Published :

Updated :

Toggle navigat

The benchmark equity index of the Dhaka Stock Exchange (DSE) witnessed the biggest weekly fall in more than a year amid widespread sell-offs, as investors grew jittery over political and economic uncertainty.

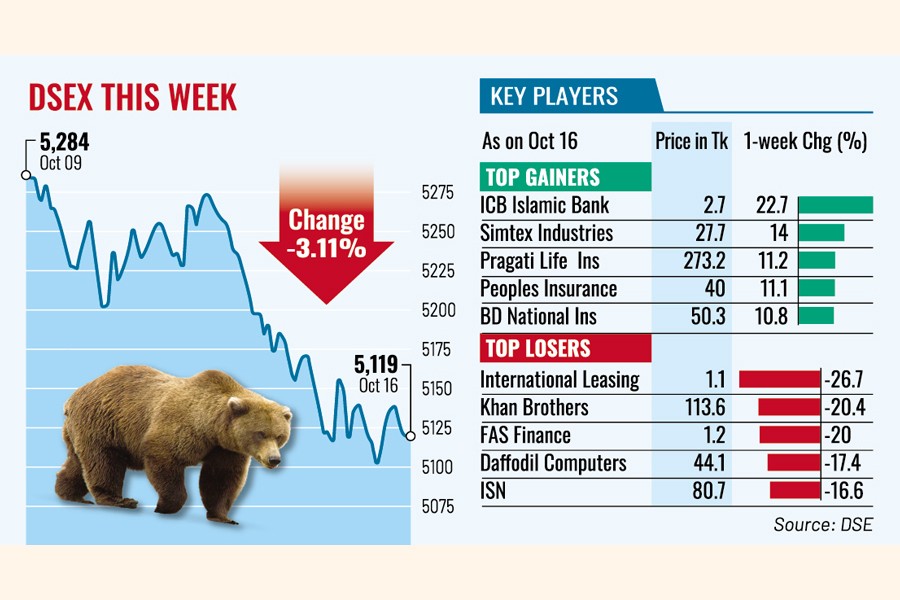

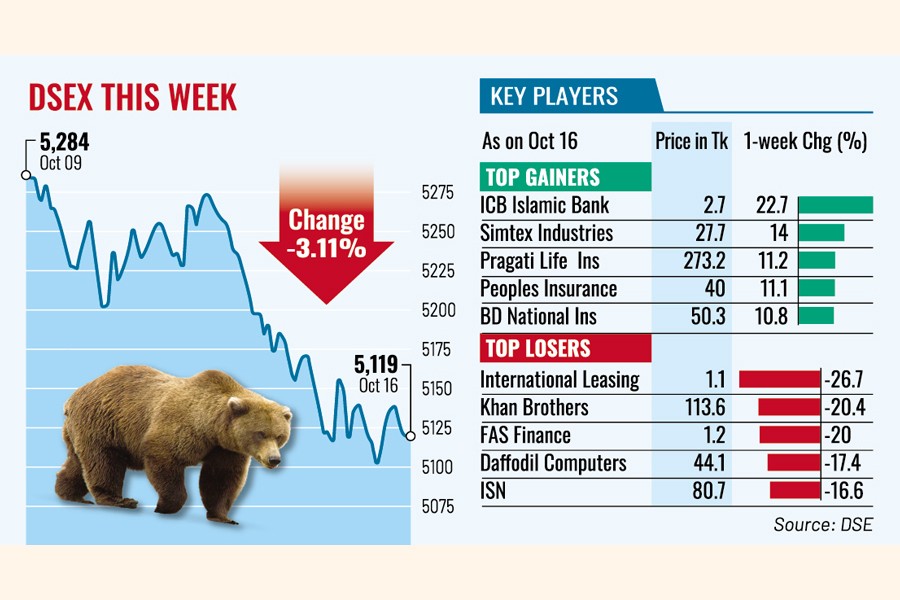

The DSEX, the prime index of DSE, slid nearly 164 points, or 3.11 per cent, to 5,119 this week -- its lowest level in more than three months, since July 16 this year.

This week's market plunge marks the steepest single-week decline since the first week of October last year, when the index fell by 176 points, or 3.13 per cent.

Analysts said market sentiment remained subdued amid persistent economic challenges and fear of political friction during the electoral transition that exacerbated the market situation.

The ongoing earnings season also led investors to adopt a wait-and-see approach in building new equity positions, said a leading stockbroker.

He said persistent political and macroeconomic challenges discouraged overseas investors from making fresh investments in stocks. The institutional investors also appeared hesitant to inject fresh funds into the market.

Meanwhile, foreign investors have retreated from Bangladesh's equity market once again as major stocks saw their foreign stakes erosion in September compared to June this year.

Rising inflation also weighed on investor sentiment. Following these developments, most investors continued heavy sell-offs, dragging the benchmark index below 5,200-mark this week.

This week, two trading sessions managed to close higher, while the remaining three ended lower on the DSE.

The DSEX lost more than 296 points while the market-cap shed Tk 258 billion in the past two consecutive weeks.

The blue-chip DS30 index, a group of 30 prominent companies, also lost 65 points to close at 1,968 while the DSES index, which represents Shariah-based companies, eroded 48 points to 1,086.

EBL Securities, in its market analysis, said that Stocks plunged further as investor sentiment weakened amid escalating political uncertainties.

"A deepening lack of confidence triggered a broad-based selling spree throughout the week, overshadowing the continuation of selective buying interest in the general insurance sector," said the stockbroker.

Price fall of selective blue chips such as Islami bank, Walton, Square Pharma, Khan Brothers PP Woven bag Industries and BAT Bangladesh, dragged the market index down. These five stocks jointly accounted for a 38-point fall in the index.

The market participants continued their cautious stance as the total turnover stood at Tk 26.11 billion as against Tk 32.86 billion in the week before.

Accordingly, the average daily turnover stood at Tk 5.22 billion, down 20 per cent from the previous week's average turnover of Tk 6.57 billion.

Investors were mostly active in the general insurance sector, which accounted for 13 per cent of the week's total turnover, followed by pharmaceuticals (11.4 per cent) and textile sector (10 per cent).

Losers outnumbered the gainers, as out of 396 issues traded, 326 saw price correction while 56 others gained and 14 issues remained unchanged on the DSE floor.

All the major sectors showed negative performance. The non-bank financial institutions witnessed the highest loss of 5 per cent, followed by engineering (4.3 per cent), power (3.7 per cent), banking (2.6 per cent), pharma (2.3 per cent) and telecom (1.8 per cent).

Low-cap companies dominated the turnover chart, with Dominage Steel Building Systems, becoming the most-traded stocks, with shares worth Tk 1.01 billion changing hands, closely followed by Orion Infusion, CVO Petrochemical Refinery, Summit Port Alliance and Progressive Life Insurance.

The Chittagong Stock Exchange also ended lower, with its All Shares Price Index (CASPI) shedding 479 points to close at 14,469, while the Selective Categories Index (CSCX) plunged 290 points to 8,898.

The port city bourse traded 10.58 million shares and mutual fund units with turnover value of Tk 698 million.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.