Unilever Consumer Care to give highest dividend in 5 years despite lower profit

Published :

Updated :

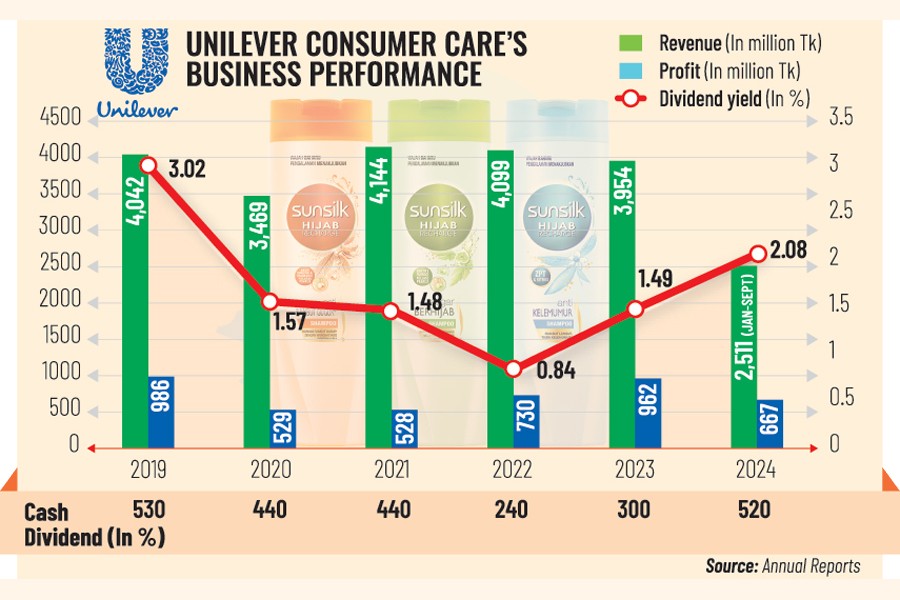

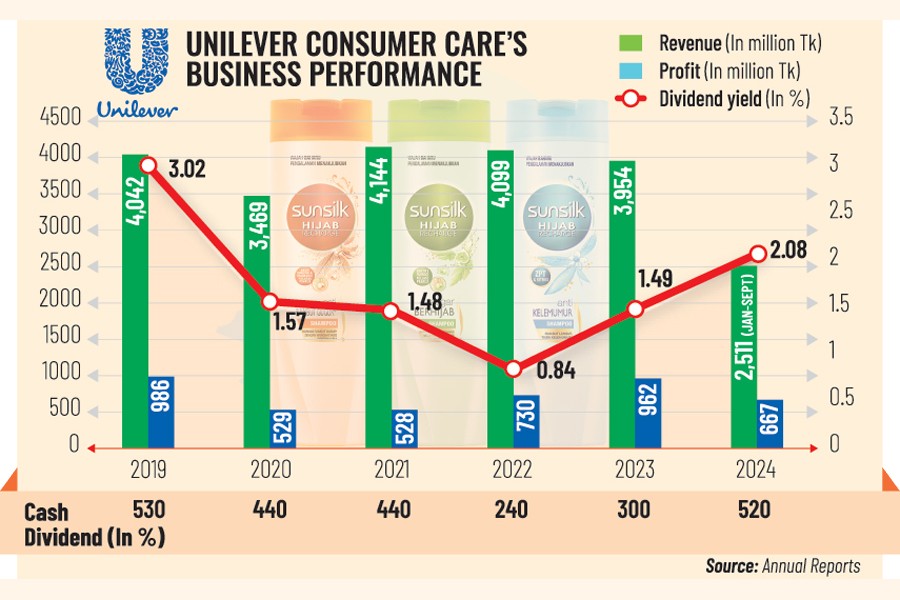

Despite a 31 per cent year-on-year decline in profit in 2024, Unilever Consumer Care recommended the highest dividend - 520 per cent -- in five years for shareholders for the year.

The multinational company's annual income plummeted to Tk 667 million in 2024, mainly due to lower sales and the re-imposition of royalty charge by the parent company.

Earnings per share (EPS) fell sharply to Tk 34.62 in 2024 from Tk 49.89 a year ago, according to a stock exchange filing on Wednesday.

The Horlicks manufacturer will give Tk 52 per share in cash dividend to its shareholders, meaning it will provide an additional Tk 17.38 per share from retained earnings.

Presently, the total number of shares is 19.27 million. So, the company will disburse more than Tk 1.0 billion in cash dividend against a profit of Tk 667 million for the year.

However, sponsor-directors will get Tk 928 million out of the Tk 1 billion to be distributed in dividends, as they hold 92.8 percent stakes in the company.

Due to higher dividend declaration, Unilever Consumer Care's dividend yield will be a five-year high of 2.08 per cent for 2024.

Investors seem to have felt little enthusiasm about the high dividends, as the stock dropped 0.51 per cent to Tk 2,501.9 per share on Wednesday on the Dhaka Stock Exchange.

The company attributed the decline in profit primarily to a fall in revenue, alongside a lower one-off benefit previously derived from reassessing past liabilities.

The re-imposition of technology and trademark royalty charge by the parent company in the third quarter onwards further pushed down profits.

A company official said, requesting not to be named, that high inflation hit the top line growth as people were reluctant to spend money on not-so-necessary products.

The high inflation squeezed consumers' purchasing power, adversely influencing the overall sales and profitability of the company.

"We managed to offset some of the costs through operating efficiency as well as efficient investment in cash, which enhanced net finance income," the official added.

The company has scheduled its annual general meeting (AGM) for May 15 to approve the proposed dividend. The record date is April 6.

Unilever is yet to disclose annual sales figures for 2024.

However, its nine months' revenue plunged 16 per cent year-on-year to Tk 2.51 billion in January-September last year.

The cost of sales, which includes all associated costs to produce goods, stood at Tk 1.40 billion in January-September last year, which was 56 per cent of total sales in the nine months through September 2024, slightly down from 57 per cent of total sales in the same period of the year before.

The net operating cash flow per share, a measure of a company's ability to generate cash from its operations, rose to Tk 25.62 per share in 2024 from Tk 25.43 the year before.

The net asset value, which refers to the excess of total assets over total liabilities increased to Tk 126.83 per share in December last year from Tk 122.21 in December 2023, due to an increase in cash and cash equivalents and short-term investments.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.