Deep-discounted MFs face mandatory liquidation or conversion under draft rules

The market price of a majority of existing closed-end MFs is far below NAV, meaning "their performance is below the mark"

Published :

Updated :

The securities regulator has proposed liquidating closed-end mutual funds or converting them into open-ended funds before maturity if their units trade at more than a 25 per cent discount to net asset value (NAV) on the bourses.

The provision has been newly added to the draft amendment to the mutual fund rules to help unitholders offload their investments in poorly-performing pooled funds, where many investors have remained stuck since the 2018 extension of fund tenures.

The draft amendment has been published seeking public opinion ahead of final approval.

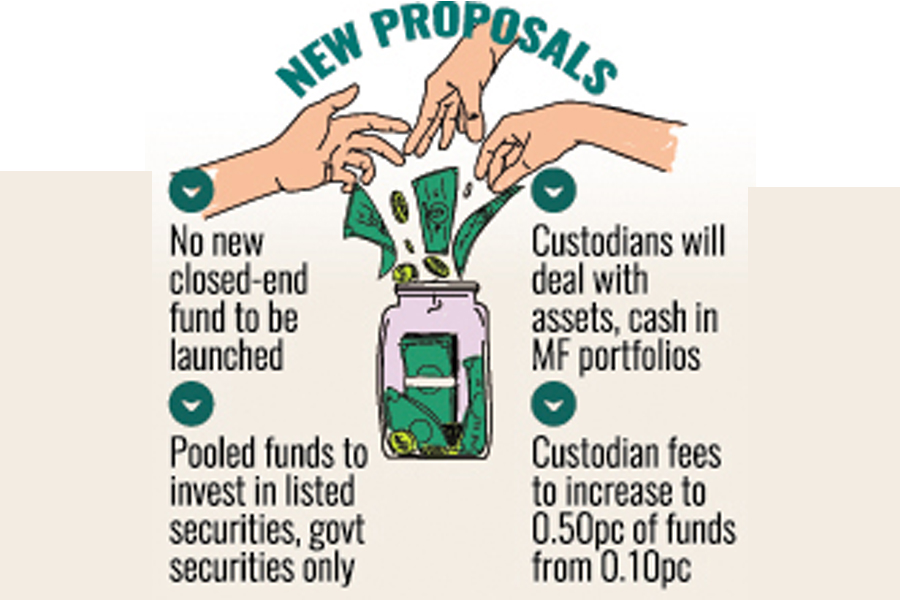

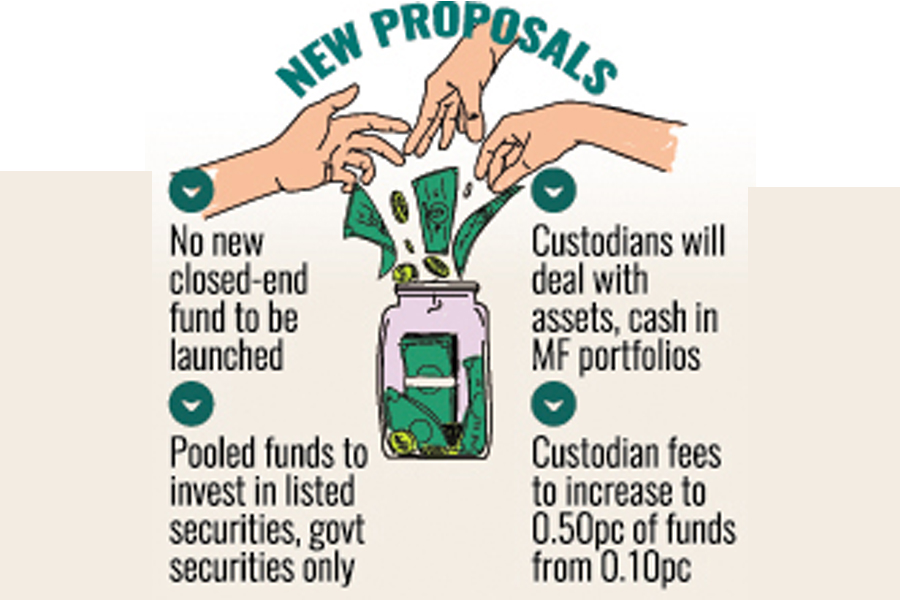

At the same time, the Bangladesh Securities and Exchange Commission (BSEC) has suggested disallowing the launch of any new closed-end fund.

According to the draft, existing funds will be subject to liquidation or conversion six months after the gazette notification if the average trading price of their units over the six-month period has remained more than 25 per cent below the average NAV based on cost price or fair value, whichever is higher.

The trustee of the affected fund must then call an extraordinary general meeting (EGM) to allow unitholders to vote on whether the fund should be liquidated or converted. Any decision will require support from three-fourths of the votes cast in the EGM.

BSEC spokesperson Md. Abul Kalam said closed-end funds are supposed to be traded at prices close to NAV, but the market price of a majority of existing closed-end MFs is far below NAV, meaning "their performance is below the mark".

"That's why they should be liquidated or converted into open-ended fund." He said that if a non-performing fund is converted into an open-ended fund, investors will have the option to realise their investments with returns at any time.

The existing rules already allow liquidation before maturity if three-fourths of unitholders consent, but reaching such a consensus has proved difficult. In many cases, unitholders have been persuaded by asset management companies (AMCs) to oppose liquidation, with interventions from different quarters coming in favour of asset managers.

If the new provision comes into effect, any non-performing listed fund would face mandatory liquidation or conversion.

According to BSEC officials, the regulator is introducing the provision to encourage professionally-managed listed funds to perform better.

Mr Kalam said the taskforce had recommended closing closed-end funds within six months of approving the amendment, "but the regulator has offered a scope of performance-based operations".

If the amendment is implemented, AMCs will no longer be allowed to handle the assets and cash funds of mutual funds. They will be responsible only for buy-sell operations, while custodians will ensure the safety of assets and cash.

A custodian must have a minimum paid-up capital of Tk 2 billion. Since banks usually meet this requirement, the regulator wants banks, such as HSBC and BRAC Bank, to act as custodian in the interest of unitholders' safety.

The BSEC has proposed increasing custodian fee up to 0.50 per cent from the existing 0.10 per cent of a fund so to inspire banks to work as custodian of MFs.

Currently, a mutual fund can invest at least 60 per cent of its assets in listed securities and the remaining 40 per cent in money market instruments or non-listed securities with regulatory approval. Under theamended rules, mutual funds would be allowed to invest only in listed securities and government securities, with no ceiling on either category.

The regulator has introduced this change to prevent misuse of investors' money through investments in non-listed securities lacking fundamental basis.

A senior BSEC official said on anonymity that many fund managers had treated investors' money as "their [AMC] inherited property", which prompted the regulator to restrict investments to listed and government securities.

The 10-year extension of closed-end mutual funds' tenure in 2018 prolonged the blockage of investors' money. Some fund managers had lobbied for the extension, claiming that liquidation would create a liquidity crisis in the market. Although the extension was granted in the name of supporting the market, it mostly ensured that fund managers continued earning management fees for another long period.

As a result, investors have neither been able to offload their units at persistently depressed market prices nor recover investments at NAV values through liquidation.

Fraudulent activities by some fund managers have also severely damaged the industry's reputation.

This is the backdrop to the majority of 37 listed closed-end funds trading far below face value.

BSEC Officials said that, if approved, the proposed amendment would bring the funds under a systematic liquidation or conversion process for the sake of investors, giving them an opportunity to recover at least part of their investments before conditions worsen further.

mufazzal.fe@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.