Published :

Updated :

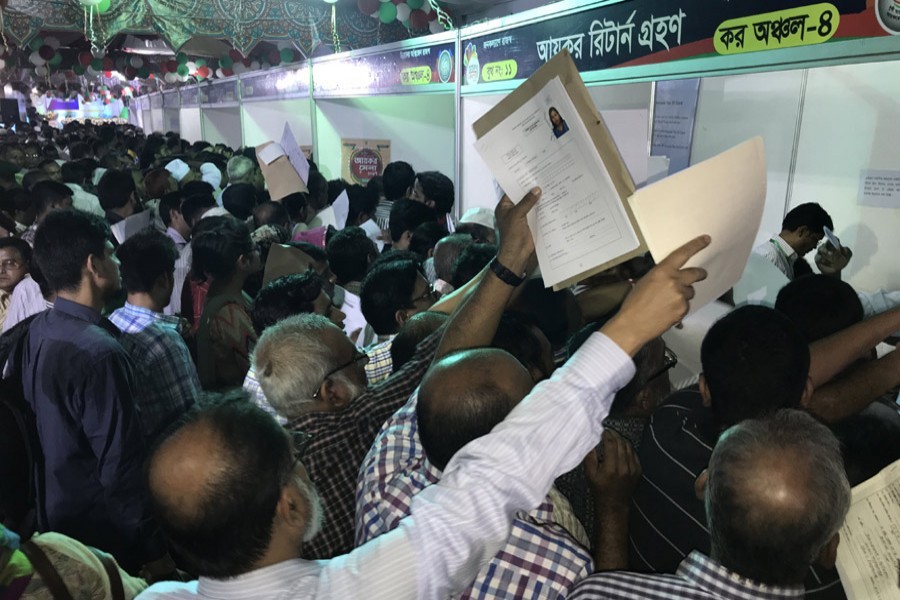

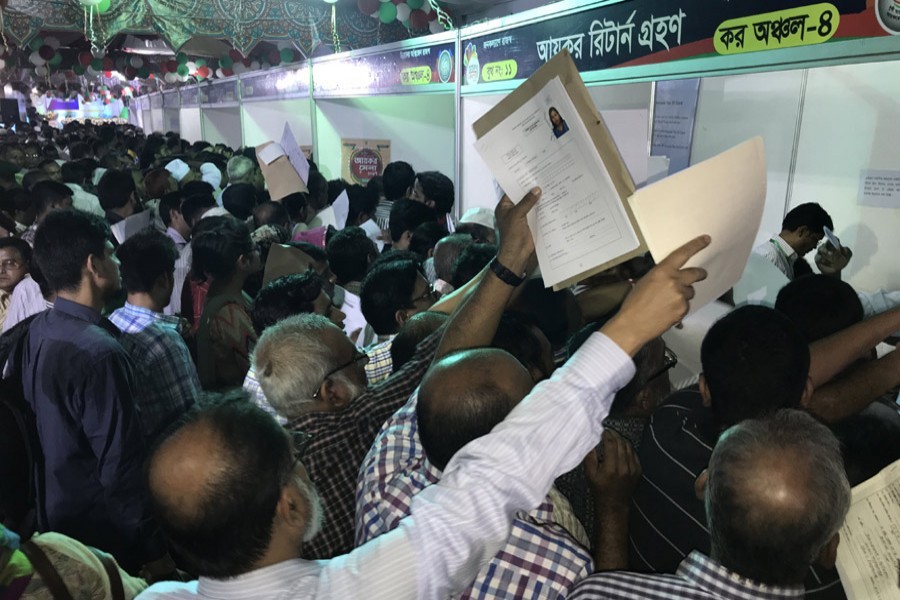

The countrywide tax fair is going to start from tomorrow (Thursday).

In the fair, taxpayers will be able to pay their tax using the mobile financial services (MFS) for the first time. They will be able to pay tax using their mobile phone from separate booths in the tax fair.

Various MFS, such as Nagad, Bikash, Rocket, Upay and SurePay etc, will be interconnected with the e-payment portal of the National Board of Revenue (NBR).

Md. Mosharraf Hossain Bhuiyan, the NBR chairman, disclosed these at a press conference on Tuesday. The NBR organised the press meet on its premises on the eve of the Tax Fair 2019.

The NBR has introduced a new website - www.aykormela.gov.bd - to deliver services of the tax fair. Taxpayers will be able to avail different facilities of the fair through the site.

The week-long tax fair will be held on Officers Club premises in the city. The fair will be held in all divisional cities for seven days and in 64 districts for four days. Mobile tax fair will be held in eight upazilas for a day.

The NBR will award 141 tax cards to the top taxpayers under different categories on the occasion of the tax fair.

The last date for submission of tax returns by individual taxpayers is November 30. Responding to a query at the press conference, the NBR chairman said large businessmen are not getting tax cards, as they often give excuses of their bank loan, high rate of loan interest and lower profit for paying higher corporate tax etc.

The country's tax payment scenario would be changed when large businessmen would start receiving tax cards as top taxpayers, he also said.

"Questions are often raised why the large businessmen are not getting tax cards when a jarda (smokeless tobacco) selling businessman, Kaus Mia, is getting the highest taxpayers award."

The NBR will take punitive measures against accountant firms in case of preparing doctored financial accounts for corporate taxpayers.

Some local companies maintain double accounts to evade tax, while the account maintenance process of multinational companies is transparent, he opined.

Some 40 million people are eligible to pay tax, while the number of tax returns was only 2.2 million last year.

"We have set a target to increase the number of tax returns to 3.0 million by the current fiscal year (FY), 2019-20."

The NBR chief further said they have already found some 0.6 million new taxpayers through carrying out survey. The NBR has targeted to raise the number of taxpayers to 10 million by 2021.

The share of income tax in the budget has to be increased to 40 per cent through promoting progressive taxation, he opined.

The NBR will be able to reduce the corporate tax rates gradually, if the tax base can be strengthened along with raising sources of alternative tax collection.

Mr. Bhuiyan noted that online tax return system should be promoted further, as the manual system will be phased out by one to two years.

There will be booths of Sonali Bank, Janata Bank and Basic Bank in the fair. Taxpayers will be able to submit returns in the tax circle offices also.

"I have instructed tax officials to provide services similar to the tax fair in the field-level tax offices," the NBR chairman further said.

There is no scope of harassment, as taxmen audit less than 4.0 per cent of the tax files submitted under self-assessment method.

However, the NBR would strictly deal with allegation of corruption or harassment to taxpayers, if any.

The NBR has also assured the Anti-Corruption Commission (ACC) of extending all-out cooperation in case of any corruption in the tax department.

On casino issue, the NBR chief said taxmen have collected some interesting information on the persons involved in casino business.

The NBR received Tk 24.68 billion tax from tax fair last year.

doulot_akter@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.