Published :

Updated :

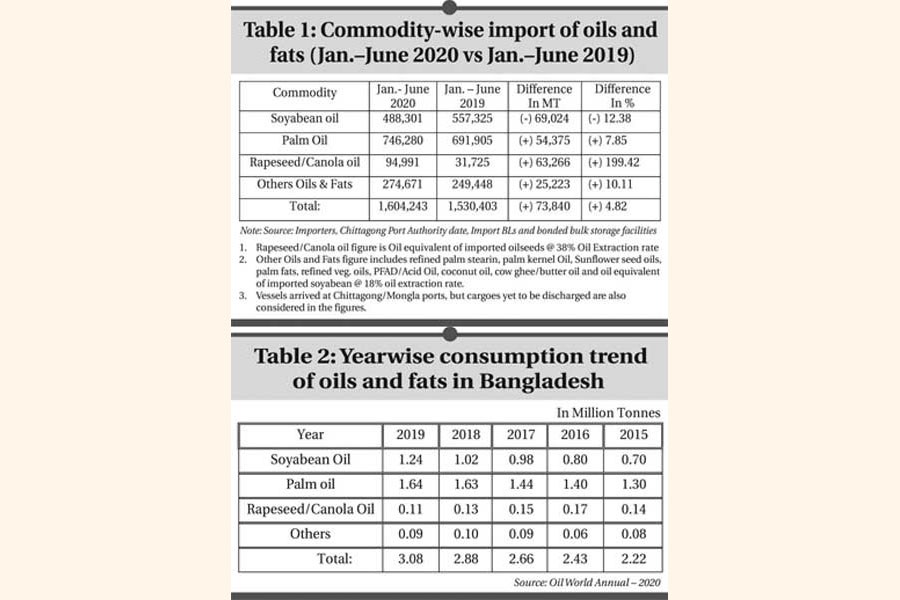

Despite outbreak of the Covid-19 pandemic import of oils and fats in Bangladesh during the first 6 months of 2020 witnessed an upward trend by 4.82 per cent compared to the corresponding period of 2019. During the period total import of oils and fats was about 1.6 million tonnes against 1.53 million tonnes during Jan-June 2019. Major three edible oils consumed in the country, namely soyabean oil, palm oil and rapeseed/canola oil, constitute about 83 per cent of the said 1.6 million tonnes, while the remaining 17 per cent was constituted by other oils and fats. Commodity-wise import details may be seen in Table -1.

Import of soyabean oil, which is leading edible oil in consumer pack market and controls about 35 per cent to 40 per cent market share of total edible oils market of the country, on an average, registered a staggering a decline of over 12 per cent compared to the corresponding period of 2019. Increased import of soyabean, which witnessed a growth of about 14 per cent during Jan-June period of 2020 compared to the corresponding period of 2019, is the reason of the said decline of import of soyabean oil. About 1.3 million tonnes of soyabean were imported during Jan-June period of 2020 against 1.1 million tonnes during Jan-June 2019 period and about 230,500 tonnes of crude soyabean oil were extracted locally from the said 1.3 million tonnes of soyabean, which entered into the market as refined soyabean oil through processing locally. As a result, actual availability of refined soyabean oil in the local market was much higher than that of imported soyabean oil. Entire quantity of soyabean oil was imported from South America, while soyabean was imported from USA/South America and Canada.

Palm oil which is leading edible oil in the country since 2003, occupying 53 per cent to 55 per cent market share of total edible oils market, on an average, witnessed a growth by about 8.0 per cent compared to the corresponding period of 2019. The sudden five-fold surge in the import of palm oil from Malaysia contributed mainly to the increased import of palm oil during Jan-June 2020 period. Price competitiveness of Malaysian palm oil compared to Indonesian palm oil is the reason of the said surge in increased import of Malaysian palm oil.

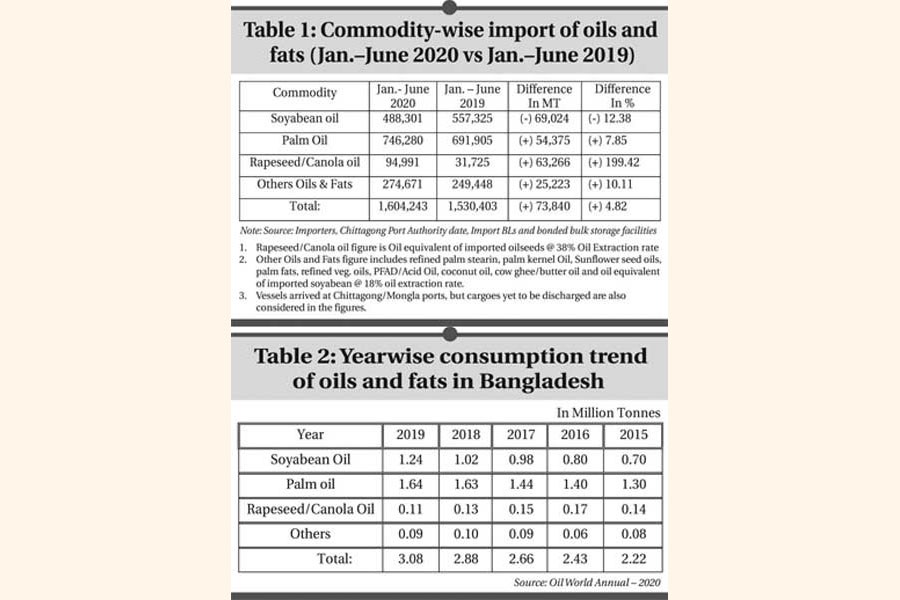

Import quantity of rapeseed/canola oil, which is imported in the seed form and marketed locally as virgin rapeseed/canola oil through extraction locally. Rapeseed/canola is traditional edible oil in the country and being used since ancient time. Its use is in declining trend due to its high price compared to other two refined oils, namely palm oil and soyabean oil. Yearwise consumption trend of major three edible oils during last 5 years may be seen in Table - 2

The writer is Regional Manager of Malaysian Palm Oil Council (MPOC), Dhaka Office.

fakhrul@mpoc.org.bd

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.