Published :

Updated :

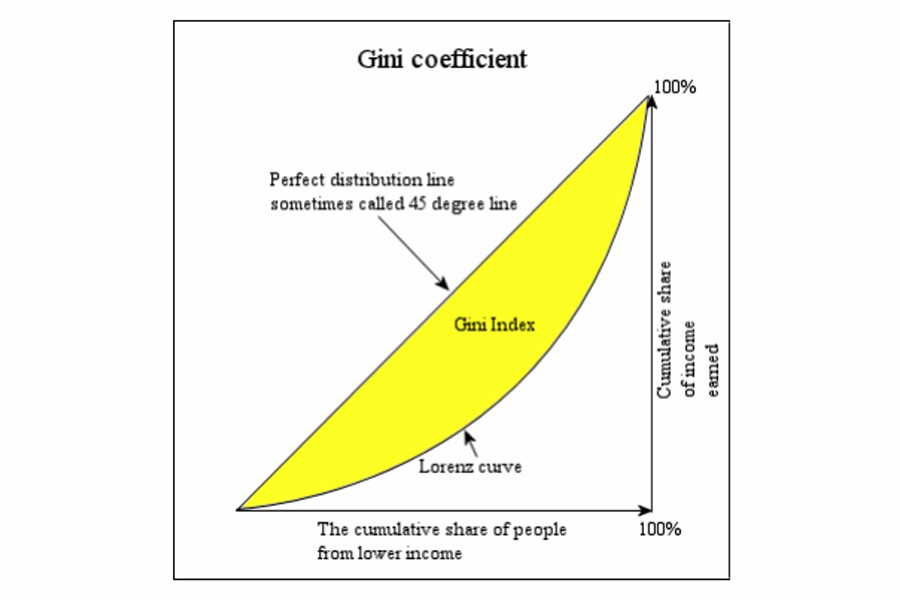

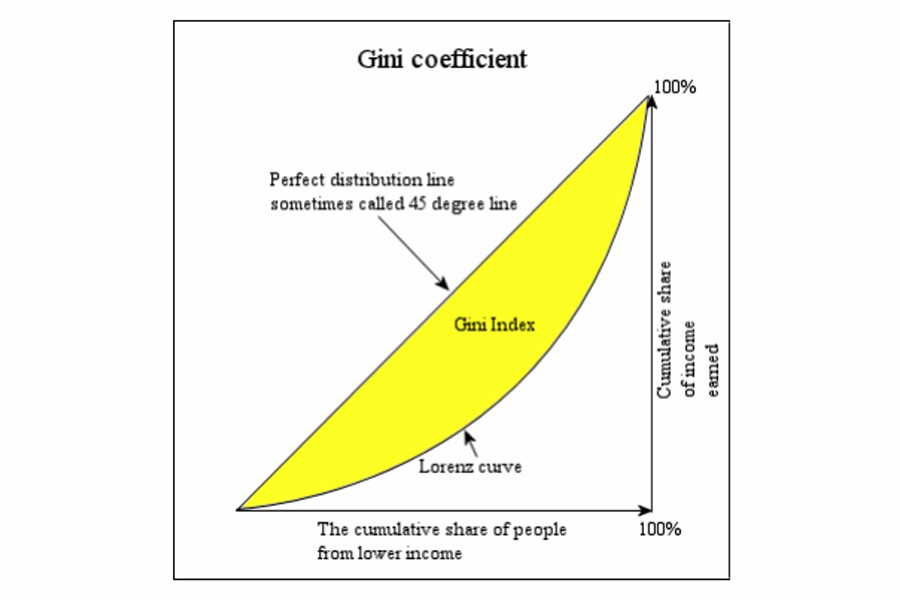

A concept from the dismal science that you can sink your teeth into easily is the Gini coefficient, which measures income inequality. This fraction varies from zero (perfect equality) to 1 (perfect inequality). To illustrate, a Gini coefficient of 0.40 is better than 0.56 because it points to more economic egalitarianism. When inequality in wealth and incomes is in the popular imagination worldwide Gini captures the very essence of this controversy. The French economist Piketty sprang this topic on us with his magnum opus. Bernie Sanders is its most vocal spokesman in the United States.

Gini coefficient is derived from the Lorenz Curve (after the American economist Max Lorenz).The curve plots, on a cumulative basis, the proportion of a country’s income that goes to a particular segment of the population. The segments are divided into deciles (one-tenth) or quintiles (one-fifth). This allows for drilling down or aggregating the data as necessary. Curves, convex in shape, rise up steeply toward the final quartile representing societies that are relatively more unequal.The slope increases toward the top right end.

Needless to say, income is necessary for sustenance and, more broadly, our well-being. For this reason, income inequality has far-reaching consequences for social policies, especially distributive ones. The fact that a loaded phrase such as income inequality can be captured by a single measure is also its bane.

Statistics is intriguing for the information that remains suppressed compared to what is actually revealed. In other words, Gini, being an imperfect index, should be interpreted with caution. In some jurisdictions pre-tax income is available, whereas in others calculations are done with gross income. Where the source is tax records it follows that conclusions will only be credible to the extent that data is not doctored. Gross incomes show more variability than pre-tax incomes because the latter includes government transfer payments.

Note that Gini is concerned with income, not wealth. In any case, wealth is more unevenly distributed than income, however derived.

A tag question is how much of the growth in national income is cornered by the wealthy. When a government becomes aware that Gini is on an upward trend (worsening) does it sit still or take remedial steps by levying more progressive taxes and strengthening welfare benefits to the poor? To latch on to their privileges, the better-off tend to resist re-distributive steps, arguing that this may lead to budget deficits.This line of argument finds resonance among the right of the political spectrum, especially when austerity is official policy in certain jurisdictions. On the other hand, the indigent demand parity.

Some say a contributory factor in income inequality is inequality of opportunities. Assuming that an individual’s income generating ability depends on human capital then education and health is the key. In the United States educational opportunities in elite colleges are skewed toward the top tier of society and health care is exorbitant. Affirmative action recently put in place by some elite institutions for helping under-represented sections of the society should help.

Income inequality negates social cohesion and, if it continues to be high, may trigger civil unrest. A contrary argument is that inequality in moderation spurs risk-taking based on the fact that risk-taking creates wealth. The question is where to strike the balance. Studies suggest that business activity gets a boost at lower levels of Gini (below 0.3). Higher than this and the less fortunate may get discouraged because they think the deck is stacked against them.

Titans of corporate America operate in oligopolistic markets which tend to concentrate wealth in the hands of a few. Winnowing out smaller rivals is a favourite ploy. Apart of this wealth sits in corporate balance sheets when profits are not distributed. Share buybacks accentuate this problem by reducing the number of shares available.

Raihan Amin is a part-time Faculty, United International University.

raihan.u.amin@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.