Analysis: Stocks break three-week winning streak

Average daily turnover slumps 16pc on DSE

Published :

Updated :

Stocks witnessed moderate correction in the shortened week that ended Thursday, snapping a three-week winning streak, as risk-averse investors opted for booking profits on sector-wise issues.

Dealers said investors mostly preferred to pocket profit on sector-specific stocks that saw significant gain in the past few weeks, taking the core index below 5,900-mark.

"The retail investors sold shares to bag profit, especially from non-bank financial institutions, engineering, pharmaceuticals, banks and food & allied sectors, which contributed to fall of indices," said an analyst at a leading brokerage firm.

The week witnessed only three trading sessions instead of five as the market remained closed on Monday and Tuesday due to public holidays on the occasion of Janmashtami and National Mourning Day respectively. Of them first session closed higher while last two faced correction.

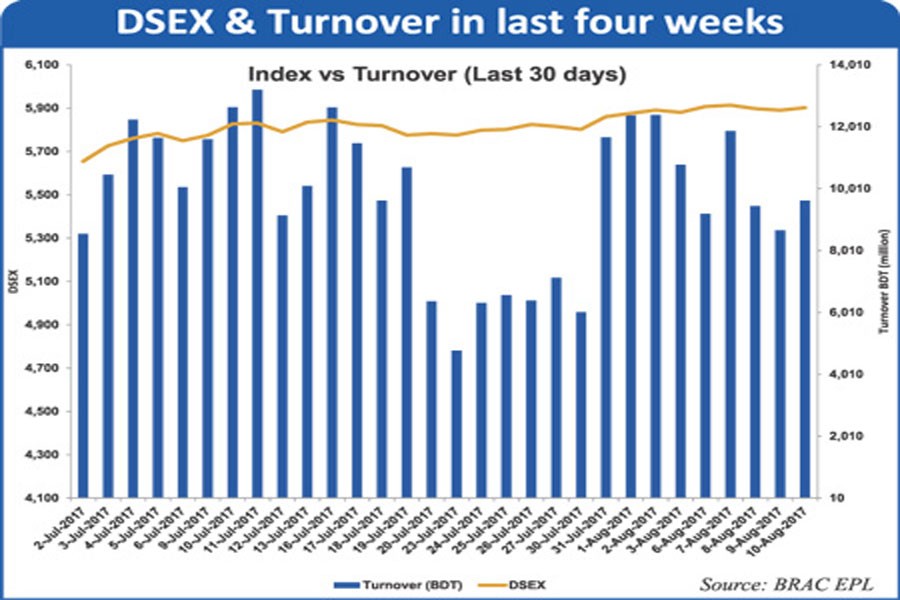

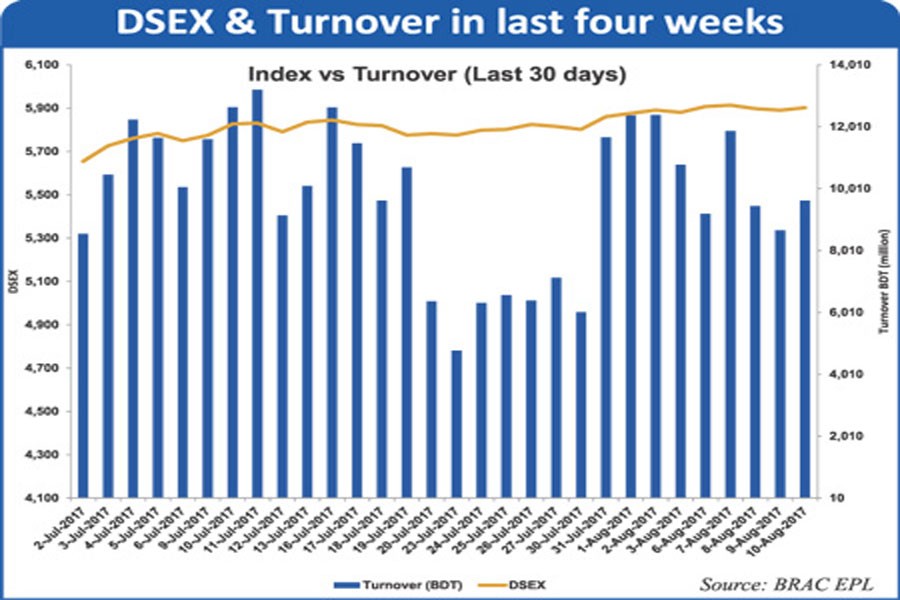

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), which replaced the DGEN in four-and-a-half-year back, went down by 40.69 points or 0.69 per cent to settle at 5,861.

"This correction was triggered by slow participation and pursuance of profit booking by the investors, made some selling pressure on market," commented City Bank Capital Resources, a merchant bank.

Two other indices also faced major correction. The DS30 index and the DSE fell 16.62 points or 0.78 per cent to settle at 2,109. The Shariah Index (DSES) lost 10.36 points or 0.79 per cent to finish at 1,304.

The port city bourse, Chittagong Stock Exchange (CSE), also finished lower with its Selective Categories Index, CSCX, losing 61 points or 0.54 per cent to settle at 11,002.

The bearish sentiment also reflected on turnover activity. The total turnover for the week stood at Tk 24.46 billion, registering a decline of 50 per cent on premier bourse against Tk 48.79 billion in the week before, as last week saw only three trading sessions.

The daily turnover averaged at Tk 8.15 billion, which was more than 16 per cent lower than the previous week's average of Tk 9.75 billion.

Block trade contributed 0.70 per cent to the total weekly turnover where stocks like Desh Garments, GP, City Bank, Salvo Chemical and BATBC dominated the block trade board.

The heavyweight bank sector kept its dominance in the turnover chart, grabbing 30 per cent of the week's total turnover, followed by engineering with 14 per cent and textile 11 per cent.

International Leasing Securities, a stockbroker, said, "Stocks slipped into the red, snapping a three-week winning streak amid choppy trading throughout the week as the cautious investors went on selling spree".

The stockbroker noted that the market faced mild correction in the week as the investors preferred to book quick-gain on their investment over the recent price surge while others were busy to rebalance their portfolios.

"The news of extending the share transactions from investors' accounts which were suffering with negative equity burden since the market crash in 2010-11 for another 16 months couldn't attract the investors to remain buoyant on the trading floor," said the stockbroker.

Rather, quick profit booking tendency of the investors pushed down the benchmark index to below 5,900 points mark after hitting its record high in the week before, the stockbroker said.

The total market cap of the DSE also inched down by 0.07 per cent last week as it was Tk 3,973 billion on the opening day of the week, while it reached to Tk 3,970 billion on closing day of the week.

Most of the major sectors posted negative return. The non-bank financial institutions witnessed the highest correction of 0.82 per cent, followed by engineering with 0.64 per cent, pharmaceuticals 0.61 per cent, banks 0.11 per cent and food & allied 0.09 per cent.

Telecommunication posted the highest gain of 2.87 per cent, followed by fuel & power with 0.05 per cent.

Most of the securities traded on the week down on the premier bourse. Of the 334 traded issues, 230 declined, 90 advanced and 14 remained unchanged.

The newly listed BBS Cables topped the week's turnover chart with shares of Tk 1.40 billion changing hands, closely followed by IFIC Bank with Tk 838 million, Uttara Bank Tk 733 million, IFAD Autos Tk 719 million and C&A Textiles Tk 562 million.

BBS Cables was also the week's highest gainer, posting 19.45 per cent gain, while Sunlife Insurance was the worst loser, losing 12.45 per cent.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.