Published :

Updated :

The Dhaka bourse is set to replace some regulations currently applied to the Alternative Trading Board (ATB) to build momentum in trading, deliver clear information about listed securities and remove existing ambiguities.

It will send its proposal to the securities regulator in two weeks' time.

Presently, an individual shareholder is not allowed to sell holdings within three months after the share purchase on the ATB.

If anyone offloads shares within the timeframe and achieves capital gains, the money will be transferred to the exchange's investors' protection fund instead of the investor's account.

The Dhaka Stock Exchange proposes that investors on the ATB be allowed to transact shares as they do on the main board upon maturity three days after the share purchase.

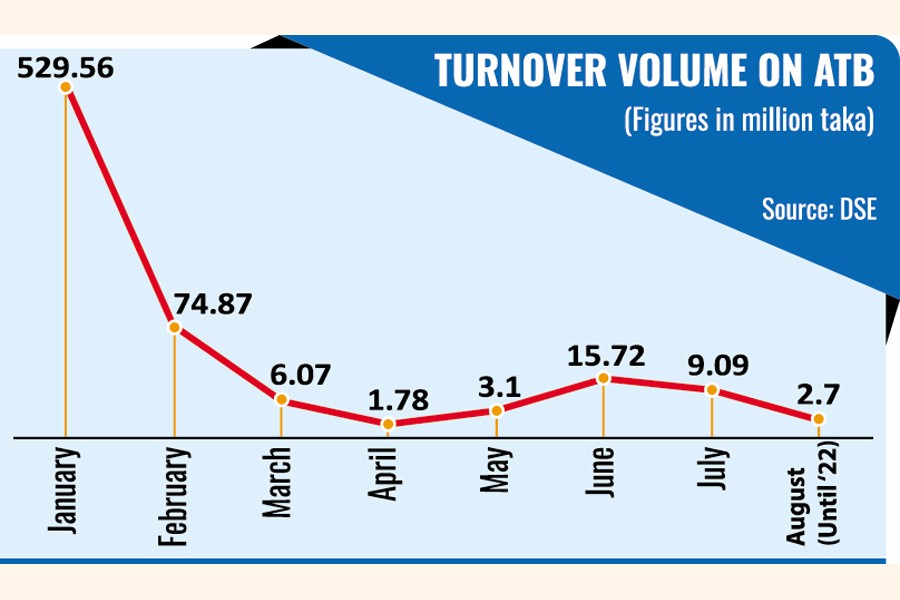

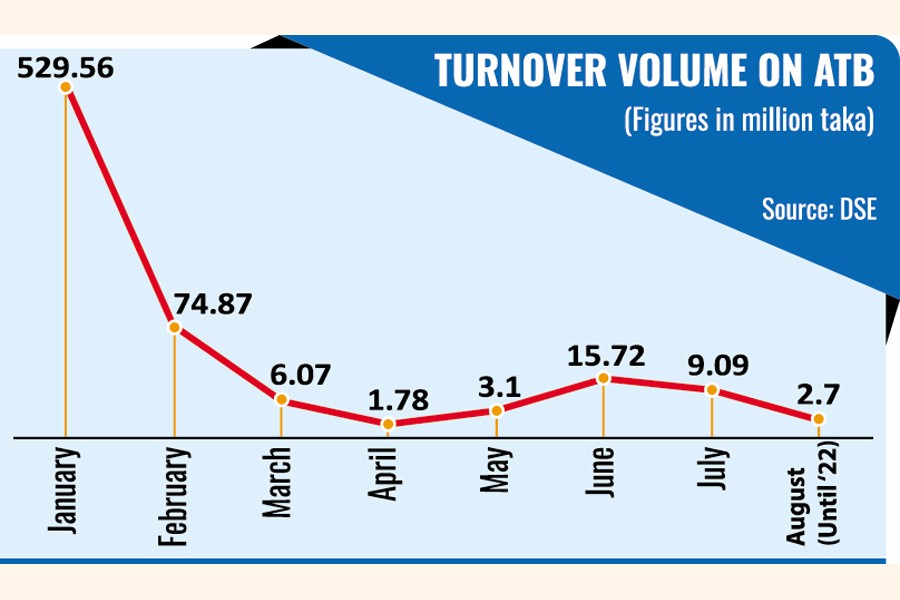

The platform was launched in January to facilitate trading of non-listed companies, bonds, debenture, Sukuk, open-ended mutual funds, and alternative investment funds.

But only two securities -- LankaBangla Securities and PRAN Agro guaranteed bonds -- have so far been listed on the platform, and transactions have been in decline. The DSE has not seen a single trade of PRAN Agro guaranteed bonds yet.

To encourage investor participation, the Dhaka bourse also seeks changes in the way circuit breaker, a measure to temporarily halt trading, is imposed on the ATB.

A 5 per cent circuit breaker is in place based on fair value of a security, fixed in every three trading sessions.

The DSE wants the circuit breaker to be set on the closing price of the previous session as is the case in the main board.

As per the existing rules, a company can offload up to 49 per cent of its outstanding shares.

Initially, the company should offload at least 10 per cent shares. But there is no clear timeframe given, within which the company should release the remaining 39 per cent.

That, the DSE thinks, creates confusion among investors about the company's future plan.

The bourse suggests that the time is specified so that sponsors of a company cannot take undue advantage by offloading the 39 per cent stakes at their convenience.

It also wants inclusion of a provision of giving exit to any strategic investor through the listing of a security.

Moreover, the DSE is in favour of incorporating a provision to allow a new sponsor only five years after a company's listing in the ATB. Until then, 51 per cent stakes held by the company's sponsor-directors should be locked-in.

"The sponsors will have no scope of exiting the company by getting rid of their stakes through unfair means," said DSE acting managing director M. Shaifur Rahman Mazumdar.

Such a stringent rule is deemed necessary especially because companies listed on the ATB are not obliged to disclose financial information quarterly as the companies in the main board do.

The securities listed in the ATB disclose financial statements once a year.

The Dhaka exchange also looks to make sure that the valuation of a company's assets is done once before the listing so that sponsor-directors cannot take undue advantage while offloading the 39 per cent stake.

The futuristic valuation of companies, such as those in the IT field having prospects, will be permitted in the revised rules of the ATB, says the DSE.

In September 2021, the securities regulator asked the Dhaka bourse to shift 18 companies of the over-the-counter (OTC) market to the ATB.

But not a single company among those has been transferred to the ATB, mainly due to inaction of the companies.

mufazzal.fe@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.