Published :

Updated :

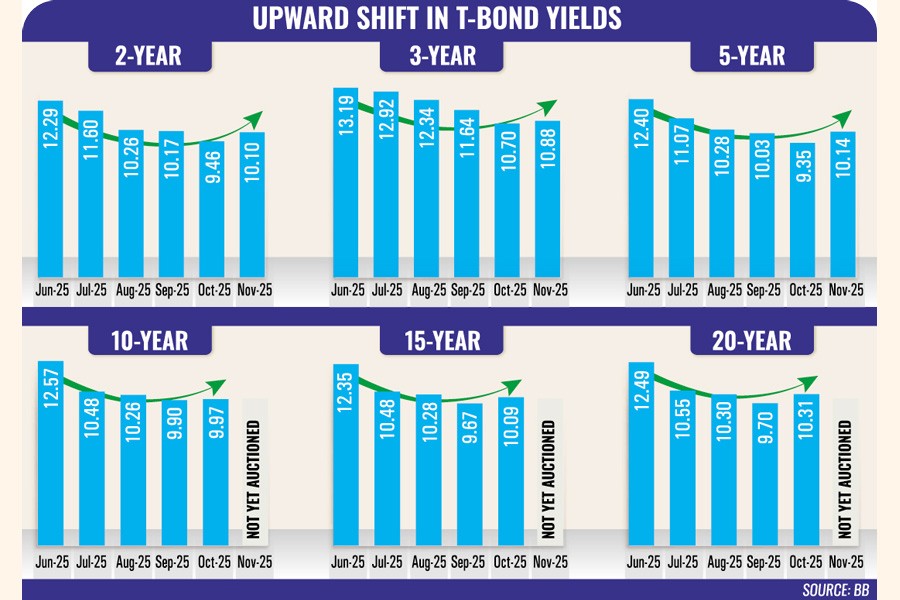

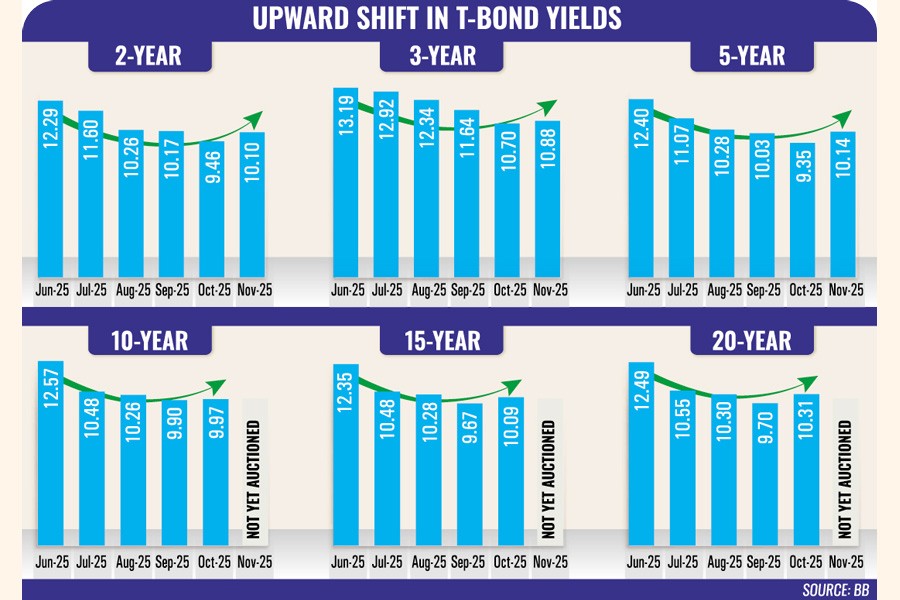

Yields on government securities (G-Secs) have again crossed 10 per cent as the government's appetite for fresh funds has increased ahead of the national polls scheduled for February this year.

The rise and fall of yields depend on the government's fund requirement to meet the budgetary shortfall and the liquidity situation in banks. The policy rate set by the Bangladesh Bank also influences T-bond interest rates, as banks borrow from the central bank at the repo rate - 10 per cent at present - the same as the policy rate.

The yield on 20-year Treasury bonds peaked at 12.75 per cent in March this year.

Similar to the long-term investment instrument, medium- and short-term investment tools had also gone remarkably high by that time, as the government needed funds to meet the last phase of the Annual Development Programme (ADP) implementation target in FY25 amid an overall economic slowdown.

Amid a gradual fall in the demand for formal credits from the private sector, commercial lenders found government securities a lucrative option to park their funds for risk-free returns.

Then liquidity flow into banks suddenly escalated when the Bangladesh Bank started purchasing dollars to cool down the forex market.

The central bank purchased $2.12 billion between July and October from commercial banks to keep the exchange rate stable. As a result, banks received huge cash inflows from the sale of dollars.

With cash becoming available, banks wanted to invest in government securities in the absence of private-sector demand. Therefore, they quoted lower rates at Bangladesh Bank auctions to ensure their bids were not rejected.

As a result, in September, the rate of 20-year bonds fell to 9.40 per cent. Similarly, the rates of other T-bonds dropped below 10 per cent.

Yields are again moving upward, having crossed 10 per cent as the government's demand for funds increased, said industry insiders.

For example, the government on Sunday collected Tk 87.89 billion by issuing T-bills with tenures ranging from 91 to 364 days, up from the earlier estimate of Tk 75 billion.

With higher demand, bidders could ask for higher rates.

Moreover, banks are over-reliant on repo-backed liquidity support, which is why they prefer rates higher than the repo rate for investments in T-bills and T-bonds.

Banks also invest in government securities using funds collected from other sources.

According to an official of Pubali Bank, who spoke on condition of anonymity, the bank is offering interest rates of up to 8.30 per cent on fixed deposit receipts (FDRs). He said good banks were currently offering interest rates around 8 per cent, whereas weak banks were paying higher rates to attract deposits.

This is the backdrop to T-bond yields rising again as the central bank refrains from intervening in bond auctions.

The old practice of regulatory intervention ceased with the fall of the previous regime. The new leadership of the central bank has been striving to bring discipline to the financial sector, and withdrawing its control from the market was part of that.

The International Monetary Fund (IMF) also suggested that rates be determined by the market.

In bond auctions, two groups of investors - competitive and non-competitive - participate. Non-competitive investors, who are mainly individuals, do not quote any price during bidding. They purchase bonds at rates equivalent to the weighted average of all rates placed at an auction.

Competitive bidders, on the other hand, receive securities at the cut-off price determined based on their quoted rates.

Since interest rates depend on competitive investors, they quote prices in a way that the cut-off price is fixed above 10 per cent - the current policy rate.

mufazzal.fe@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.