of quality auditing is undeniable, not just in Bangladesh but across the world.

Income Tax member GM Kaikobad says there is a need to bring accounting professionals under discipline.

"Many of the corporate taxpayers are facing tax evasion cases owing to faults in audit reports, which auditors have not verified properly," he says.

"The document verification system (DVS) to check anomalies has started paying off, limiting the scope for multiple books of accounts," he adds.

doulotakter11@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.