Why market to bleed more due to floor price now than during Covid

Published :

Updated :

The stock market took 15 months to stride past the bar on price movement after its introduction for the first time in March 2020, benefiting from stimulus measures and idle cash with scanty investment opportunities during the pandemic.

Flooded with fresh investments, the broad index grew at a faster pace than many other Asian countries, such as Pakistan, Japan, Malaysia, and China, and even the UK at the time.

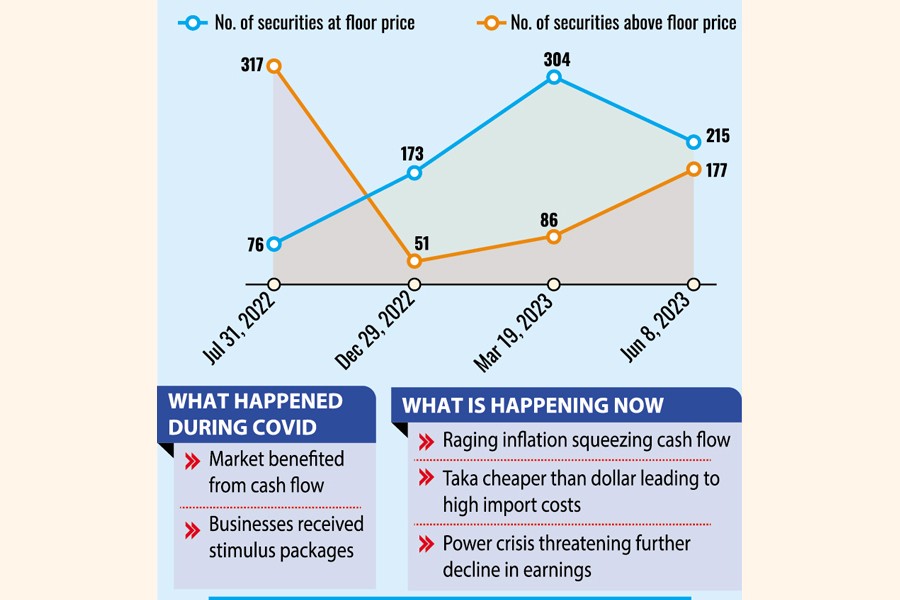

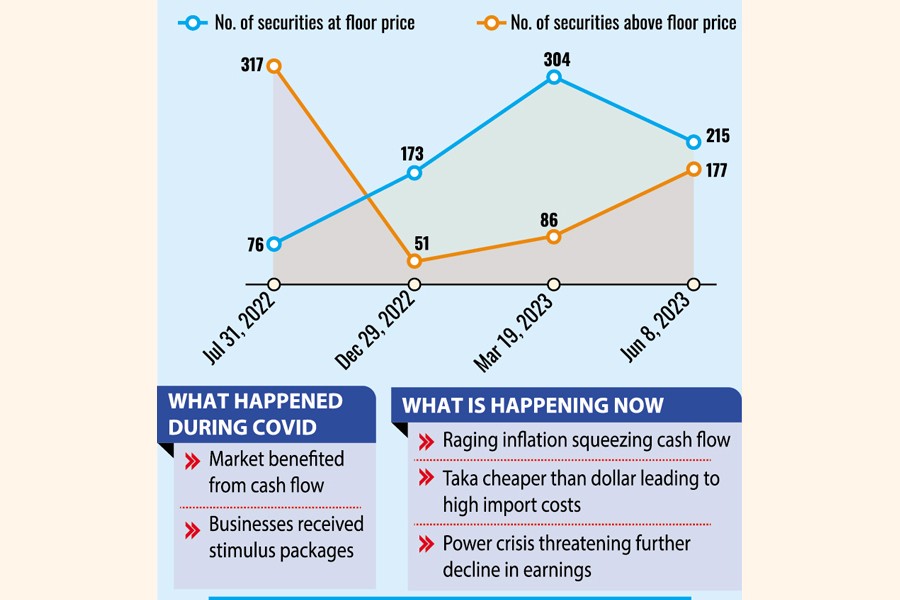

Twelve months have gone by after the second-time imposition of floor price in July last year. Still, a majority of the listed securities are confined to the floor.

Some positive signs such as the rise in the purchase volumes of foreign investors, the recent increase in daily market turnover and a number of securities moving above the floor prices in the last six months have brought back optimism surrounding the market.

Entrepreneurs and experts, however, are skeptical about the market regaining its normal functions anytime soon for the challenges that are unique in the prevailing scenario.

They say better performance by some companies might have restored investors' confidence to some extent, but the emerging power crisis and persistent devaluation of the local currency may drag down earnings of local businesses rendering impacts on the stocks.

The number of listed securities above the floor price was 51 in December last year, which rose to 177 on Thursday.

Managing Director of Midway Securities Ashequr Rahman said most of the securities which went above the floor price are small cap and they were subject to speculative trading.

"Any remarkable change will not be visible in the market until the large cap and blue chip companies get back liquidity through rational participation by big investors."

The DSE-30 index comprising 30 blue chip stocks has seen only seven stocks trade above the floor prices. They include LafargeHolcim Bangladesh, Meghna Petroleum, and Unique Hotel & Resorts.

The remaining 23 companies, including Grameenphone, Robi Axiata, and Square Pharmaceuticals, which have significant market share in terms of market capitalisation, have long been languishing at the floor.

2020 price restriction becoming irrelevant

The broad index of the Dhaka bourse lost 526 points to 3,603 points in just three consecutive sessions by March 18, 2020 due to panic-driven selloffs as the Covid outbreak led to the suspension of almost all business activities and social movement restrictions across the country.

The following day the securities regulator put in place floor price to stop securities from cascading further. Investors reacted to it positively and the DSE broad index regained 371 points in that single trading session.

Businesses were offered stimulus packages by the government. The central bank relaxed monetary policy and exempted banks from classifying loans.

The Bangladesh Securities and Exchange Commission also relaxed rules of compliance.

Stuck at home, investors injected a substantial amount of idle money into stocks, causing a boost to the liquidity flow in the market.

The then lower interest rate of 3-4 per cent on deposits also drove savings to the market for higher returns, said Managing Director of Prime Bank Securities Md. Moniruzzaman.

At the end of 2020, the DSEX crossed 5,402 points while the market recorded a daily turnover of more than Tk 15 billion, which was below Tk 4 billion before the imposition of the floor price.

Seeing the market buoyant, the regulator lifted the restriction in phases.

The price restriction was no longer needed in the third week of June 2021 as most stocks were higher up their floor prices. By the time, the broad index gained 2,449 points to 6,052 points while the turnover volume was about to touch Tk 20 billion in many trading sessions.

The DSEX gained 2,992 points to 6,596 points on August 5, 2021 and the premier bourse outstripped Asian frontier markets in terms of market returns.

Challenges to overcome existing price restriction

As Russian tanks rolled into Ukraine in February last year, the DSE broad index started falling and plunged below 6,000 point by July 28, 2022.

The day after, the regulator imposed the floor price again. This time the broad index regained 153 points crossing 6,000-point mark.

Though the index remained above 6,000 points the turnover declined gradually to as low as Tk 1.99 billion on December 26 last year.

The regulator lifted floor price for 169 securities in December but quick price erosions prompted it to re-impose the bar.

In the past six months, the index moved between 6,177 and 6355 points. In the recent few sessions, the daily turnover was getting a boost due to a rise in investors' participation.

Performance of the companies is the key to a restoration of investors' confidence in the market, Mr. Moniruzzaman said.

Erosion of earnings due to the taka becoming cheaper against the dollar, however, poses challenges. Then higher returns at 5-7 per cent interest from bank deposits, sky-high inflation, and evolving shortage of power bring down the possibility of the stock market breaking free of floor price in near future.

"The companies are now not in a position to run operations in multiple shifts [due to power cuts] as they did before and that's why production growths will decline," said Azam J Chowdhury, former president of the Bangladesh Association of Publicly Listed Companies.

Flicker of hope

The country's stock market witnessed withdrawal of funds by foreign portfolio investors throughout 2022. The sell volumes were much higher than buy volumes, a trend that continued until February this year.

The market saw the highest monthly sales of holdings of foreign investors worth Tk 6.68 billion against a buy volume of Tk 0.86 billion in August last year.

The buy-sell volumes observed in March and April this year show a return of foreign investments to the market. The purchased securities were equivalent to Tk 1.31 billion in April while the sell volume was of Tk 0.51 billion.

Some of the listed multinational companies started to get back liquidity flow and so they climbed up floor prices. Of the companies, Heidelberg Cement saw 354 per cent appreciation from the floor price while the share price of LafargeHolcim was up 7 per cent.

Many cement manufacturers said they had an unexpected rise in earnings in January-March this year as their import costs slid due to a decrease in the prices of raw materials in the global market, and for the stability in the forex market.

"If the [stock] market were driven by right investors, the companies having strong fundamentals would have seen [upward] price movements," said Mr Chowdhury.

mufazzal.fe@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.