Weekly review: Stocks rebound riding on GP

Telecom, banking, NBFI sector surge most

Published :

Updated :

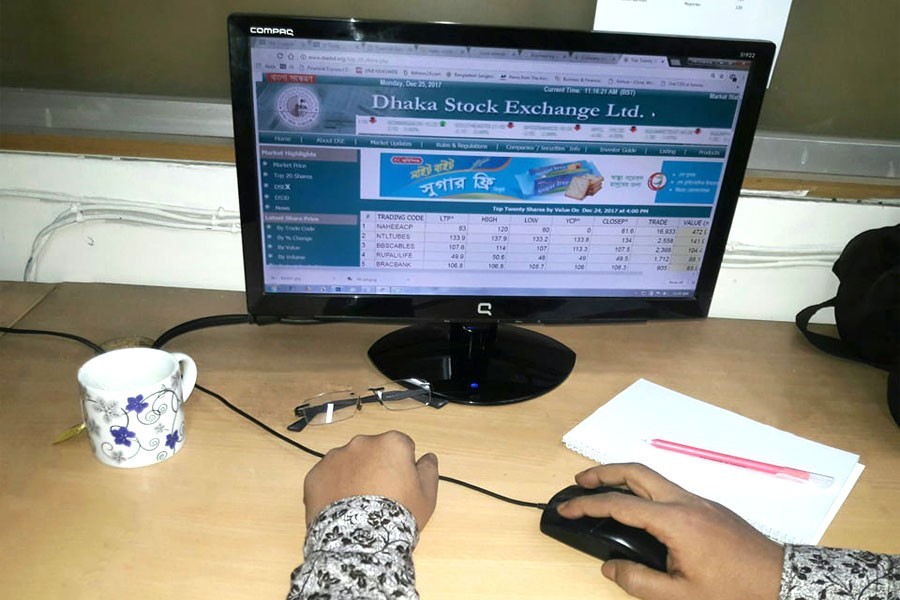

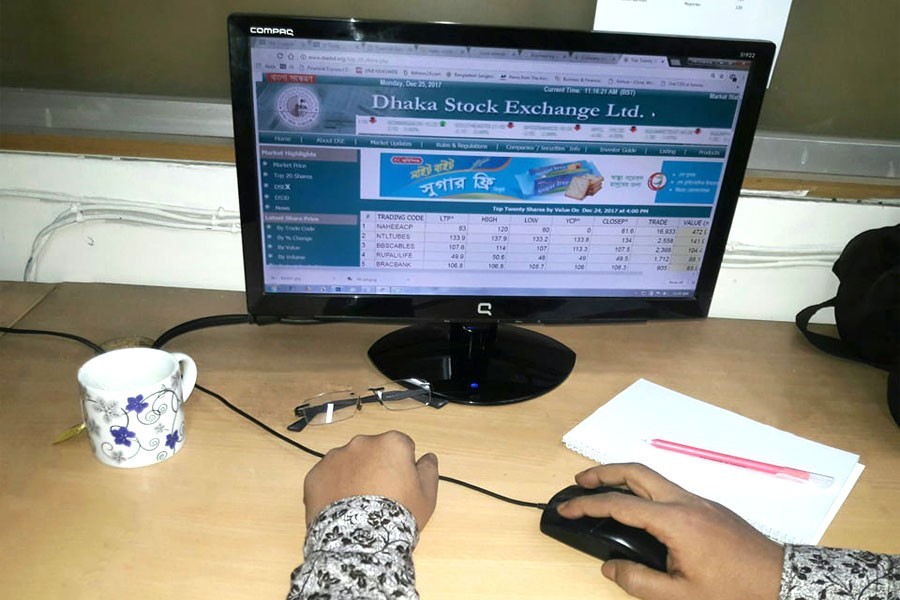

Stocks rebounded strongly in the outgoing week, snapping a four-week losing streak, as optimistic investors showed their buying spree on large-cap shares.

Week on week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), went up by 112 points or 2.32 per cent to settle at 4,968, after losing 381 points in the past four straight weeks.

Market analysts said the central bank's market supportive measures coupled with the government move to resolve Grameenphone's spat with the telecom regulator jacked investors' confidence up to some extent.

The Bangladesh Bank has announced a fresh policy for providing temporary liquidity support to the scheduled banks for boosting their investment in the country's ailing capital market.

Under the new policy, the banks will be eligible to invest such liquidity only in their own portfolios or the portfolios of their subsidiaries as loan, according to a notification, issued by the BB on September 22.

The government and top mobile phone operators have reached a consensus over settling the long disputed audit claims amicably which made investors optimistic.

A leading broker said bargain hunters showed their appetite on selective large-cap shares, particularly on heavyweight GP, amid positive news surrounding the GP.

He noted media report that the government is also considering waiving off the late fees, which made up almost half the Tk 125.79 billion claimed by the telecom regulator as unpaid dues from GP was very encouraging to the investors.

He noted that the institutional investors also became active in the market following the central bank and government's market supportive measures.

Accordingly, GP, which is the largest company by capital, soared 7.19 per cent, contributing nearly 54 points of the index's rise alone during the week.

"Such gain in the market triggered by the positive movement of large cap stocks, particularly GP, as the government is considering reduce the claimed amount to get a swift resolution," commented City Bank Capital, in its weekly analysis.

The outgoing week saw five trading days as usual. Of them, three sessions closed higher while two sessions faced price correction.

Two other indices also closed higher. The DS30 index, comprising blue chips, rose 33.02 points to finish at 1,768 and the DSE Shariah Index gained 25.31 points to close at Tk 1,148.

The weekly total turnover on the prime bourse stood at Tk 19.57 billion, up from Tk 18.98 billion in the week before.

The daily turnover averaged out at Tk 3.91 billion, up 3.16 per cent from the previous week's average of Tk 3.79 billion.

According to EBL Securities, news of finance minister's involvement in mediating GP-BTRC feud and possible waver of late fees has propped up GP's price.

The central bank's move to provide liquidity support to the scheduled banks for investing in capital market also triggered positive movement in the index and higher turnover, the stockbroker said.

International Leasing Securities said the optimistic investors showed their buying with anticipation that liquidity condition in the country's stock market would increase following the central bank's move to provide funds to the banks for investing in the stock market.

The market capitalisation of the DSE also rose 2.05 per cent to Tk 3,765 billion on Thursday, from Tk 3,689 billion in the previous week.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.