BSEC to help boost startup and venture capital ecosystem

VCPEAB members seek policy support

Published :

Updated :

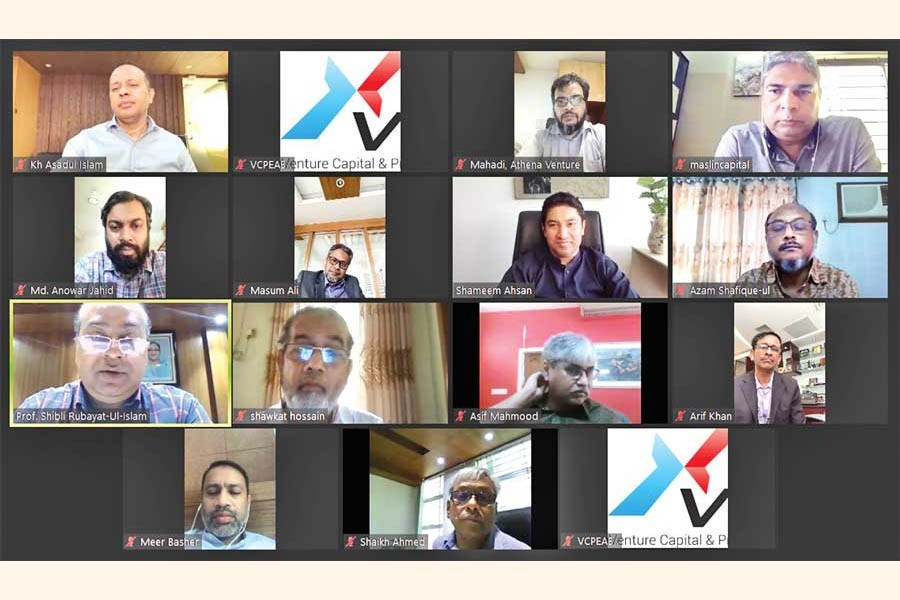

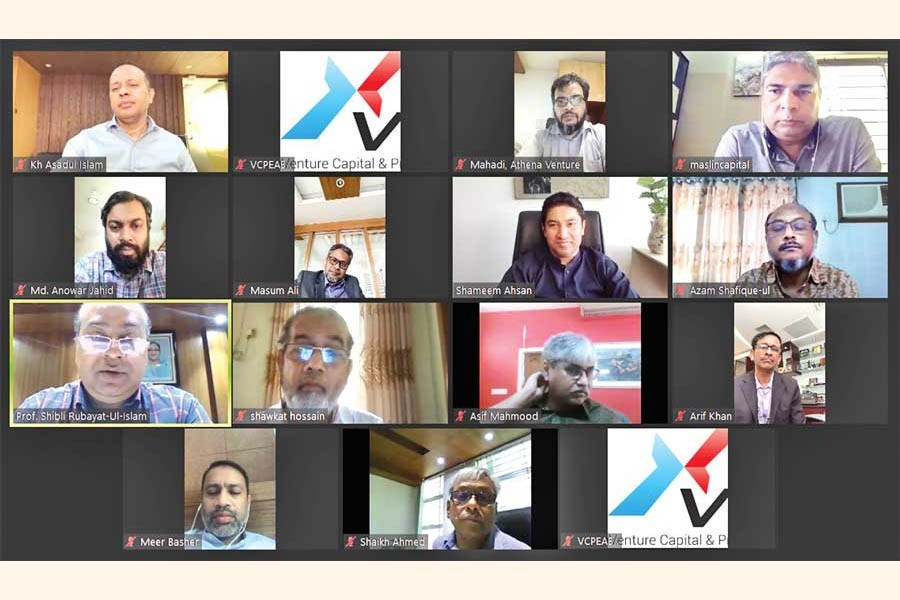

A delegation from Venture Capital and Private Equity Association of Bangladesh (VCPEAB) led by Shameem Ahsan, Chairman of VCPEAB and General Partner of Pegasus Tech Ventures (former Fenox Venture Capital), met Professor Shibli Rubayat-Ul-Islam, Chairman, Bangladesh Securities and Exchange Commission (BSEC) and his team through a video conference.

Venture capital and private equity association has sought policy support to create a sustainable venture capital industry in the country.

They sought the support when a delegation from Venture Capital and Private Equity Association of Bangladesh (VCPEAB) met Professor Shibli Rubayat-Ul-Islam, Chairman, Bangladesh Securities and Exchange Commission (BSEC) and his team through a video conference on Wednesday.

The delegation put emphasis on the possible contribution by venture capital and private equity investments to boost trade, innovation, export and help create home-grown startups that can contribute to the securities market in Bangladesh.

The delegation was led by Shameem Ahsan, Chairman of VCPEAB and General Partner of Pegasus Tech Ventures (former Fenox Venture Capital), according to a statement.

During the meeting, the team discussed different initiatives related to strengthening the venture capital, private equity and startup ecosystem.

The BSEC chairman assured to give support to work with VCPEAB on policies to nurture the emerging industry.

"BSEC is continuously working to make the investment environment easier and transparent in our country. We will certainly accommodate relevant changes that are necessary for the venture capital and private equity enterprises," Professor Shibli Rubayat-Ul-Islam added.

Shameem Ahsan, Chairman, VCPEAB, urged to expand the scope of venture capital and private equity industry with policy support to assist them contribute to the economy through their investment in innovative startups. He mentioned that as a result, these startups can create an ecosystem that can contribute up to 2.0 per cent of GDP of Bangladesh by 2025.

Shameem also said, "The successes of global companies like Google and Facebook is not only attributed to their founders but also to the VC investors like Sequoia Capital, Accel Partners and Greylock partners among others, who supported them while they were only startups. Similarly, the best companies from Bangladesh will emerge with the investments of venture capital and private equity funds."

BSEC Commissioner, Dr. Shaikh Shamsuddin Ahmed said that they will give all kinds of support to improve the startup and venture capital industry in Bangladesh.

Shawkat Hossain, General Secretary, VCPEAB, presented a keynote on behalf of the association to share the policy reforms necessary to develop the venture capital and private equity industry.

"We can see our current policy has many drawbacks when compared to policies followed worldwide. From VCPEAB we are proposing to amend and add to our current structure to make an industry conducive to creation of local startups," said Shawkat Hossain.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.