Published :

Updated :

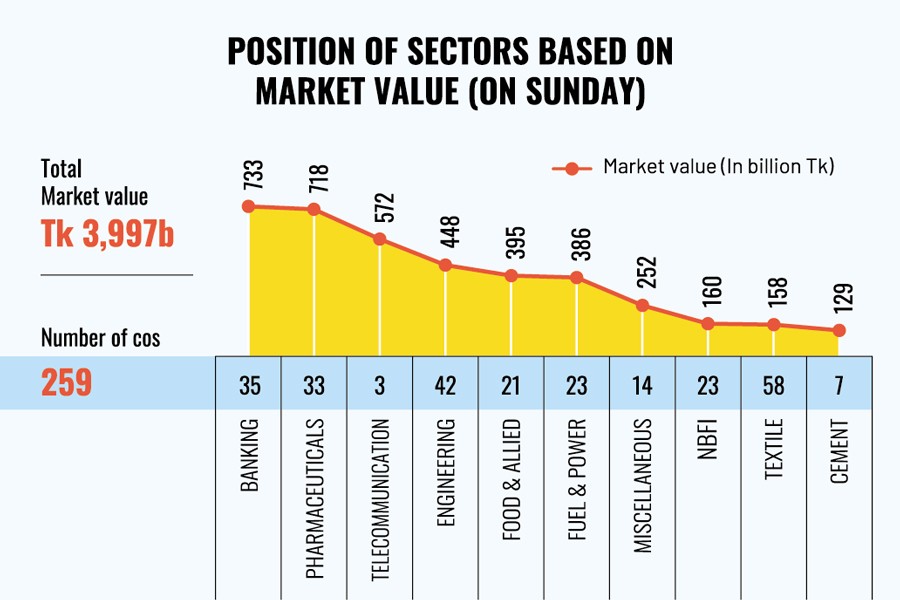

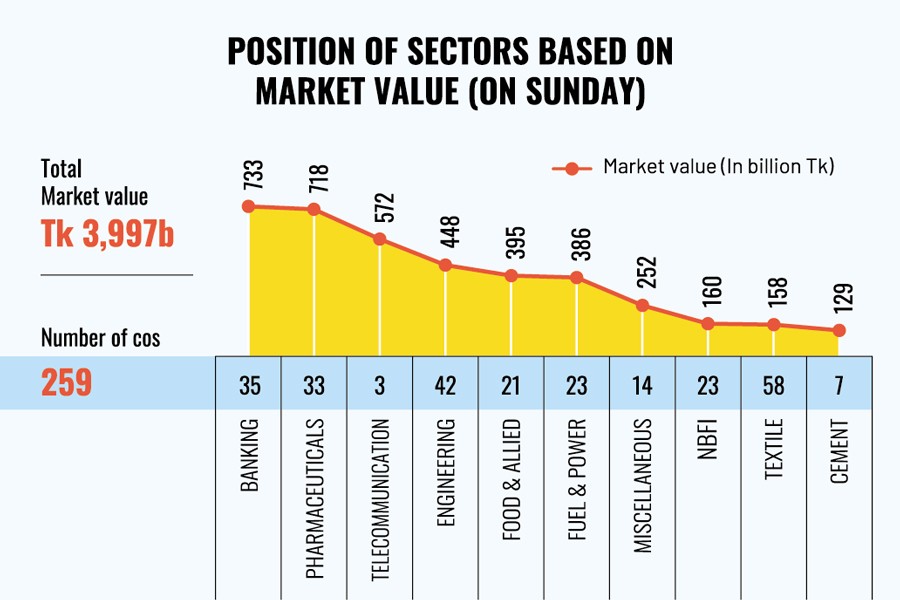

The banking sector emerged as the market-cap leader on Sunday after three years, replacing the pharmaceuticals, for continued rally of bank stocks on the Dhaka Stock Exchange (DSE) after the floor price removal.

Having been undervalued for a long time, bank stocks came to limelight as the sector gained 4.30 per cent in terms of market capitalisation on Sunday alone. Except for Islami Bank, which remained unchanged at Tk 32.6 per share on the DSE, all bank stocks experienced appreciation on the day.

Since the withdrawal of the price restriction through Sunday, the banking sector's market value surged by Tk 39 billion to Tk 733 billion.

"Investors poured fresh funds into bank stocks, considering the fact that the sector remains at a lucrative price level," said Prof Abu Ahmed, former chairman of the economics department of the University of Dhaka.

Apart from the removal of floor, favorable earnings disclosures also boosted investors' confidence in bank stocks. Many investors, including institutional ones, have been putting fresh bets on bank shares in anticipation of higher dividends, Prof Ahmed added.

Supported by bank stocks and non-bank financial institutions (NBFIs), the benchmark index of the DSE surpassed the 6,400-mark on Sunday after 16 months.

Twenty NBFIs, out of 23, rose, pushing the sector up by 4.3 per cent.

The market opened higher on Sunday and the upbeat trend continued until the end of the session, driving the prime index of the Dhaka exchange to 6,447, with a rise of 73.72 points or 1.16 per cent from the day before.

The DSEX added more than 368 points in the past 10 trading days, led by the banking sector, while the overall market-cap of the prime bourse surged by Tk 287 billion during the period.

Along with the upward trend of the index, the market turnover stayed above Tk 15 billion for the last six days, as investors began returning to the market on high hopes.

Turnover, a crucial indicator of the market, stood at Tk 18.52 billion on Sunday, only 0.3 per cent down from the day before.

The stock market seems to have got back its rhythm. The recent growth in turnover and index - the two most important indicators of the market -- suggests that investors' are regaining confidence in the market.

The pharmaceuticals sector kept its dominance on the day's turnover chart, accounting for 18 per cent of the day's total turnover, followed by banking 14.6 per cent and engineering 11 per cent.

According to EBL Securities, the market remained upbeat, mainly riding on investors' continued interest in the giant bank sector owing to positive expectations from the upcoming year-end earnings disclosures.

However, most of the traded issues lost value on Sunday. Out of 394 issues traded, 196 declined, 165 advanced, and 33 issues remained unchanged on the DSE trading floor.

Two other indices also ended higher. The DS30 index, comprising blue chips, rose 21.70 points to finish at 2,160, while the DSE Shariah Index gained 10.74 points to close at 1,398.

Fortune Shoes, which gained 9 per cent, topped the turnover list, with shares worth Tk 650 million changing hands, followed by Orion Pharma, Orion Infusion, IFIC Bank, and Intraco Refueling.

SBAC Bank was the day's top gainer, posting a gain of 10 per cent while Shyampur Sugar Mills the worst loser, shedding 8.75 per cent.

The Chittagong Stock Exchange also ended higher with its All Shares Price Index (CASPI) rising 310 points to close at 18,605 and the Selective Categories Index, CSCX gaining 187 points to 11,138.

Of the issues traded on the CSE, 146 declined, 128 advanced and 20 issues remained unchanged.

The port city bourse traded 10.60 million shares and mutual fund units with a turnover of Tk 238 million.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.