Meghna Petroleum makes record profit, fuelled by non-operating income

Published :

Updated :

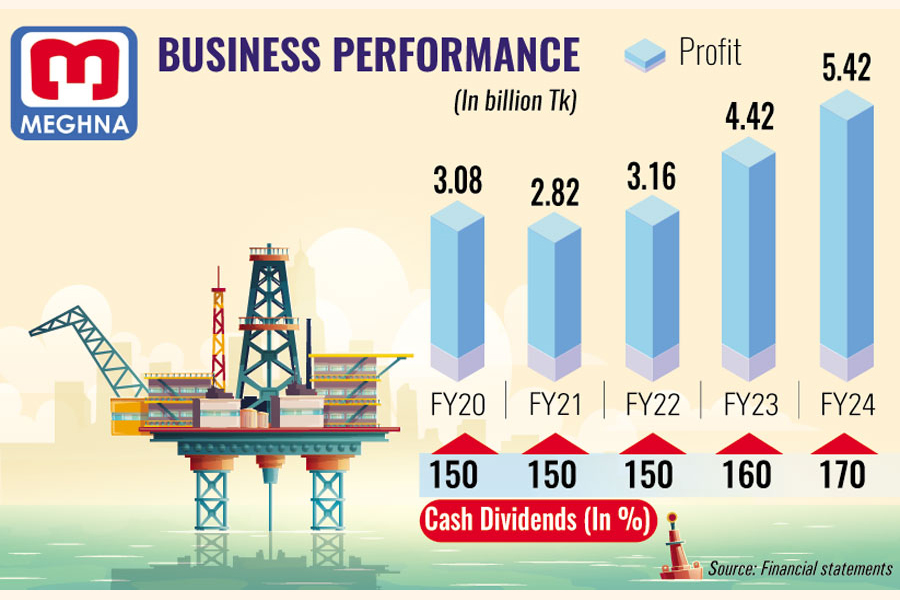

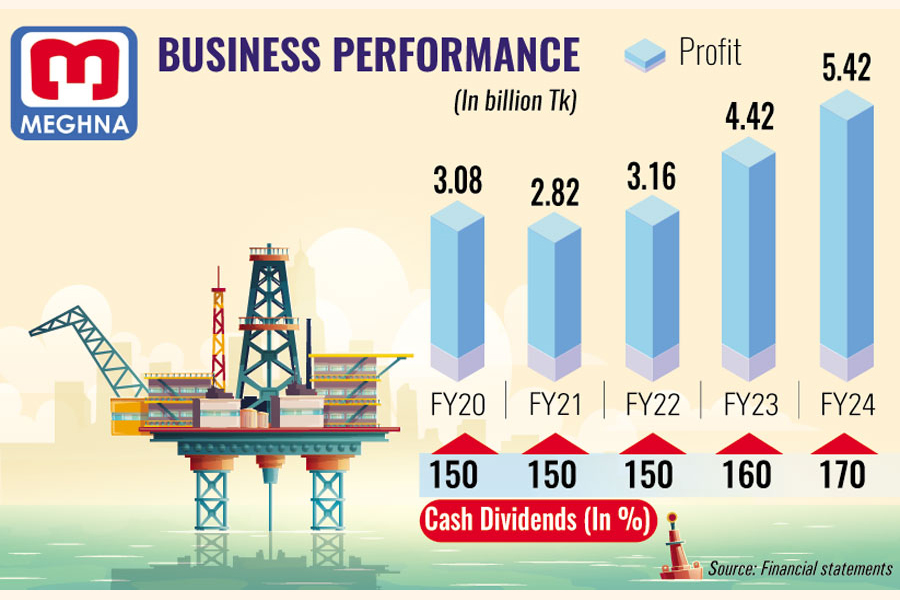

Meghna Petroleum secured a profit of Tk 5.42 billion in FY24, the highest since its 2007 listing and a 23 per cent increase year-on-year, as income from bank deposits escalated amid the rising interest rate.

The state-run petroleum marketer's earnings per share (EPS) stood at Tk 50.11 for FY24, elevated from Tk 40.86 a year ago, according to a stock exchange filing on Tuesday.

The profit rose on the back of a substantial surge in non-operating income against bank deposits, said the company.

Many state-owned companies have always had bank deposits as a major source of income outside business operations. However, the non-operating income recently shot up because of the hikes in interest rates.

Buoyed by the record profit, the company declared 170 per cent cash dividends for FY24, again the highest since listing. That means investors will get Tk 17 per share against an income of Tk 50.11 per share in the year.

Currently, the company's total number of shares is 108.21 million. So, Meghna Petroleum will distribute only one-third of the profit in cash dividends to its shareholders for the year.

Following the earnings disclosure, the stock of Meghna Petroleum rose 1.61 per cent to Tk 221.3 per share on Tuesday on the Dhaka Stock Exchange (DSE) while the overall market was in the red.

The company is yet to publish its detailed financial statement for FY24. Hence, data, such as yearly sales, interest income, and non-operating income are not available as of now.

The nine-month non-operating income soared 29 per cent year-on-year to Tk 3.52 billion through March this year while operating income fell 17 per cent year-on-year to Tk 672 million during the period.

That indicates the profit was solely driven by the non-operating income.

Market operators say funds must have been set aside for interest income instead of distributing them in cash dividends.

Meghna Petroleum's short-term investments (FDRs) amounted to Tk 10.97 billion as of March this year.

Profits outside its core business had stayed high because it had not distributed enough cash dividends, said Akramul Alam, head of research at Royal Capital.

Interest rate has been in an upward momentum since the government removed the ceiling on the lending rate in July last year. The rate further rose when the government stopped controlling it and left it to the market in May this year.

The company scheduled the annual general meeting for February 1 next year and the record date for the entitlement of dividends is December 15 this year.

First-quarter (July-September) performance

Meghna Petroleum's first-quarter profit also jumped 51 per cent year-on-year to Tk 1.38 billion for higher sales and increased non-operating income.

Its net earnings from petroleum products rose 13 per cent year-on-year to Tk 711 million while non-operating income surged 53 per cent to Tk 1.47 billion in the quarter through September.

Meghna Petroleum's short-term investments (FDR) rose further to Tk 12.12 billion by September this year.

The profit was up in the quarter, compared to corresponding period of the previous year due to an increase in sales margin and other income, said the company.

In March this year, the government raised the margin on fuel sales by 60 per cent to Tk 0.80 per litre for the three state-owned oil marketing companies - Jamuna Oil, Meghna Petroleum, and Padma Oil, while the margin of octane and petrol went up 50 per cent to Tk 0.90 per litre.

The net operating cash flow per share, a measure of a company's ability to generate cash from its operations, turn positive, Tk 65.41 per share in Q1, from Tk 68.91 in the negative for July-September last year.

The product price hikes and less payment made to suppliers and others reversed the cash flow.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.