Regulator to fine directors of cos for non-payment of dividends

They have been given until December 15 to clear the dues

Published :

Updated :

In a major drive to enforce compliance, the securities regulator is going tough on errant companies that failed to complete the distribution of approved cash dividends.

In a major drive to enforce compliance, the securities regulator is going tough on errant companies that failed to complete the distribution of approved cash dividends.

The Bangladesh Securities and Exchange Commission (BSEC) has decided to penalize directors and managing directors of 10 listed companies with a fine amounting to Tk 1 million to Tk 23.5 each if they fail to make the payments by December 15 this year.

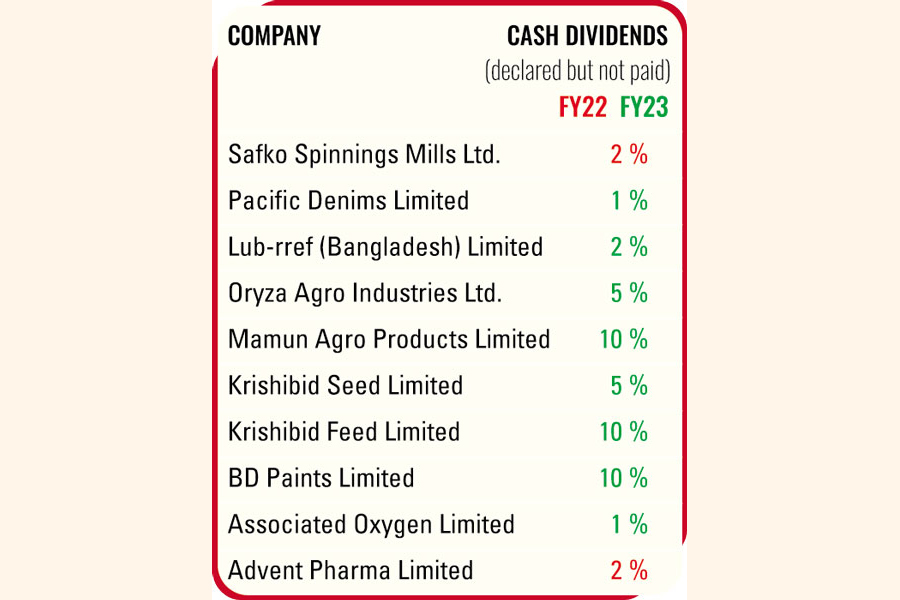

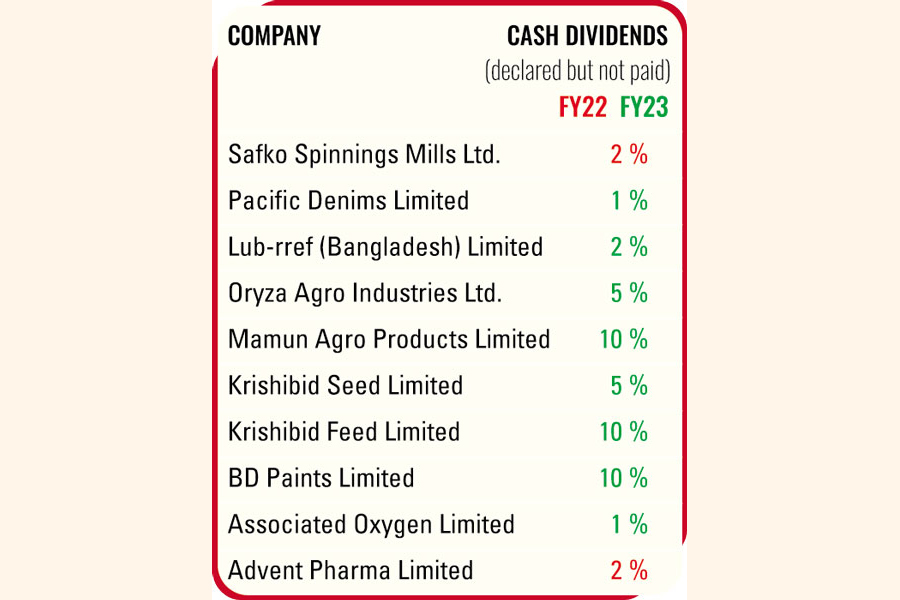

The directors and managing directors, who may have to pay the fine, head Safko Spinning Mills, Pacific Denims, Associated Oxygen, Lub-rref (Bangladesh), Oryza Agro Industries, Mamun Agro Industries, Krishibid Feed, Krishibid Seed, and Bangladesh Paints.

Each director of Safko Spinning Mills will be fined Tk 2 million for not clearing the dividend payments within the new deadline. The company is yet to disburse 2 per cent cash dividends announced for FY22. It declared no dividend for FY23 and FY24.

The directors of Pacific Denims will be fined Tk 1.3 million each while for Lub-rref (Bangladesh) the penalty will be Tk 23.5 million for each director, the highest fine to be imposed on the non-compliant companies.

Lub-rref declared a 2 per cent cash dividend for FY23, but failed to distribute it. It recommended a 1 per cent cash dividend for FY24.

Associated Oxygen's directors, including managing director, will be fined Tk 19.1 million each. For Oryza Agro Industries, a SME company, the fine will be Tk 4.7 million imposed on each director, while heads of Mamun Agro Products will face a fine of Tk 1.3 million each and Krishibid Feed Tk 1 million.

Each of the directors of Krishibid Seed and BD Paints will face a penalty of Tk 1 million and Tk 9.7 million respectively if they do not comply with the regulatory directive.

The BSEC said the managing director and all directors of Advent Pharma would pay Tk 0.4 million each if the drug maker fails to pay due dividends by November 30.

The move to impose fines was taken at a meeting of the Bangladesh Securities and Exchange Commission (BSEC) on Sunday, presided over by its Chairman Khondoker Rashed Maqsood.

It was aimed at protecting investors' interests and upholding the integrity of the capital market.

A BSEC executive director said the issuer companies must pay their declared dividends by December 15. The regulator vowed to impose penalties on directors of the companies for failing to disburse dividends as per their declarations, he said.

Directors of those companies, excluding independent directors, will be required to pay dividends to shareholders from their own accounts if the distribution is not done by the new deadline.

In September this year, the regulator downgraded 28 listed companies to the 'junk' or 'Z' category. Half of the business entities did not complete the payments of approved dividends while the other half lost their status for other issues of non-compliance.

Brokerage firms penalized too

Prudential Capital and NLI Securities will have to pay a fine of Tk 0.5 million each for deficits in their consolidated customers' accounts.

"If they continue to keep the deficits, there will be a daily fine of Tk 10K," reads a statement issued by the BSEC on Sunday.

As per the report of the Dhaka Stock Exchange (DSE), Prudential Capital falls short of Tk 47.52 million as of November 4 in its consolidated customer's account (CCA).

The brokerage firm has been running with a deficit in customers' fund since June this year, reaching the highest amount of Tk 84.06 million on August 8 this year.

The deficit in NLI Securities' CCA has been hovering around Tk 18 million.

A CCA is a separate bank account maintained by stockbrokers to hold unused cash of clients against their beneficiary owner's (BO) accounts.

It is strictly prohibited to utilise the money for any purpose other than paying for securities purchased by clients or collecting commissions or fees owed by them.

Any other use of the fund of the CCA would result in a deficit.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.