INTEGRATING FRAGMENTED DATA

Revenue board to be linked to multiple public agencies

Published :

Updated :

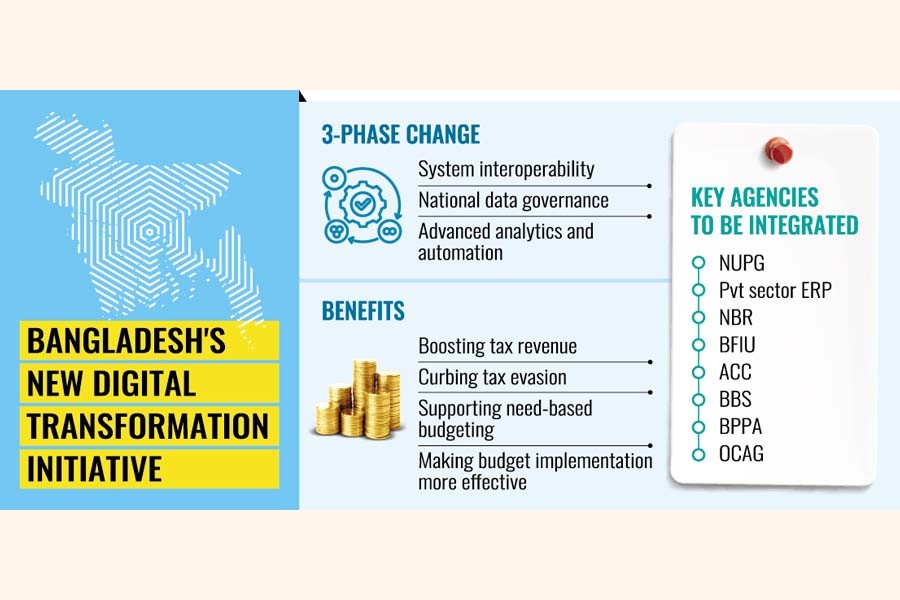

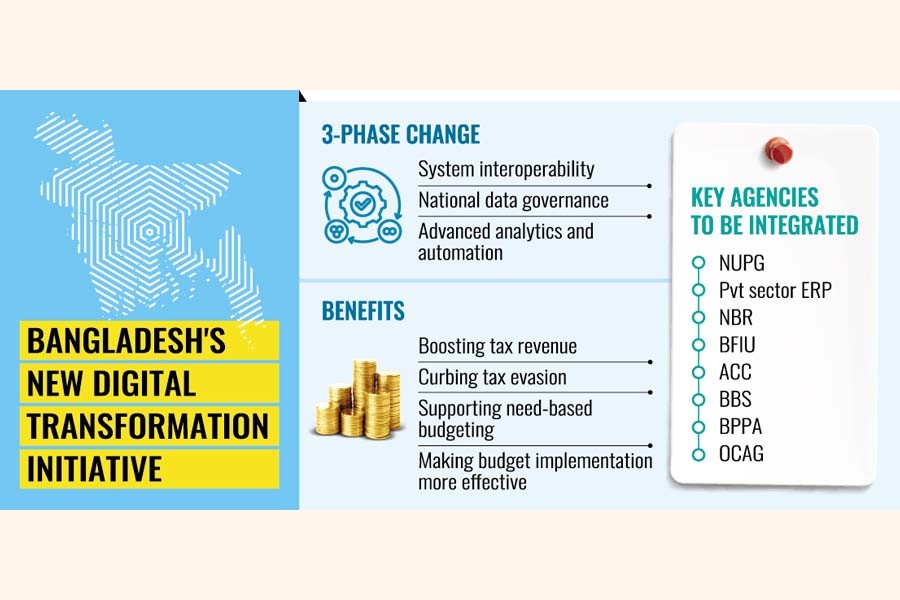

The government plans to launch a new digital transformation initiative to integrate siloed, fragmented, and duplicative data from public agencies across multiple ministries and divisions, say Planning Commission sources.

The initiative aims to link the National Board of Revenue (NBR) with the national universal payment gateway, private-sector enterprise resource planning (ERP), Bangladesh Financial Intelligence Unit (BFIU), and Anti-Corruption Commission (ACC) to boost revenue collection and curb tax evasion.

Further integration of the Bangladesh Bureau of Statistics (BBS), Planning Commission, Bangladesh Public Procurement Authority (BPPA), and the Office of the Comptroller and Auditor General (OCAG) with the NBR is expected to support need-based budget formulation and more effective implementation.

"A recent meeting under the Strengthening Institutions for Transparency and Accountability (SITA) project focused on data integration, formation of the National Data Governance and Interoperability Authority, and extensive use of artificial intelligence (AI) and machine learning (ML) in economic policy formulation and implementation," says a senior Planning Commission official.

The meeting, chaired by Planning Adviser Dr Wahiduddin Mahmud, also featured a concept paper by Faiz Ahmad Taiyeb, special assistant on ICT to the chief adviser, highlighting the need to procure software from domestic sources, retain government ownership of all source code, and avoid exclusive reliance on foreign vendors for upgradation or maintenance.

Economists have repeatedly called for better integration of government agencies through technology to boost revenue collection, as revenue mobilisation has failed to keep pace with economic growth.

The revenue-to-GDP ratio fell to 7.69 per cent in FY25, slipping below the 8 per cent level maintained over the past five years, according to the Ministry of Finance data.

Besides, the tax-to-GDP ratio dropped to 6.70 per cent in that fiscal year.

Among 37 Asia-Pacific countries, Bangladesh ranks at the bottom in terms of tax-to-GDP ratio, according to the Asian Development Bank (ADB), resulting in a comparatively lower national budget than its regional peers.

Dr Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), has told The Financial Express Bangladesh remains trapped in low-budget formulation and weak implementation due to its failure to generate revenue in line with economic capacity.

She says tracking all financial transactions through technology and integrating systems across banks, payment gateways, and stock exchanges could significantly boost tax revenue.

"Tax collection will rise and corruption will reduce as automation reduces human intervention," she adds.

A senior official overseeing the project says digital transformation will be implemented in three phases, with the first one focusing on creating interoperability between the existing software systems across government agencies, enabling seamless data exchange.

"Most IT systems have separate front-end, middleware, backend, and storage components, often developed with different programming protocols. This hinders data sharing. Through sectoral APIs and middleware integration, we aim to ensure a unified data exchange standard," he explains.

A concept paper by Taiyeb reveals the SITA framework, as well as software from the BBS and NBR, will adopt common protocols in their middleware and backend systems despite having different ownerships.

This will allow these separate systems to exchange data in a standardised and secure manner. Initially, government agencies will continue to operate their existing systems until primary data and storage can be migrated to a central national data centre, it explains.

The second phase involves establishing the National Data Governance and Interoperability Authority, which will oversee a national data exchange system connecting all ministries' core databases.

The authority will operate a licence-free, vendor-neutral platform and maintain a central repository to store all source code.

It will also include a sectoral data governance hub tasked with personal data protection, compliance enforcement, engineering oversight, and quality assurance.

The paper has urged NBR, BBS, e-GP, OCAG, and the Planning Commission to collect transactional metadata directly from primary sources using automatic and API-based systems.

It has called for NBR systems to be fully interoperable with the payment ecosystem, including NPSB, RTGS, BEFTN, Ekpay, Google Pay, and SSL, via the National Universal Payment Gateway and develop modules to generate e-invoices directly from the gateway.

The paper also emphasises linking NBR with the local business ecosystem so that transactions can be recorded directly in the revenue board's systems.

"eTDS can collect company taxes straight from the ERP software hosted by businesses. NBR will gather tax, VAT, and transaction data from ERP systems across corporates, government companies, other organisations, banks, and ports," it says.

Taiyeb has proposed a micro-service-based AI be deployed in sectoral data exchanges to detect predefined patterns and enable cross-sectoral collaboration.

"The NBR will be automatically notified of asset changes, such as car purchases or land sales, while the Bangladesh Financial Intelligence Unit and Anti-Corruption Commission will receive real-time alerts on suspicious transactions," he says.

AKM Fahim Mashroor, former president of the Bangladesh Association of Software and Information Services (BASIS), says introducing ICT will help boost revenue collection and reduce wastage of public funds, while procuring software from domestic sources will accelerate the growth of the local IT industry.

However, he notes, several previous public initiatives failed to deliver results as foreign consultants left the country after receiving payments before completing the work.

He has urged the government to take such issues into account before launching new initiatives.

jahid.rn@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.