Weekly market review

Stocks extend losses for third week

Average daily turnover drops 14pc

Published :

Updated :

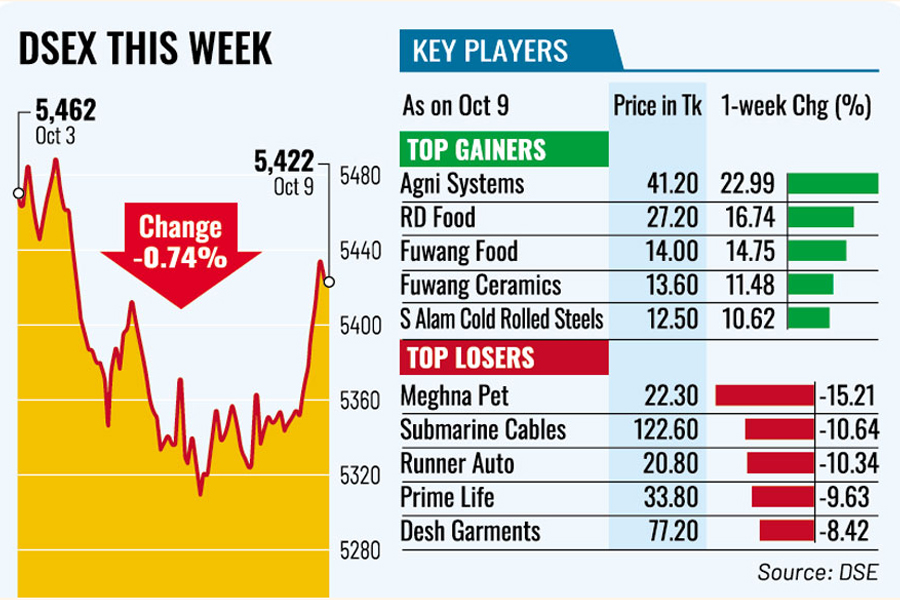

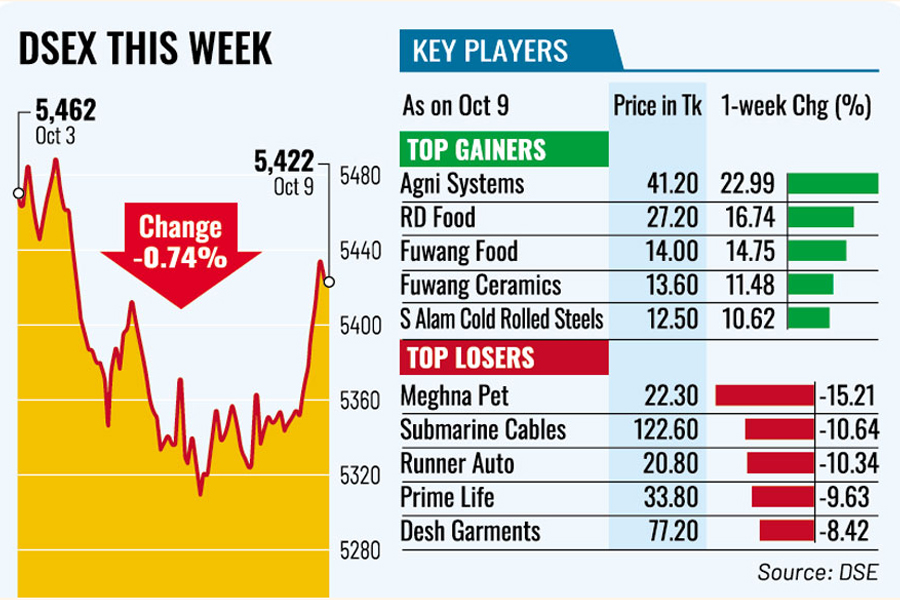

Equity benchmark index lost more ground, extending the losing streak for a third consecutive week, as investor sentiment remains downbeat amid ongoing push for market reforms.

Majority of the securities experienced price appreciation this week, but mixed performance of large-cap stocks led to volatility on Dhaka Stock Exchange (DSE), driving the index down.

This week featured four trading days instead of the usual five due to the Durga Puja holiday on Thursday. The index fell during the first three trading sessions, but the final session saw a sharp rise, recovering most of the losses.

Finally, the benchmark DSEX index settled at 5,422, shedding more than 40 points or 0.74 per cent. The DSEX lost 312 points in the past three weeks.

Analysts say recent regulatory actions against several major manipulators and non-compliant companies have left investors in a state of panic, resulting in massive selloffs.

Recent measures included a record penalty of Tk 4.28 billion imposed on the manipulators of Beximco's shares, as well as downgrade of 29 companies to the 'Z' category due to their failure to declare dividends and complete the distribution of approved dividends.

Insiders claimed that the manipulators targeted by these regulatory actions played a role in the market's decline.

However, experts have welcomed the regulatory actions, stating that such measures are essential for bringing discipline to the market.

Alongside the prime index, the blue-chip DS30 index, a group of 30 prominent companies, also fell 5.86 points to 1,985 while the DSES index, which represents Shariah-based companies, shed 15 points to 1,206.

Turnover, a crucial indicator of the market, tumbled to 14.66 billion this week, as against Tk 21.31 billion in the week before.

Subsequently, the average daily turnover came down to Tk 3.6 billion, down 13.9 per cent from the previous week's average of Tk 4.26 billion.

A market review of the EBL Securities said the benchmark index extended its bearish headwinds for three consecutive weeks as investors' negative sentiment regarding the market momentum continued to pervade across the trading floor.

Of the issues traded last week, 211 advanced while 146 declined and 38 remained unchanged.

Investors' participation was concentrated mostly on the banking sector, which grabbed 25.53 per cent of the weekly market turnover, followed by Pharmaceuticals & chemicals and the IT sectors.

The companies which were largely responsible for dragging the index down include Islami Bank, BRAC Bank, British American Tobacco Bangladesh Company, Renta, Grameenphone, Square Pharmaceuticals, LafargeHolcim Bangladesh and Runner Automobiles.

Of the top index draggers, the stock price of Runner Automobiles declined 10.3 per cent as the company was shifted to 'Z' category over its failure to complete the distribution of at least 80 per cent cash dividend approved for FY22.

On September 25, some 28 companies transferred to 'Z' category from 'B' category for not complying with the provision of dividend recommendation and distribution.

These companies experienced price fall following their category change.

Of the major sectors, the engineering sector experienced the largest decline, with a market-cap drop of 2.93 per cent, followed by jute, services and real estate, life insurance, and banks.

The sectors which experienced most price appreciation include IT, financial institutions, ceramics, food & allied and travel & leisure.

Agni Systems experienced the highest price appreciation of 22.99 per cent, followed by Rangpur Dairy & Food Products, Fu Wang Food and Fu Wang Ceramic Industries.

mufazzal.fe@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.