WEEKLY MARKET REVIEW

Stocks rebound after two-week slump

Average daily turnover jumps 32pc on prime bourse

Published :

Updated :

The equity benchmark index rebounded this week, snapping a two-week losing streak, as bargain hunters showed their buying interest in select lucrative stocks amid renewed optimism.

Analysts said the market witnessed major corrections in the past two consecutive weeks and many good stocks came down to a lucrative price level, which encouraged investors to bet on beaten-down stocks.

The rebound was largely supported by fundamentally strong stocks such as Beximco Pharma, Beacon Pharma, Orion Infusion, Kohinoor Chemicals and Walton, which faced major corrections in the past few trading days.

The week opened on a bullish note, with renewed buying interest in these lagging stocks. However, the momentum was somewhat tempered mid-week, as profit-taking pressure emerged in the banking sector, coupled with cautious sentiment following regulatory developments.

The Bangladesh Securities and Exchange Commission (BSEC) on Tuesday released a draft amendment to margin rules, inviting public opinion over the next two weeks. This move triggered a mixed reaction among investors, with some choosing to reduce exposure to reassess the potential implications of the proposed changes.

Despite these headwinds, the market reflected some resilience as bargain hunting activity re-emerged in the later half of the final trading session.

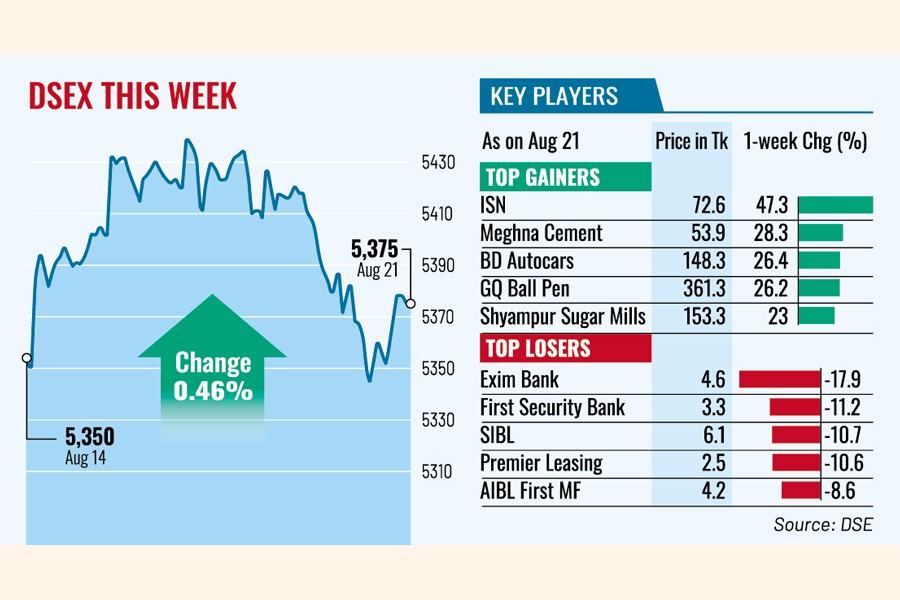

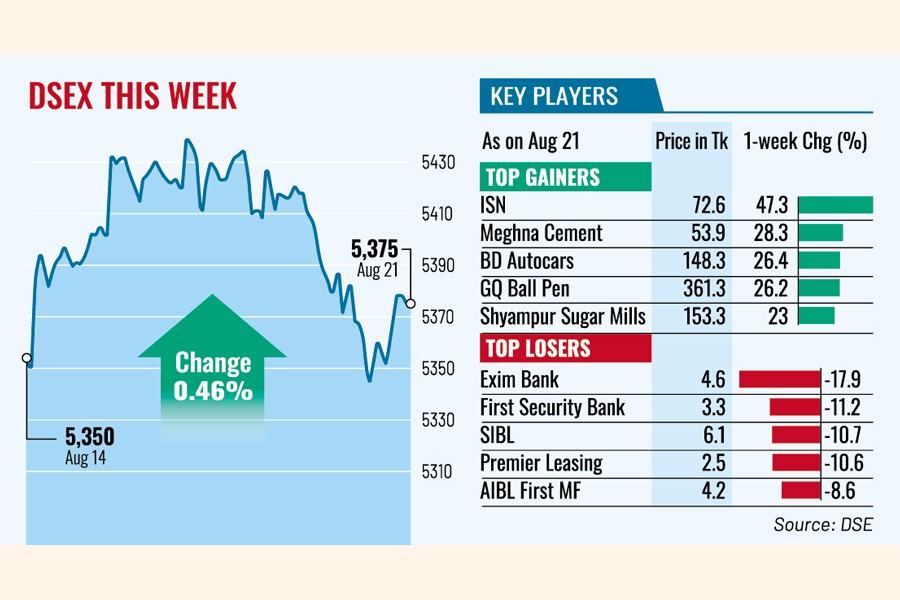

The DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), finally settled the week almost 25 points or 0.46 per cent higher at 5,375 points. It shed 93 points in the past two consecutive weeks.

EBL Securities said stocks are back in positive momentum this week after a brief retracement, supported by renewed investor interest in selective large-cap stocks.

The investors' buying interest in certain June-ending stocks ahead of their upcoming corporate declarations, also contributed to the market's upbeat vibe.

The blue-chip DS30 index, a group of 30 prominent companies, also gained 16 points to 2,089 while the DSES index, which represents Shariah-based companies, rose 17 points to close at 1,180.

Price hike of selective large-cap shares such as Beximco Pharma, Beacon Pharma, Orion Infusion, Kohinoor Chemicals and Walton largely contributed to the weekly index gain, as they jointly accounted for around 25-point rise in the DSEX.

Meanwhile, shares of low-performing companies continued to surge, signalling potential market manipulation.

Four junk stocks -- Shyampur Sugar Mills, Zeal Bangla Sugar Mills, Zahintex Industries and Aziz Pipes -- featured in the weeks' top 10 gainer list, soaring 25 per cent, 23 per cent, 22 per cent and 19 per cent respectively this week.

The non-performing stocks are significantly beating their industry peers nowadays that are in regular business operation, posting profits and giving dividends to their shareholders.

Market participation also became robust as the total turnover reached Tk 45.36 billion this week as against Tk 34.46 billion in the week before.

Accordingly, the average daily turnover rose to Tk 9.07 billion, up 32 per cent from than the previous week's average turnover of Tk 6.89 billion.

The pharmaceuticals sector dominated the turnover chart, accounting for 17.7 per cent of the week's total turnover, followed by the textile sector (11.6 per cent) and banking sector (11.5 per cent).

Gainers took a strong lead over losers, as out of the 394 issues traded, 241 ended higher, 129 closed lower and 24 remained unchanged on the Dhaka bourse.

Bangladesh Shipping Corporation became the most-traded stocks, with shares worth Tk 1.68 billion changing hands, closely followed by Beximco Pharma, Orion Infusion, City Bank and Beach Hatchery.

The Chittagong Stock Exchange also rebounded, with its All Shares Price Index (CASPI) rising 53 points to 15,025, while the Selective Categories Index (CSCX) gained 27 points to 9,218.

The port-city bourse traded 29.9 million shares and mutual fund units, with a turnover value of Tk 689 million this week.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.