Published :

Updated :

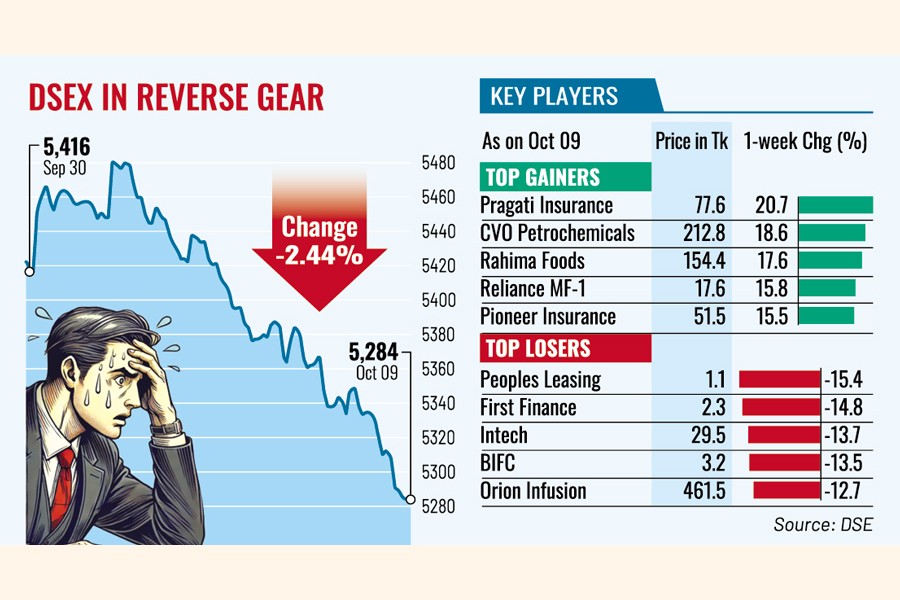

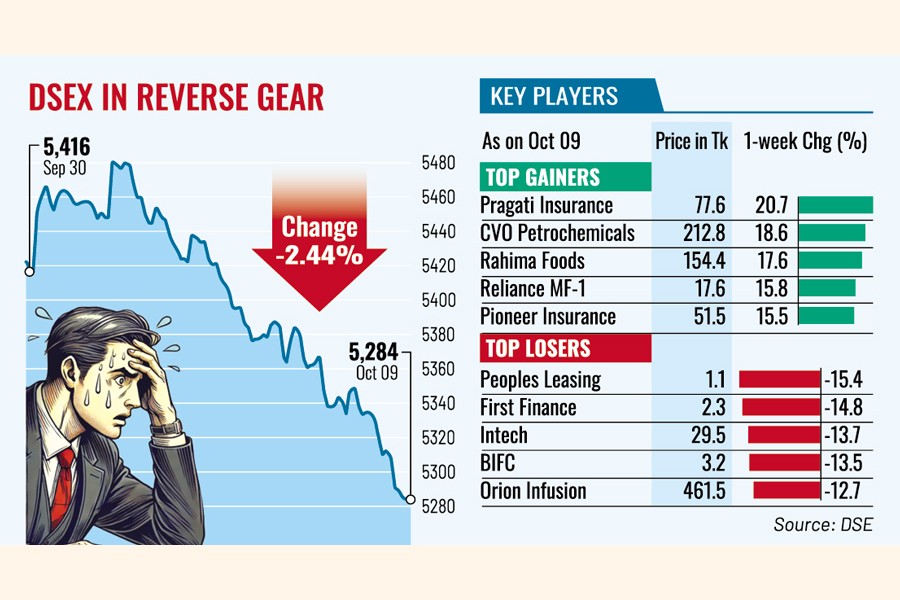

The benchmark index of the Dhaka Stock Exchange (DSEX) saw a steep fall this week, hitting a seven-week low, as widespread sell-offs by jittery investors reflected growing concerns over market momentum and macroeconomic uncertainties.

Market sentiment remained subdued as investors turned cautious in the absence of a strong catalyst for the market momentum.

The upcoming earnings season also led investors to adopt a wait-and-see approach in building new equity positions, said a leading stockbroker.

Political uncertainty, elevated banking sector vulnerabilities and subdued private sector investment prompted many investors to exercise caution, he said.

Rising inflation in September also weighed on investor sentiment.

Following these developments, most investors continued heavy sell-offs, dragging the benchmark index below 5,300-mark.

However, prospect of a policy rate cut amid easing inflation and declining yield rates of the government securities are expected to drive market momentum ahead.

The yield rates on 2-year government bonds dropped below 10 per cent to 9.44 per cent from 10.17 per cent during Tuesday's bidding, signalling potential easing of interest rates in the money market.

This week, only the first trading session ended higher, while the remaining four closed sharply lower, with the DSEX plunging nearly 132 points, or 2.44 per cent, to 5,283 -- its lowest level since July 22 this year.

The blue-chip DS30 index, a group of 30 prominent companies, also lost 49 points to close at 2,033 while the DSES index, which represents Shariah-based companies, shed 38 points to 1,134.

EBL Securities, in its regular market analysis, said that amid the absence of a reviving catalyst for the volatile market, broad-based selling pressure plunged the market indices into negative territory.

However, notable buying interest was witnessed in the general insurance stocks, buoyed by optimism over potential business expansion prospects following the central bank's recent directive allowing the export of goods on open account credit terms against coverage from domestic insurance companies, it added.

Price fall of selective blue chips such as Walton, BAT Bangladesh, Beximco Pharma, LafargeHolcim and Square Pharma, dragged the market index down. These five stocks jointly accounted for a 24-point fall in the index.

The total turnover stood at Tk 32.85 billion as against Tk 18.60 billion in the week before as this week saw five trading sessions instead of previous week's three.

Accordingly, the average daily turnover stood at Tk 6.57 billion, up 6 per cent from the previous week's average turnover of Tk 6.20 billion.

Investors were mostly active in the general insurance sector, which accounted for 12 per cent of the week's total turnover, followed by pharmaceuticals (10 per cent) and textile sector (9.7 per cent).

Losers outnumbered the gainers, as out of 396 issues traded, 298 saw price correction while 79 others gained and 19 issues remained unchanged on the DSE floor.

All the major sectors showed negative performance. The non-bank financial institutions witnessed the highest loss of 3.9 per cent, followed by engineering (3.4 per cent), food (2.7 per cent), banking (2 per cent), power (1.8 per cent) and telecom (1.20 per cent).

Low-cap companies dominated the turnover chart, with CVO Petrochemical Refinery becoming the most-traded stocks, with shares worth Tk 1.07 billion changing hands, closely followed by Sonali Paper, Rupali Life Insurance, Summit Port Alliance and Orion Infusion.

The Chittagong Stock Exchange also ended lower, with its All Shares Price Index (CASPI) shedding 132 points to close at 14,947, while the Selective Categories Index (CSCX) fell 76 points to 9,188.

The port city bourse traded 14.44 million shares and mutual fund units with turnover value of Tk 666 million.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.