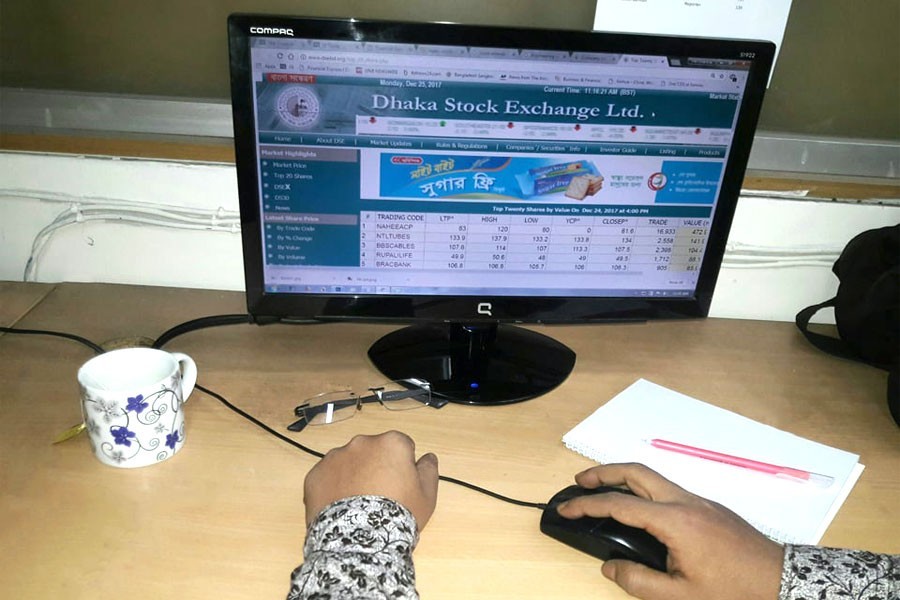

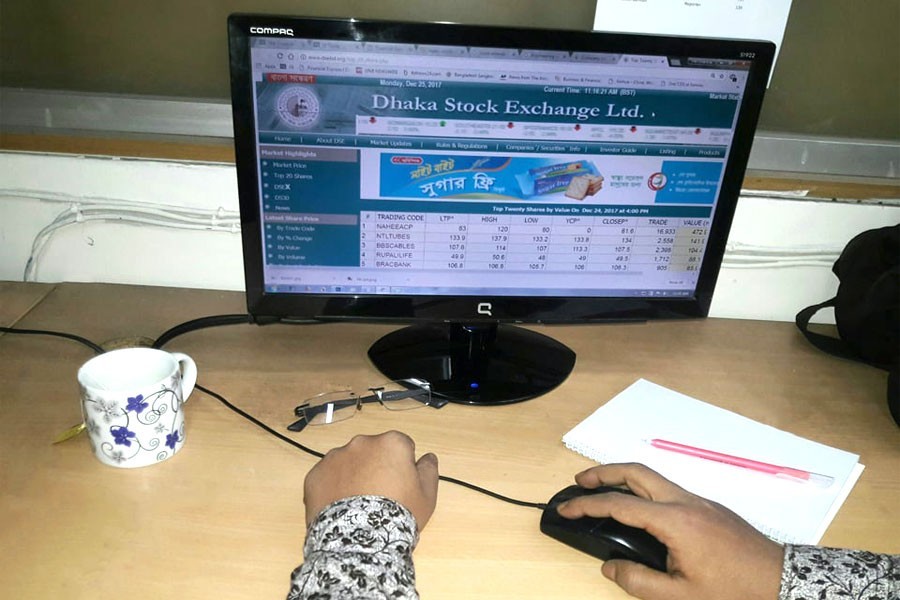

Weekly analysis: Stocks tumble on political jitters

Turnover drops 15pc on prime bourse

Published :

Updated :

Stocks tumbled this week as growing political tensions led the investors to sell off their stocks ahead of the national election.

Thursday was the last trading day of the week which saw the DSEX, the prime index of the Dhaka Stock Exchange (DSE), hit one-month low of 5,251 points.

Week-on-week, the DSEX went down by 81.79 points or 1.53 per cent.

All the five trading sessions of the week witnessed corrections as political tensions weighed on the investors' sentiment.

Market operators said the news of major scams in banks, soaring non-performing loans, provisioning shortfall of banks coupled with falling foreign portfolio investment eroded the investor confidence.

"Election sentiments are in the minds of investors and many of them have taken a cautious stance, taking the market to the red territory," said a leading broker.

According to a report of the Centre for Policy Dialogue, scams in 14 banks cost Tk 225 billion in the past decade, which is about four-fifths of the Padma bridge project cost.

The amount of classified loans also reached an all-time high of nearly Tk 1.0 trillion in September ahead of the upcoming national election, the central bank data shows.

Net foreign funds in the DSE remained a negative Tk 225 million in November as foreign investors were reluctant to inject fresh finds into the market ahead of elections.

"The downward shift in the index is mainly driven by significant negative changes in large-cap sectors like banking, telecoms, financial institutions, pharma and engineering," commented LankaBangla Securities.

The banking sector witnessed the highest correction of 2.18 per cent, followed by telecoms (1.74 per cent), pharma (1.51 per cent), engineering (1.41 per cent) and financial institutions (1.27 per cent).

Two other indices of the prime bourse -- the DS30 index and the DSE Shariah Index (DSES) -- also ended lower.

The DS30 index, comprising blue chips, fell 18.71 points to finish at 1,843 and the DSE Shariah Index lost 17.41 points to close at 1,206.

Bearish sentiment also reflected on the trading activities as the total turnover on the DSE stood at Tk 25.55 billion, down from Tk 30.03 billion in the previous week.

The daily turnover averaged out at Tk 5.11 billion, registering a decline of 15 per cent over the previous week's average of Tk 6.0 billion.

Sectors like pharma, textile, engineering, power, bank and miscellaneous sectors ranked as the top contributors on the turnover chart.

Block trade contributed 3.50 per cent to the total weekly turnover, where stocks like Shahjalal Islami Bank, Renata, Bengal Windsor Brac Bank, and BATBC dominated the block trade board.

"Fall across the banking, telecom, pharma and engineering issues triggered the market decline," commented IDLC Securities.

The market capitalisation of the DSE also fell 0.99 per cent to Tk 3,798 billion, from Tk 3,836 billion in the week before.

This week, a listed company -- Prime Islami Life Insurance -- has recommended 15 per cent cash dividend for the year ending on December 31, 2017.

Of the 346 issues traded, 209 closed lower, 117 advanced and 20 issues remained unchanged on the DSE trading floor.

The United Power topped the week's turnover chart with 2.43 million shares worth Tk 721 million changing hands.

The other turnover leaders were Square Pharmaceuticals (Tk 691 million), JMI Syringes (Tk 652 million), Wata Chemicals (Tk 650 million) and SK Trims & Industries (Tk 546 million).

Paramount Insurance Company was the week's best performer, posting a gain of 31.69 per cent while Information Services Network was the biggest loser, shedding 34.56 per cent following the news of its declaration of 'no' dividend.

The port city bourse, Chittagong Stock Exchange (CSE), returned to the red zone, with its CSE All Share Price Index -- CASPI -- losing 201 points to settle at 16,125 and the Selective Categories Index -- CSCX -- shedding 124 points to finish at 9,754.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.