Published :

Updated :

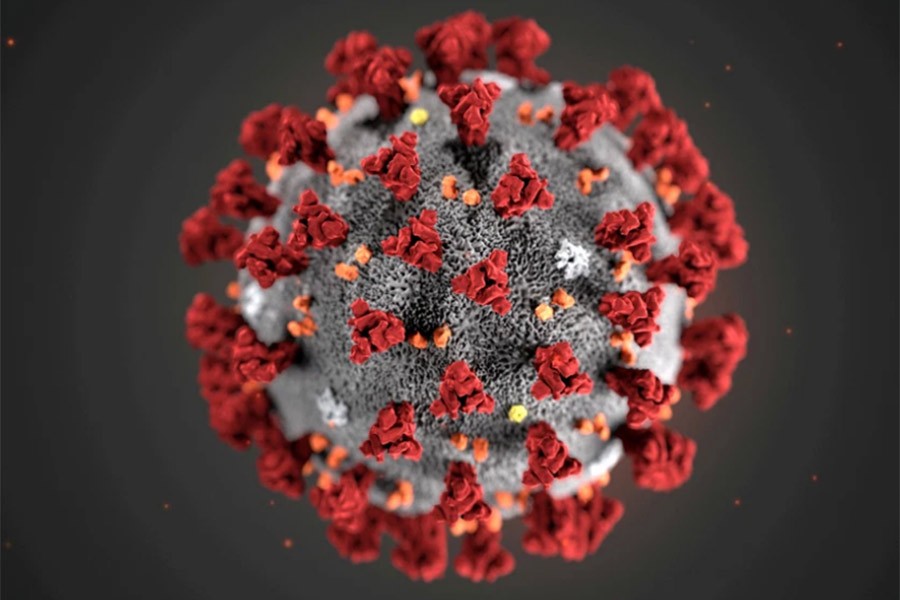

My macroeconomics class lecture today (March 10) covered the potential adverse economic consequences of the Novel Coronavirus (COVID-19) pandemic - an impromptu lecture topic, if you will - on the US and the global economy. I began my lecture by stating that the disease is given the name "corona" because in a microscopic view the virus looks like a "crown" and hence the name "corona". The word "novel" which precedes the name "corona" simply means previously unknown.

The lecture presentation began with the question: Why did the Federal Reserve Chairman Jerome Powell announced on March 03 a surprise and emergency interest rate cut of 50 basis points (0.5 per cent)? Is it to fight the escalation of COVID -19 or to stop the stock market plunge?

The March 03 rate cut rate led to a new lease of life with an upbeat but short-lived midday rally while closing the day with investors' despairs. Specifically, the rally was followed by a sharp nosedive of the DOW (Dow Jones Industrial Average of 30 largest US companies) and ended the day with DOW down by 786 points (3:00 per cent), while the yield on the 10-year Treasuries fell slightly below 1.0 per cent - historically, a first ever, flashing worries of an impending recession.

The market bleeding after the midday rally began once investors became apprehensive of the "unknown" that an emergency big rate cut of 50 basis points by the Fed has not happened since the financial crisis of 2008 which glided the economy to the Great Recession. Investors' fear of the unknown was not unreasonable given that the Fed has more information about the economy than anyone else. Investors could have thought that the Fed would not make such a big rate cut unless something ominous is looming ahead. Whatever may be the case, all previous stock market routs are overshadowed by what happened today (Monday, March 10) - the DOW fell 2014 points - a 7.79 per cent rout, the biggest ever. This market rout is blamed on the dual occurrence of plummeting oil prices and of course, the brewing fear and panic of the escalating COVID-19 pandemic.

After the rate cut the federal funds rate (benchmark rate) now stands at 1.25 per cent down from 1.75 per cent. The overwhelming market anticipation is that the rate will be slashed another 50 basic points at the Fed's March 18 meeting.

Many experts and television talking heads have questioned the rationale for interest rate cut since the recession threat is not posed by aggregate demand slack. "You are not going to slay a disease by lowering interest rates," said Bernard Baumohl, chief global economist at The Economic Outlook Group. He compared the interest rate cut to "placing a band-aid on an arm to cure a headache." The Fed Chairman Jerome Powell conceded that the Fed is not in the business of vaccine development or in restoring a supply chain broken up by the eruption of a disease in China. However, he defends the rate cut as an antidote against a potential speedy economic slowdown.

A hysterical downward spiral of the stock market has debilitating effects on shareholders, and the people in general. Panic-stricken cash withdrawal by depositors threatens banks with potential liquidity distress. To assure that lack of liquidity does not add additional stress on the ongoing COVID-19 generated supply-demand dilemma, the Fed preemptively acted to cut interest rate. Although, the action failed to slow stock market bleeding, interest rate cut was intended to act as an insurance reduction against landing a rapid economic downturn. Other central banks in advanced economies are also resorting to cutting their benchmark rates to get a soft-landing recession - if there were to be one.

Interest rate cut is certainly a demand-stimulating monetary policy activism (shifts the aggregate demand rightward) that lowers borrowing cost to businesses and mortgage refinancing costs to homeowners, allowing homeowners to cash in home equity, which can be used for car and credit card and other debt payments. One may recall that supply chain disruption is an aggregate supply (AS) shock - if prolonged for a period of 6 (six) months and over, raises the spectre of a stagflation (AS curve shifting leftward) - a simultaneous experience of inflation and recession. If an economy glides into a stagflation, interest rate cut will be ineffective - if not totally useless.

As though the interest rate cut is not enough, today (March 10) President Trump - motivated by his reelection bid in November - has proposed for a one-year reduction in payroll taxes. This tax revenue funds social security (retirement entitlement) and medicare (health benefits for retirees). About 75 per cent of US taxpayers who earn up to $137,700 annually are assessed for these taxes. Thus, a payroll tax cut would immediately boost disposable income of working people, if enacted by the US Congress. The president also proposed that COVID-19 infected employees (those self-quarantined and missed work) will keep receiving their pay checks uninterrupted. Obviously, these measures will help consumer spending with aggregate demand in good standing.

Despite the healthy US economy, fear of a recession is growing by the day. People still reminisce with distress the severities and sufferings of the 2008 Great Recession, notwithstanding that the ongoing stock market plunge is a supply chain disruption caused by the outbreak of a disease - not by any economic or financial calamity like the sub-prime housing collapse of 2007. Once, hopefully within a short span of time, a vaccine is developed, everything will get back to normalcy.

The uncertainty about the successful development of an effective vaccine against the COVID-19 is the problem. A genuine uncertainty that looms large is the growing fear of a large-scale escalation in countries where the disease just cropped up in a few individuals. The virus has now spanned over 80 countries and claimed over 31,000 deaths and counting. It has now spread over 34 states in the US. In the US the growing fear has the potential of creating a panic amongst the population (California, New York and New Jersey already declared state of emergency) which will invariably slow down normal household spending. The Wall Street collapse (7.79 per cent in one session: March 10) has already depressed consumer confidence. These adverse fallouts, if run unabated, have the potential to depress business investment spending, which could make the economy morph into a recession.

The virus has now gained a changed status from epidemic to a pandemic and straining the global supply and demand through supply chain interruptions, labour shortage brought about by self-imposed and government-imposed stringent quarantine regime.

The virus has already slowed down the US exports and imports. The trade war has forced US retailers to shift some outsourcing to other destinations away from China. Now if the virus-driven disruptions in production and delivery continue, the US economy would see additional adverse impact on supply chain. Because of the grounding of commercial flights from China, many airborne products are arriving sporadically; retailers will be forced to look for merchandise elsewhere or face supply shortage causing shoppers to pay a higher price. Obviously, we will see this occurring across a wide range of products globally depending on how the virus spreads.

Pessimistic economic outlook from major trading partners (for example: Japan, UK, Germany, China and so on) have only added additional uncertainty generated by COVID-19 escalations. The slowdown has pushed global investors in general to buying US Treasuries as they exchanged their weakening currencies for dollars. That obviously increased the value of the dollar in the foreign exchange market. The dollar index (made up of six currencies of major trading partners) moved up more than 3.6 per cent this year - highest since 2017. The strong dollar, on one hand helps lower the costs of borrowing and helps imports cheaper while on the other having negative impact on business investment and manufacturing. The strong dollar also affects exports negatively - and hence a bigger gaping hole in trade deficits.

Given the adverse consequences of the eruption of the COVID-19 pandemic, a US recession cannot be ruled out outright. Therefore, a global recession will be unavoidable. Historically, "when the American economy sneezes, the rest of the world catches a cold."

Dr Abdullah A Dewan, formerly a physicist and a nuclear engineer at Bangladesh Atomic Energy Commission (BAEC), is Professor of Economics at Eastern Michigan University, USA.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.