Weekly market review: Stocks rebound on regulatory measures, strong earnings

Published :

Updated :

The benchmark equity index rebounded strongly this week after a five-week rout, potentially signalling an end to the downward trend, as bargain hunters came out of the sidelines to snap up beaten-down stocks.

Favourable earnings reports and regulatory moves to restore stability in the market contributed to the index's recovery.

Analysts said investors showed buying appetite based on the latest earnings and dividend declarations as some of the listed companies posted a hefty profit and declared higher dividends.

The regulatory efforts to investigate the reasons behind the recent market crash by forming a panel helped boost investor confidence to some extent.

Finance Adviser Dr. Salehuddin Ahmed's meeting with the Bangladesh Securities and Exchange Commission this week regarding liquidity support also bolstered overall market sentiment.

The finance adviser discussed the ongoing market crisis and assured that initiatives would be taken to address these issues in the short term, medium term, and long term to restore stability in the market.

The market's reversal was largely supported by fundamentally strong stocks, as their prices came down to a lucrative level after a sharp correction

The market opened this week on a pessimistic note, reflecting lingering bearish sentiment and dragging the benchmark index below the 'psychological' threshold of 5,000.

However, higher-than-expected earnings and dividend declarations from some companies, along with a move to provide liquidity support through the ICB, helped stimulate investor sentiment.

As a result, the last three sessions of the week closed higher, recovering all the losses from the first two days of teh week.

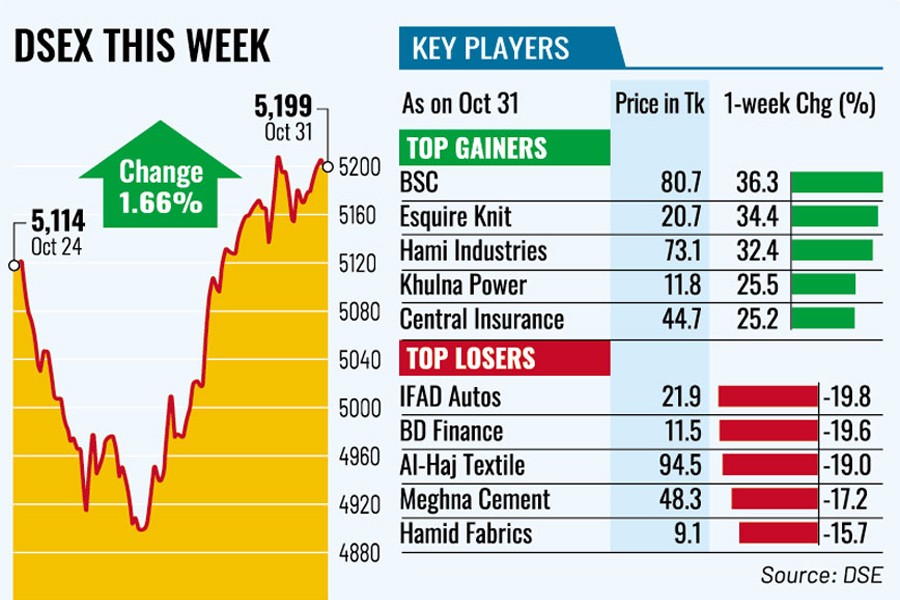

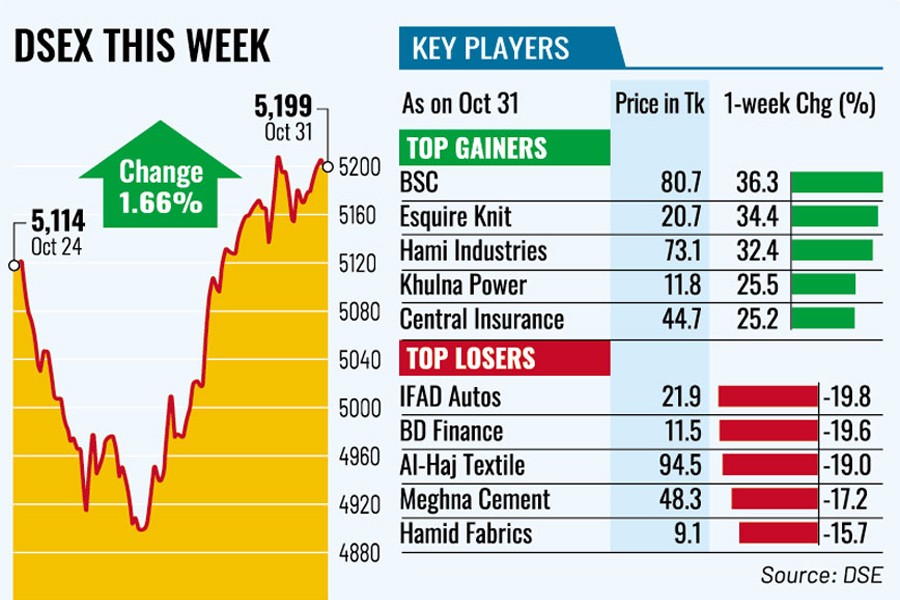

Substantial price surge of large-cap stocks, including blue chips, helped the benchmark index of the Dhaka Stock Exchange (DSE), surged almost 85 points or 1.66 per cent to settle the week at 5,199, after losing 616 points in the past five straight weeks.

Buyers showed their dominance across the trading floor, bolstered by better-than-expected earnings and dividend declarations of the listed companies, said EBL Securities.

"Anticipation of several policy supports from the regulator to enhance liquidity and reduce tax burdens further garnered the buying momentum," said the stockbroker.

This week, Tk 85 billion was added to the market cap, which shed Tk 365 billion in the past five consecutive weeks. The market cap now stands at Tk 6,653 billion.

The market-cap is calculated by multiplying the total number of a company's outstanding shares by the current market price.

Seven large-cap stocks -- Brac Bank, Walton, British American Tobacco, Robi, Bangladesh Shipping Corporation, LankaBangla Finance and City Bank -- together accounted for 60 points of the index's rise during the week, according to EBL Securities.

BRAC Bank achieved an impressive 70 per cent year-on-year growth in profit, reaching Tk 4.2 billion for July-September quarter this year, while profits for the nine-month period totalled Tk 10.1 billion.

Following the news, BRAC Bank's stock price jumped 9.10 per cent, contributing to a 15.7-point rise of the key index during the week.

Walton Hi-Tech Industries accounted for a 13.6-point rise of the weekly index, as the company posted a remarkable 73 per cent year-on-year growth in profit in FY'24, overcoming high inflation and macro-economic challenges.

Subsequently, the blue-chip DS30 index, a group of 30 prominent companies, jumped 47 points to close at 1,926. However, the DSES index, which represents Shariah-based companies, saw a fractional loss of 0.89 points to 1,145.

Turnover, a crucial indicator of the market, rose to Tk 28.83 billion this week, as against Tk 16.93 billion in the week before.

The average daily turnover reached Tk 4.16 billion, up 23 per cent from the previous week's average of Tk 3.38 billion.

Investors were mostly active in the banking sector, which accounted for 19 per cent of the week's total turnover, followed by the pharma sector (16.6 per cent) and food (10.8 per cent).

Most of the traded stocks saw price appreciation, as out of 395 issues traded, 279 advanced, 101 declined and 15 remained unchanged.

Most of the major sectors posted gains with mutual funds seeing the highest gain of 10 per cent, followed by engineering, food, power, and pharmaceuticals.

Lovello Ice-cream was the most-traded stock with shares worth Tk 635 million changing hands, closely followed by Brac Bank, Islami Bank, Fareast Knitting & Dyeing and IBN Sina Pharma.

The Chittagong Stock Exchange (CSE) also rebounded, with the CSE All Share Price Index (CASPI) recovering 140 points to settle at 14,442 and its Selective Categories Index (CSCX) gaining 74 points to 8,779.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.