ICB, Sadharan Bima subscriptions restore govt's majority stake in NTC

Published :

Updated :

The government has regained control of National Tea Company (NTC) with a majority stake after purchasing placement shares at the eleventh hour of the latest subscription period.

The shares, which had been on offer since 2023 but remained unsubscribed until the fourth extension of the subscription period ending on August 13, appear to have been purchased under duress.

An official of the Investment Corporation of Bangladesh (ICB), preferring anonymity, said the investment was bound to incur losses in the struggling company, at a time when the ICB itself was grappling with a fund crisis. The ICB recently purchased about 9.75 million shares of NTC.

ICB Chairman Prof. Abu Ahmed also admitted there was no certainty of returns from the investment in NTC. "The ICB has a fund crisis. We subscribed our portion [of placement shares] with funds generated by offloading some shares from our portfolio following a decision by the government," Mr. Ahmed said.

Apart from the ICB, Sadharan Bima Corporation and the commerce ministry completed the subscription of the placement shares on August 13 - more than two years after the securities regulator granted its approval for the tea producer to raise funds to meet a working capital shortfall.

NTC has reported losses for four consecutive years through FY23.

In April 2023, the Bangladesh Securities and Exchange Commission (BSEC) approved NTC's plan to raise Tk 2.80 billion by issuing 23.4 million placement shares at Tk 119.53 each. There was a condition, however, that the government stake would have to be returned to 51 per cent.

But state-run entities, including ICB and Sadharan Bima Corporation, were initially reluctant to subscribe to their portions, fearing the investments would remain stuck without yielding returns.

Both ICB and Sadharan Bima Corporation have seats on the NTC board.

Shahidul Islam, chief executive officer of VIPB Asset Management Company, said there was still potential for NTC to turn around if "prudent initiatives" were taken.

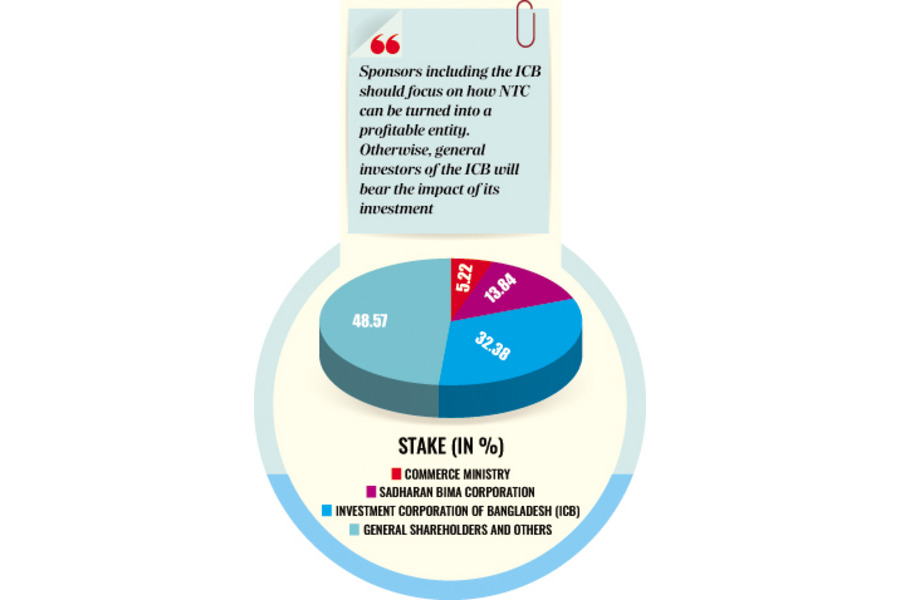

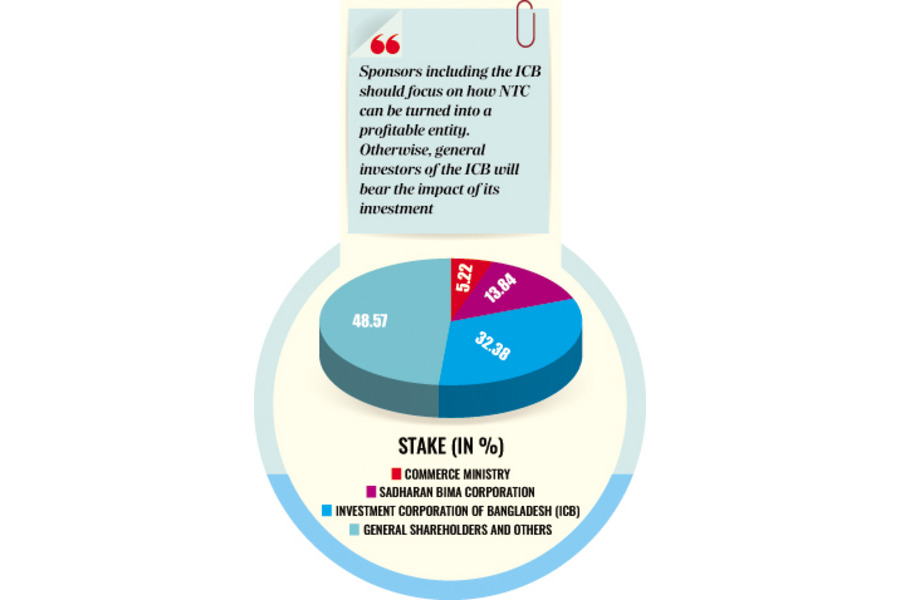

"ICB's investment should not be seen as irrational," he said, noting that companies like NTC have substantial liquidation value because of their valuable assets, including land. "Sponsors including the ICB should focus on how NTC can be turned into a profitable entity. Otherwise, general investors of the ICB will bear the impact of its investment," he added.

ICB Managing Director Niranjan Chandra Debnath said their board had already identified operational loopholes in NTC and discussed ways to return the company to profitability. "The labour ministry has also laid importance on ensuring a good working environment at the company's tea garden," he added.

Apart from subscribing to its own portion, ICB also subscribed to shares initially allocated to other shareholders. It purchased 1.20 million shares at a cost of Tk 143.57 million on March 27, and the ICB Unit Fund subscribed to 6.72 million shares at a cost of Tk 803.57 million on August 13.

On August 21, ICB subscribed to another 1.83 million shares that had previously been offered to other shareholders and the subscription period for which ended on August 31.

As a result, ICB and the ICB Unit Fund together invested over Tk 1.16 billion, enabling the government to regain control over NTC. Officials said their stake in NTC now stands at 32 per cent.

A senior official of Sadharan Bima Corporation's investment department, speaking on condition of anonymity, said their stake in NTC is now 14 per cent. Explaining the delay in their subscription, he noted that complexities in decision-making at the board level caused the holdup.

NTC company secretary A.K. Azad Chowdhury said the commerce ministry now holds the remaining portion of the stipulated 51 per cent, having paid on behalf of the government.

The decline in government stake

During the company's listing in 1979, the government had a 51 per cent stake in NTC. The holdings plummeted after 2002 as the ICB sold a portion of its stake to Haris Chowdhury, political secretary of the then prime minister.

The government's stake further declined during the tenure of the immediate past government following the transfer of a substantial number of shares from the ICB to Chowdhury Nafeez Sarafat, former chairman of Padma Bank.

A director of the NTC recently told The FE that the ICB should have sold shares to state-run entities only.

Mr. Sarafat purchased NTC shares from the ICB ahead of an annual general meeting, intending to contest for the position of shareholder director. He eventually became the director of NTC when his opponent withdrew his candidature.

NTC last distributed a dividend - 7.5 per cent cash - for FY22. It made a profit of Tk 136.40 million in FY19 but plunged into the red the next year with a loss of Tk 367.68 million. The annual losses mounted to Tk 635.16 million in FY24.

The company's production has often been suspended due to workers abstaining from work over unpaid wages amid an acute working capital shortage. According to auditors, the workers' gratuity fund had a zero balance as of June last year.

NTC's operating costs have consistently outstripped income, as the company has been unable to process tea leaves properly or on time. Capital shortages also hindered timely tree plantation, while outdated machines prevented quality tea leaves processing.

Insiders said NTC sells processed tea leaves at Tk 180 per kilogram at auction, while production costs stand at Tk 250 per kilogram.

mufazzal.fe@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.