Published :

Updated :

When Covid pandemic has put a damper on most businesses, country's bicycle manufacturers are enjoying their heyday.

Bicycle sales at home and abroad have gone up significantly in recent months.

In view of meeting the need for social distancing as a health safety measure, more and more people are now using bicycle instead of public transport, said Kamaruzzaman Kamal, marketing director of local bicycle maker RFL.

His company has estimated 25-per cent growth in its sales this year, he told the FE.

"One of our three factories has received export orders for more than 130,000 units in the past five months," said a high official of Meghna Group.

"The orders are equivalent to the total order we got in 2019," the official of the leading bicycle manufacturer told the FE on condition of anonymity.

According to insiders, Bangladesh is currently exporting more than 0.8 million units of bicycles annually.

The industry, according to preliminary estimate, might have seen at least 6.0 per cent growth in the just-ended fiscal.

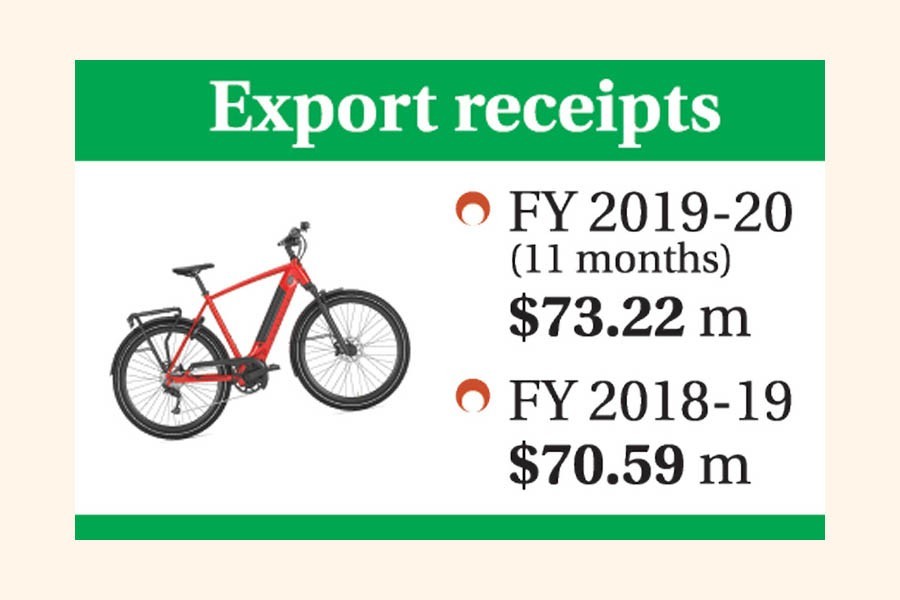

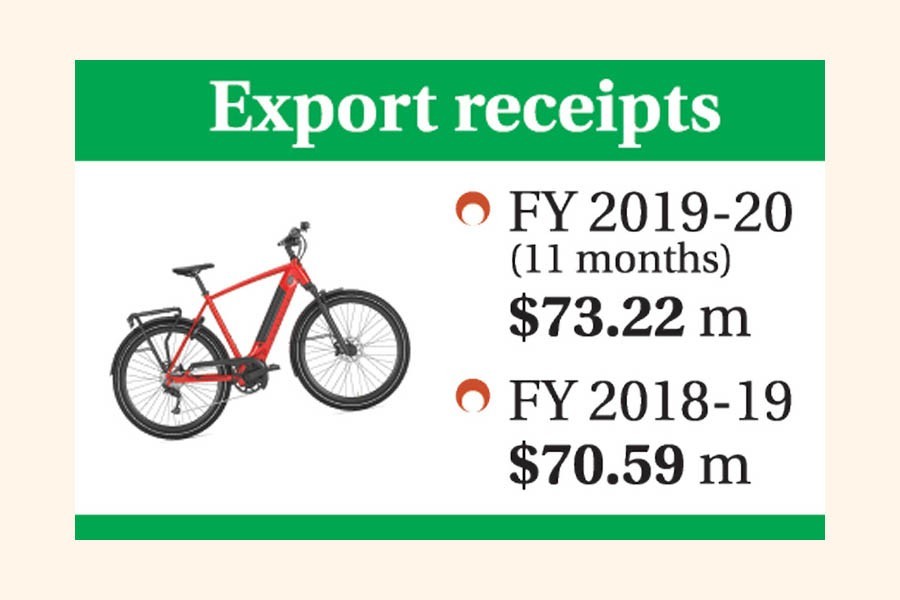

In the first 11 months in fiscal year (FY) 2019-20, bicycle export earned $73.22 million. It was $70.59 million in the same period of FY 2018-19.

The country's bicycle exports got a boost due to the imposition of anti-dumping duty on China by European Bicycle Manufacturing Association.

The global bicycle market is expected to expand by 37.5 per cent within 2016-24 and the market size would reach $62 billion by 2024, said a USAID comprehensive private-sector assessment report.

Bangladesh is now the third-largest non-European Union (EU) exporter of bicycle after Taiwan and Cambodia.

Export earnings from bicycle contributed to 12 per cent of the total light-engineering exports in FY 2017-18.

In FY '18, the bicycle export industry earned $85 million with 3.97-per cent growth compared to the previous fiscal's.

The EU countries have the most bicycle-friendly cities and the consumers buy an estimated 18-million bicycles annually.

Around 60 per cent of the bicycles are supplied by local manufacturers and the rest are imported, indicating a high demand for bikes in the EU.

At present, three players dominate the local bicycle industry. Meghna Group remains at the top with the annual exports of an estimated 450,000 units.

RFL and a Taiwanese firm in Chittagong EPZ, which produces Alita brand, are another two biggies.

RFL exports more than 1,000 units, and the Taiwanese company and other players do the rest.

RFL has recently expanded its capacity and its two factories in Habiganj have a combined capacity of producing 600,000 units now.

The domestic bicycle industry is booming for the past several years also due to an increasing demand at home.

This growth is led by huge traffic congestion, rising eco-consciousness and the expansion of home delivery services by different businesses.

According to Bangladesh Bicycle Merchant Assembling and Importers Association, the local market demand for bicycles is estimated at nearly 1.5-million a year with an annual demand growth remaining at around 30 per cent.

The domestic market of bicycles is estimated at Tk 12 billion a year and its demand has been rising constantly.

Unfortunately, 70 per cent of this market is dominated by imports from China and India.

Trade experts suggest withdrawal of duty on spare parts and said that a reduction in lead time would further boost the prospect of this growing industry.

Bangladesh is still unable to produce 35 per cent of bicycle spare parts and has to depend on imports. So, duty reduction will make the industry competitive.

Spare parts like bicycle frame, tyre, rim and spoke are manufactured locally, but derailleur gears, known as cycle gears, have to be imported.

The introduction of bicycle ride sharing through apps will also raise the demand, industry analysts said.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.