Published :

Updated :

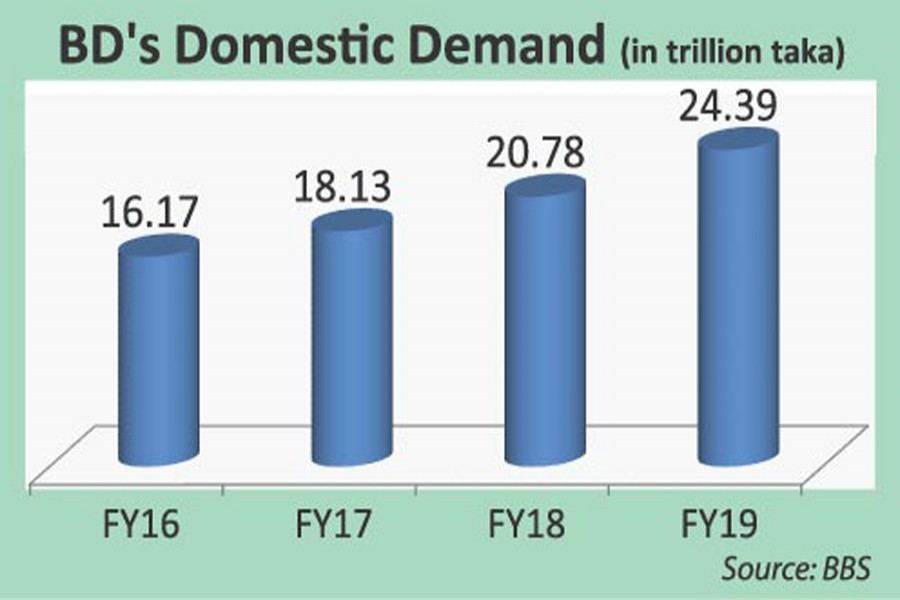

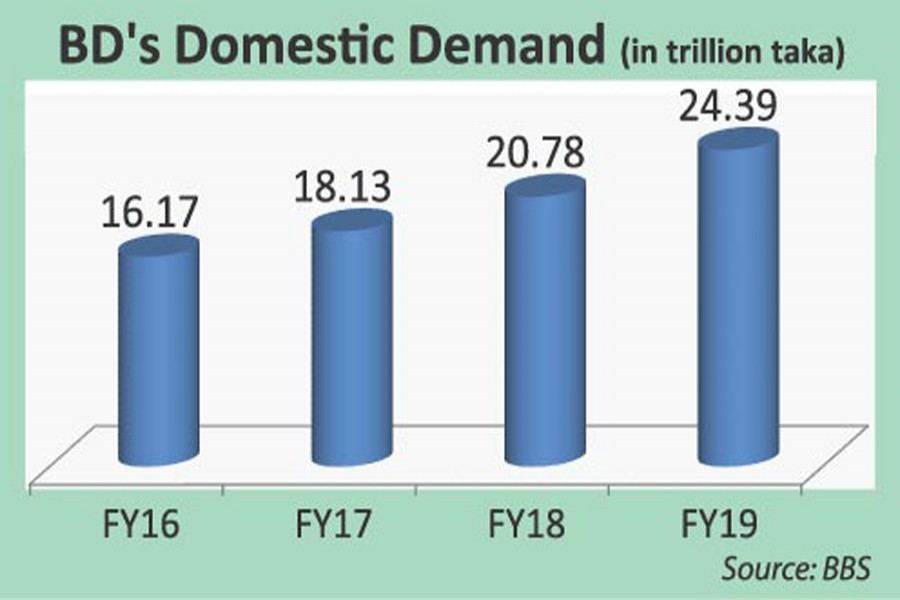

The Washington-based IIF said Bangladesh's broad-based domestic demand expansion would continue in the current fiscal year (FY), 2018-19, and also in the next FY, 2019-20, albeit at a slower pace.

The Institute of International Finance (IIF) is a global association of financial institutions, created by 38 banks of the leading industrialised countries in 1983.

The IIF's mission is to support the financial industry in prudent management of risks; to develop sound industry practices; to advocate regulatory, financial and economic policies that are in the broad interests of its members; and to foster global financial stability and sustainable economic growth.

The global institution in its latest report on some frontier economies, including Bangladesh, said private consumption, buoyed by robust remittance inflow, and infrastructure-driven investment should remain the primary drivers of growth for this FY and the next.

Besides, garment manufacturing continues to drive exports.

But it noted that the budget and current account deficits remained the main structural challenges for the economy.

"We forecast a smaller balance of payments (BoP) deficit this year and in FY 2020, while international reserves (excluding gold) are expected to cover less than four months' import of goods and services," mentioned the report, which the Financial Express obtained from the IIF HQ in Washington.

The sharp widening of the merchandise goods' trade deficit created a BoP deficit in FY 18, the first time since FY 11.

It also noted that non-resident capital flows should rebound in FY 19.

"The current account deficit is likely to fall, but will still be larger than the financial account surplus."

The fiscal deficit should decline, but would remain above 4.0 per cent of Gross Domestic Product (GDP) in FY 20, the report opined.

Following the general election in December 2018, current expenditure should expand at a slower rate in FY 19, contributing to a falling budget deficit.

"Slow progress in tax reform and commitment to higher capital expenditure will keep the budget deficit wide."

However, given the healthy growth outlook, the levels of general and central government debt should remain well below 40 per cent of GDP in FY 20.

Headline inflation is likely to be around 5.5-6.0 per cent in FY 19 and FY 20, below the central bank's forecast.

Food and transport are among the main drivers of inflation.

"To anchor inflation, we anticipate a 50 basis point hike by the central bank in Q3 of 2019," it reported.

External imbalances and the falling reserves pose a risk.

The IIF said Bangladesh's exports remained heavily dependent on a limited set of products with garment exports making up close to 70 per cent of total exports, while over 30 per cent of the country's exports target European markets.

"The weak growth outlook in Europe could weaken demand for Bangladesh's exports."

On the domestic front, a high non-performing loan (NPL) ratio, particularly in the state-owned commercial banks (around 25 per cent), might weigh on growth.

Furthermore, reliance of the state-owned banks on capital injection from the government budget could widen the fiscal deficit further.

Commenting on the report prepared by the IIF, Dr Zahid Hussain, the lead economist at the World Bank (WB) Dhaka Office, termed the report good in terms of analysing and predicting many macro issues.

But Dr Hussain noted that the report failed to analyse details about the sustainability of some growth engines of Bangladesh, like consumption.

"It did not elaborate how long the demand expansion will continue," he added.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.