Published :

Updated :

Stocks saw a big jump on the first trading day after the 13th parliamentary election, as investor confidence improved and bargain hunters took positions in potentially lucrative shares amid renewed optimism.

The market opened higher, aided by price appreciation in select large-cap stocks, as opportunistic investors expected political stability and macroeconomic recovery following the peaceful election. The BNP-led alliance secured an absolute majority in the national election held on Thursday. Following the BNP's landslide victory, investors are hopeful of favourable market conditions ahead.

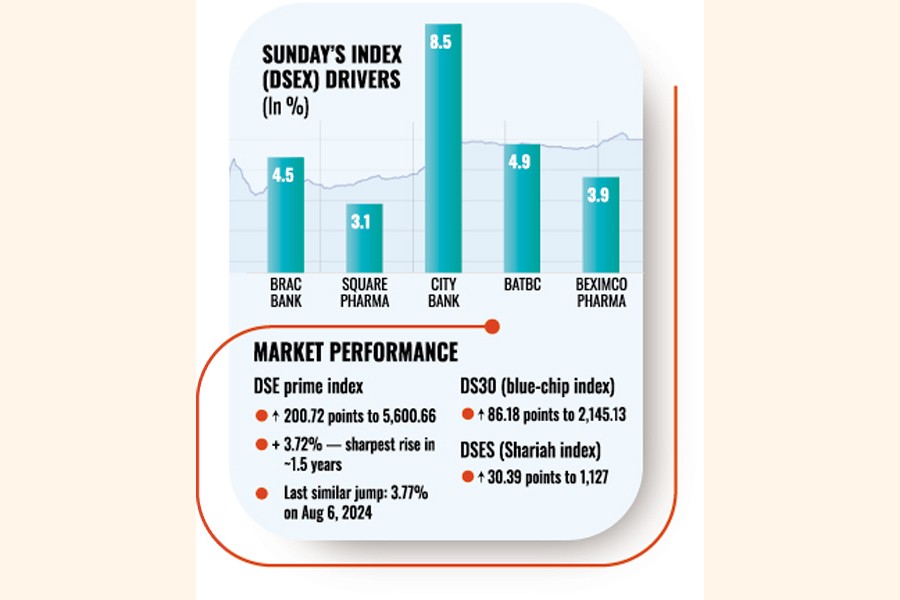

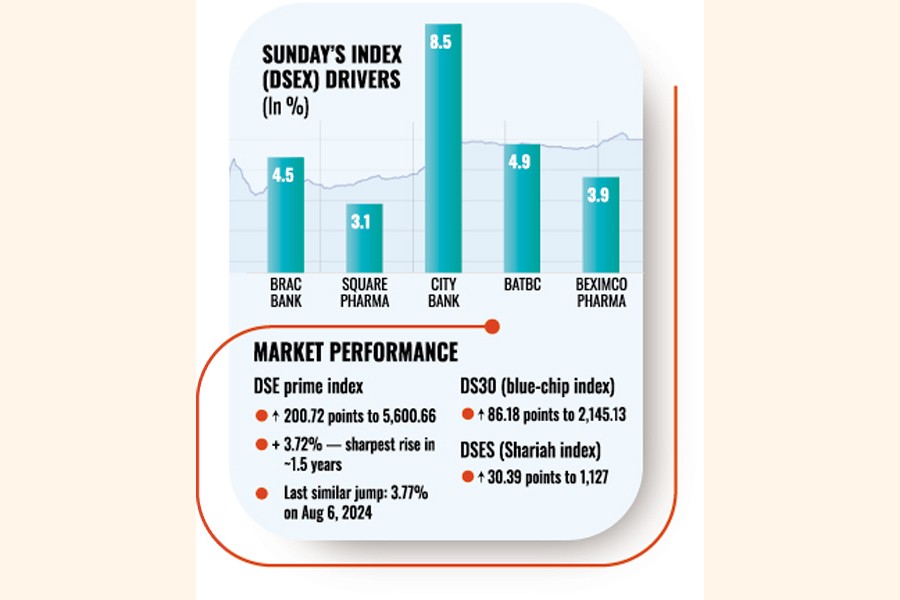

The prime index of the Dhaka Stock Exchange (DSE) rose by 200.72 points to settle at 5,600.66 on Sunday.

In percentage terms, the gain stood at 3.72 per cent -- the highest in one and a half years. The previous comparable rise was 3.77 per cent on August 6, 2024.

The benchmark index surged as trading resumed after the election holidays, driven by strong investor enthusiasm amid clearer signals on the political transition, which lifted expectations for a supportive post-election market outlook, according to EBL Securities.

The blue-chip DS30 index, comprising 30 leading companies, advanced by 86.18 points to 2,145.13, while the DSES index, representing Shariah-compliant companies, gained 30.39 points to close at 1,127.

Md Moniruzzaman, managing director and CEO of Prime Bank Securities Ltd (PBSL), explained the elated equity market while sharing his views with the FE.

"From a logical perspective, there are a couple of points. First, some stocks are undervalued, so there is room for appreciation. Second, a new political government might be able to resolve certain bottlenecks that had remained unsolved."

He pointed out that many investors had been fined during the interim government, but the fines were yet to be collected. Many accounts remained frozen. The IPO flow has dried up.

If these basic issues are addressed, the market could improve, with renewed investor interest.

"But bringing discipline and enforcing reforms take time. Even if a new government starts working on these [matters] from day one, it will still take time to see results."

On Sunday, the market showed strength from the opening bell, as widespread participation pushed prices higher across most stocks and reinforced bullish momentum.

Turnover crossed the Tk 10 billion mark, surging 61.4 per cent to Tk 12.75 billion from the previous session. This was the highest turnover in five months.

Most stocks posted gains, as out of the 394 issues traded, 364 closed higher, 26 ended lower, and four remained unchanged on the DSE trading floor.

City Bank was the most-traded stock, with shares worth Tk 807.26 million changing hands, followed by Dhaka Bank, Square Pharmaceuticals, BRAC Bank, and Bangladesh Shipping Corporation.

On the sectoral front, banking stocks accounted for the largest share of turnover at 26.3 per cent, followed by pharmaceuticals at 14.2 per cent and textiles at 12.3 per cent.

All sectors posted gains, with financial institutions rising 6.7 per cent, travel 6.4 per cent, and ceramics 6.0 per cent.

The Chattogram Stock Exchange (CSE) also ended higher, with its All Share Price Index (CASPI) gaining 484.37 points to settle at 15,518.81 and the Selective Categories Index (CSCX) rising 282.83 points to close at 9,555.25.

The port city bourse traded 5.13 million shares and mutual fund units, with a turnover of Tk 246.59 million.

farhan.fardaus@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.