Published :

Updated :

The establishment of the country's first Commodity Exchange (CX) has now come under a legal framework with the publication of a gazette notification on its rules approved by the regulatory authorities.

Following this recent development, the Chittagong Stock Exchange (CSE) has submitted an application to the Bangladesh Securities and Exchange Commission (BSEC) for the registration of its CX.

"Now, the registration of the CX would be granted upon meeting the eligibility criteria stipulated in the rules," said Mohammad Rezaul Karim, an executive director and spokesperson for BSEC.

The BSEC aims to issue the registration this year, he said, adding that the CSE may start the operation of the CX early next year upon registration.

Md. Ghulam Faruque, the acting managing director of CSE, said they would initiate operations once they receive registration and upon the completion of relevant exchange regulations.

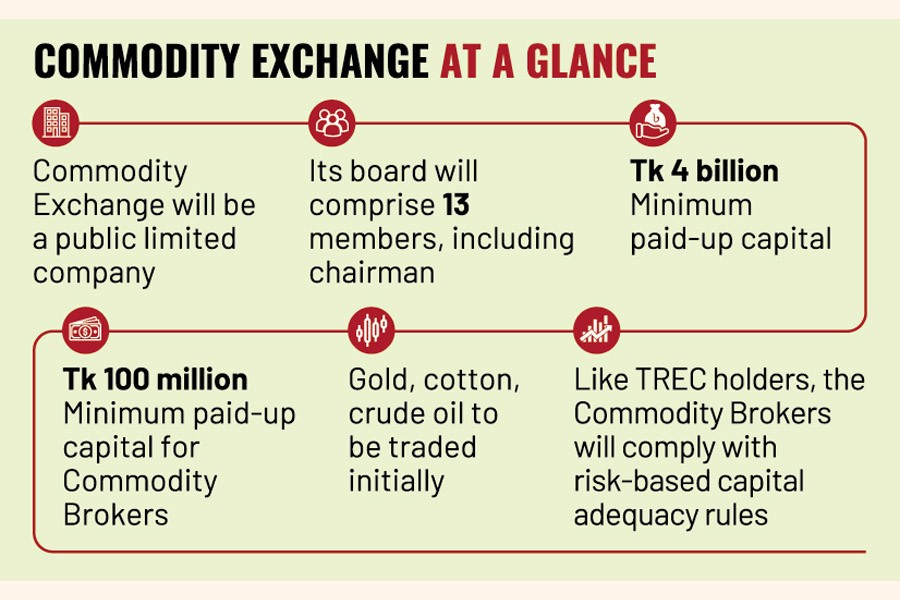

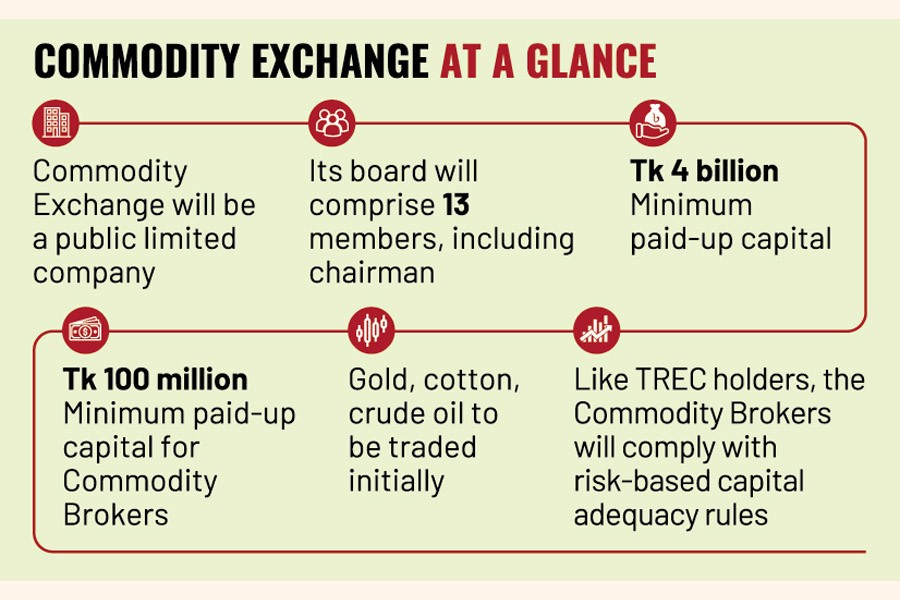

Initially, the CX will facilitate non-delivery cash settlements for three commodities: gold, cotton, and crude oil, with plans to transition to physical delivery settlement of the commodities in the future.

As per the draft rules, the CX's minimum paid-up capital will be Tk 4.0 billion while the minimum paid-up capital required for each commodity broker will be Tk 100 million.

A commodity exchange enables the trading of future commodity contracts, where traders agree to buy or sell goods at a negotiated price on a predetermined date. The proposed CX will function as a subsidiary of the port city bourse.

The operations of the CX closely resemble those of stock exchanges. TREC (trading right entitlement certificate) holders execute transactions of listed securities, while commodity brokers manage the trading of commodities on the CX.

Like the TREC holders, the commodity brokers will have to comply with the risk-based capital adequacy rules. In that case, the rules can be relaxed a bit for the commodity brokers.

According to the rules, the CX's board will consist of 13 members, including seven independent ones. And the chairman of the board will be chosen from among the independent directors.

This governance structure mirrors that of demutualized stock exchanges, which also feature a majority of independent directors (seven) with the chairman selected from their ranks.

Like the TREC holders, the commodity brokers will also open consolidated customers' accounts (CCA) in its name with any scheduled bank.

And this account will be maintained only for the deposit of the money received from and for, and payment of money to and for, the customers.

The settlements of the trades on the commodity exchange will be executed through Central Counterparty Bangladesh Limited (CCBL).

Traders will be allowed to purchase a contract, subject to payment of a 5-10 per cent margin or security money paid to the exchange.

After the purchase, the contract can be transacted through a new contract. In that case, the original buyer will receive the gain only or will pay the amount of loss incurred in the transaction.

On completion of the maturity period of the contract or contracts, the sellers will receive cash equivalent to their net position and the margin.

Commodity brokers will charge a commission for the transactions of the contracts.

The main challenges of the CX's operations lie in executing settlements and setting reference prices for commodities. The formation of a business specification model is also a complicated process.

Nexus of middlemen is a much-talked-about issue in Bangladesh as consumers in many cases are unable to purchase commodities at fair prices because of them. Producers and peasants are also deprived of fair prices of their products.

It's expected that the full operations of the commodity exchange will offer an opportunity to curb the influence of middlemen in commodity trading.

In September 2021, the securities regulator allowed the CSE to go ahead with its proposal to establish the CX.

In April 2022, the CSE appointed Multi Commodity Exchange of India Ltd (MCX) as a consultant to help frame rules and regulations for the CX. The CSE invested $0.7 million for the consultancy, software and hardware platform.

In November 2022, ABG Ltd, a concern of Bashundhara Group, purchased 25 per cent stake in the CSE as a strategic partner in line with the demutualisation process.

mufazzal.fe@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.